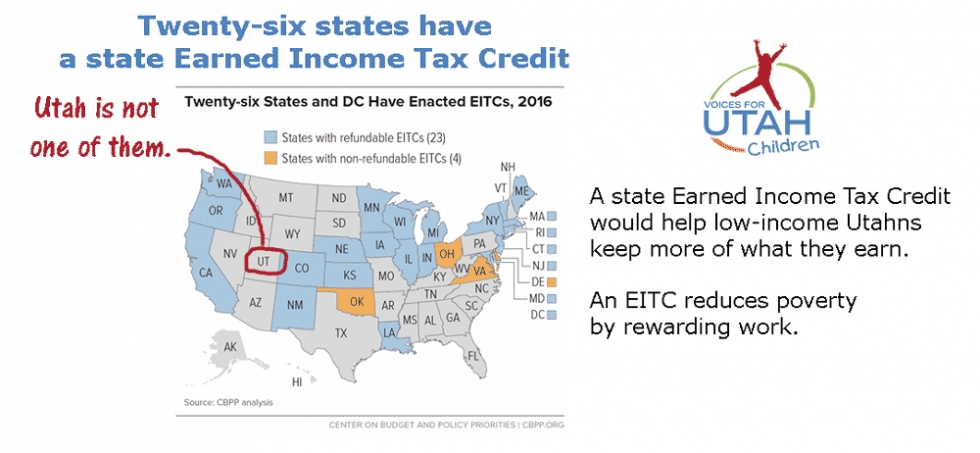

Voices for Utah Children Supports HB 294, the Utah Intergenerational Poverty Work and Self-sufficiency Tax Credit. HB 294 strengthens Utah’s groundbreaking Intergenerational Poverty (IGP) initiative with an Earned Income Tax Credit (EITC). Twenty-six other states across the nation and across the political spectrum have already created state EITCs, boosting work, independence, and self-sufficiency for low-income families. Utah should too, starting with our most at-risk population, the 37,512 adults and 57,602 kids grappling with intergenerational poverty (comprising 25% of all adults receiving public assistance, 62% of whom worked in 2015).

How would the IGP EITC work? (HB 294)

It would create a state EITC for IGP families that work, qualify for the federal EITC, and file their state taxes

How much would families receive?

10% of the federal EITC: ~$250 on average, up to ~$600, depending on income and # of kids

For more information, see the complete factsheet:

![]() Vote Yes on HB 294: The IGP EITC

Vote Yes on HB 294: The IGP EITC

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express, our "Making a Difference All Year Long" sponsor.