State Policy

State Policy

Invest in Utah Children!

State Policy Agenda

All kids have health care coverage and access.

All kids get the care they need from their parents and families.

All kids have a chance to live in economically prosperous families.

All kids start school ready to learn and thrive.

All kids have equal access to justice in schools and community.

Click here for our 2020 Utah Election’s Guide

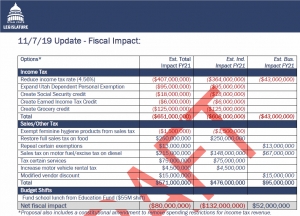

Legislature Passes Tax Package Including Revenue Losses, Grocery Tax (and Credit), EITC

In-State vs Out-of-State Effects: The Key to Tax Restructuring Success?

If someone told you that the key to the success of the Utah Tax Restructuring and Equalization Task Force may well be found in an examination of the in-state vs out-of-state effects of the current draft proposal, your eyes would probably glaze over and you might suddenly recall a dentist appointment that you had forgotten.

But wait! Please tell the dentist you’ll reschedule and take a few minutes to read on.

Kansas: Tax Cuts That Went Too Far

The greatest danger for Utah’s future in the current debate is that fans of anti-tax/anti-government Pied Piper Grover Norquist and former Kansas Governor Sam Brownback will try to take advantage of the political pressures of the coming election year to follow in the footsteps of Kansas and include in the package a large revenue reduction. After all, tax cuts are always popular, and Utah has been giving in to that temptation for years.

Yet we know what an economic disappointment those tax cuts were in Kansas (it turns out that underinvesting in education and infrastructure does not actually help grow the economy), leading to devastating losses in subsequent elections for the plan’s proponents. The suddenly more moderate (while still Republican) Kansas legislature subsequently rolled back the tax cuts (though the voter backlash went on, electing a Democratic Governor last year in that very red state).

Apparently, it is possible to have too much of a good thing, even when it comes to tax cuts.

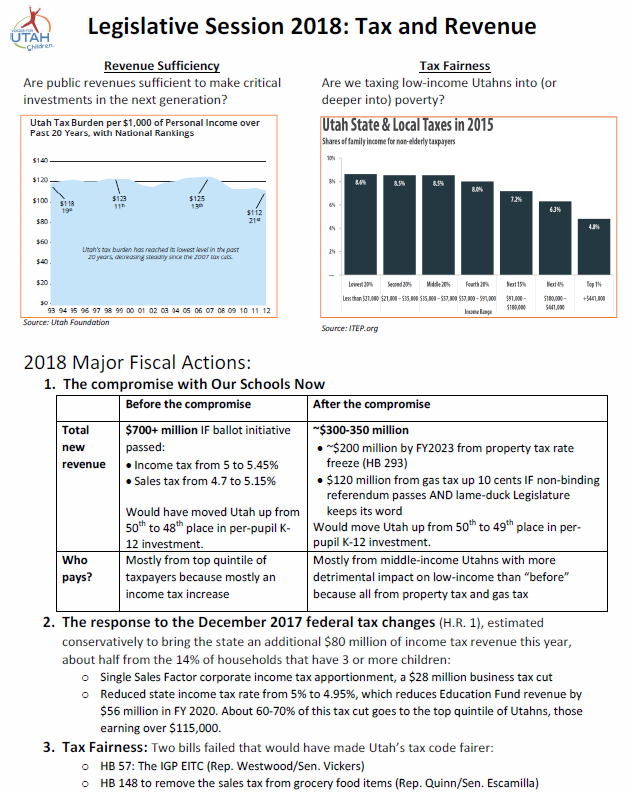

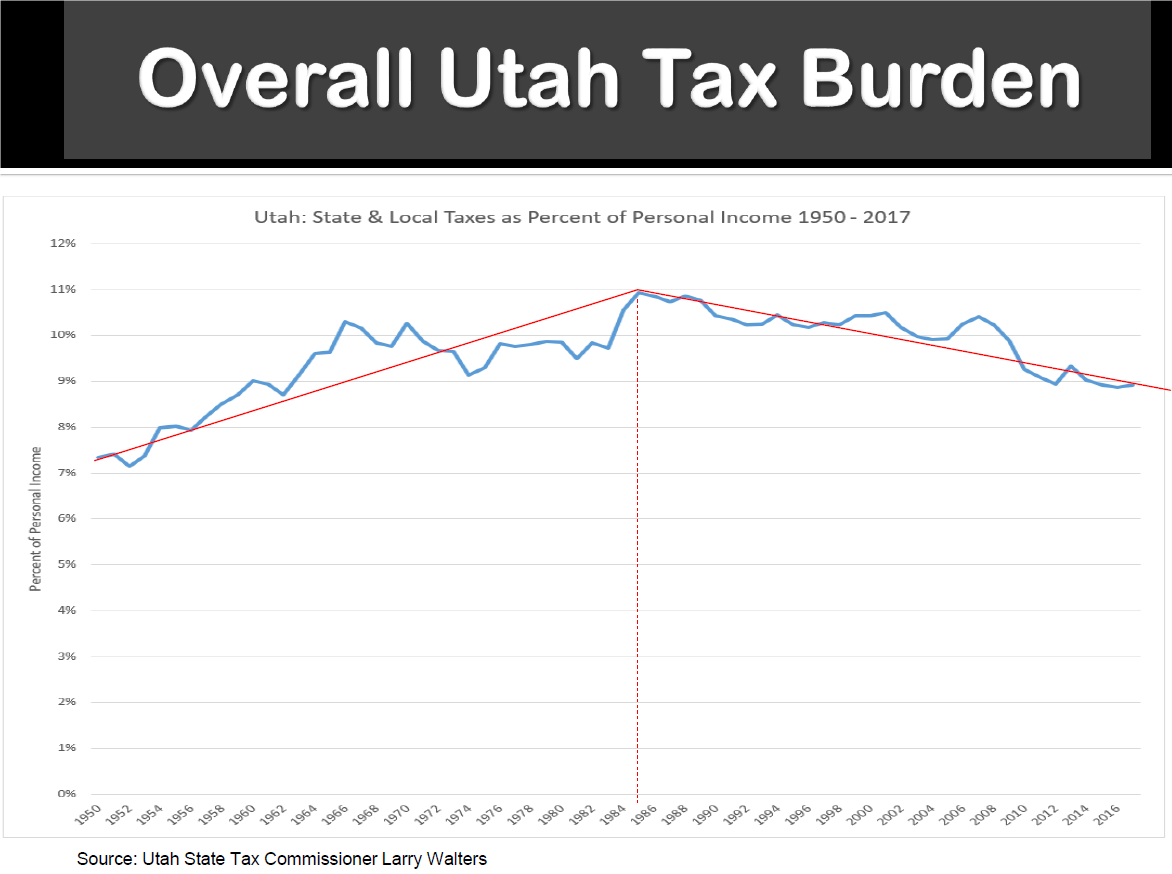

Successive rounds of tax cuts have left Utah with our lowest tax levels in decades, according to recent data from both the Utah Foundation and the Utah State Tax Commission. According to the Utah Foundation, the tax cuts of the last two decades have moved us from having the 6th highest taxes in the nation to #31 (even as we continue to have the nation’s highest percentage of children to educate). The Tax Foundation says that today we rank in the top 10 states for our business tax climate. By all accounts, our economy is booming and generating all the jobs we need, with an unemployment rate currently measured at 2.7%. So is it wise at this stage to use our temporary budget surplus to make even more permanent cuts to state revenues? Such additional tax cuts seem likely to have one of two possible outcomes, neither very desirable: Either they could rev our job-creating engine to the point that we’re creating enough new jobs not just for the next generation of Utahns but for hundreds of thousands of Californians to move here as well, or they could undermine the educational and infrastructural foundations of our long-term economic prosperity, as was the case in Kansas. Indeed, the tax cuts of recent decades have already crippled our ability to invest in education, infrastructure, air quality, public health, poverty prevention, and so many other areas where we have urgent unmet needs.

Should We Apply the Solutions of the Past to the Challenges of Today?

Certainly there is a strong case to be made that the tax cuts of recent decades helped Utah achieve our current economic success. Perhaps our most significant economic achievement of the last 20 years is that Utah has moved from being a low-wage state to middle-wage status, based on our rank for median hourly wage over the last two decades (#39 in 2006 vs. #27 last year). But rather than applying the solutions of the past to the challenges of today, the progress we've made puts us in a new position and allows us to ask a new question: Now that we have achieved middle-wage status, how can we, in the decades to come, follow in the footsteps of states like Colorado and Minnesota and move toward becoming a high-wage state?

Utah Has Fallen Behind on Educational Attainment

The secret to those states’ success lies in their higher levels of educational attainment. But right now Utah is behind on educational attainment. It is well-known that our teacher attrition rates are too high and so are our class sizes. But it is less well-known that, adjusted for demographics, our high school graduation rate is also behind the national average. In other words, for example, if you are White or Latino in Utah, you are less likely to graduate high school than Whites or Latinos nationally. At the college level, we have fallen behind national trends for BA/BS+ attainment among our younger generation, with only 34% of Utahns ages 25-34 having graduated college compared to 36% nationally, according to the latest 2018 Census data.

Utah’s Next Great Challenge: Our Growing Majority-Minority Gaps

Moreover, Utah is in the midst of a demographic transformation that is enriching our state immeasurably but also bringing majority-minority gaps of a type and at a scale that our state has not had to confront in the past. Education Week magazine recently ranked Utah among the worst 10 states for our growing educational achievement gap between haves and have-nots. Now is the time to make the upfront investments that will help us avoid going the way of other states that failed to close those gaps when they had the chance to do so in the most cost-effective manner.

While there is little doubt that Utah does more with less better than any other state, we will not close our growing gaps and raise our educational attainment as long as we are stuck in last place for per-pupil investment. The unfortunate reality remains that our very real economic progress of recent decades has not resulted in increased investment in education. Rather, our total inflation-adjusted per-student state + local K-12 education revenues remained below pre-recession levels last year.

In-State vs. Out-of-State Effects

If we can agree that there could be real downsides to making additional cuts to state revenues in the proposed tax restructuring package, then what does this have to do with in-state vs. out-of-state effects of the proposed tax changes, and how could understanding those effects potentially save the package?

The answer is that the draft package’s roughly $600 million shift of revenues from income taxes to sales taxes also brings with it a less-noticed shift of about $100 million from in-state payers (aka Utahns) to out-of-state payers (non-Utahns). This is because a much higher share of the sales tax than of the income tax is paid by non-Utahns – about 25% of all sales tax revenues (though a much higher 40% for the gas tax and a much lower 5% for the grocery tax since tourists mostly eat prepared foods, which are already fully taxable). (That exact percent varies slightly from state to state. The state of Texas, for example, estimates that 21% of their sales tax is paid by non-Texans. while Minnesota estimates 23% for their sales tax.*)

The Implications of $100 Million of New Revenue from Out-of-State

The first implication of this $100 million shift is that the Task Force’s claim of an $80 million tax cut in their draft package actually understates the in-state tax cut (the tax cut for us Utahns) by roughly $100 million. This means that the draft package actually proposes a $180 million tax cut for Utahns -- in a package that costs the state $80 million of revenue annually.

The further implication of this is that the package could very easily be adjusted (simply by changing the proposed income tax rate) to make it revenue neutral overall – and still have a $100 million tax cut for Utahns.

But, building on the discussion above about our urgent unmet needs and chronic revenue shortages, the best implication of this in-state vs out-of-state shift is that this package could achieve one of the holy grails of tax policy – getting non-Utahns to pay for the things we Utahns need (education, infrastructure, etc.) – by using the new out-of-state revenue to get this package out of the red and permit a $100 million revenue enhancement for the state budget without costing Utahns a dime.

The Compromise That Could Carry the Day

But politics is politics, and politicians are politicians, and next year is an election year. Which brings us to the compromise that could potentially save this package: Take that $100 million of new out-of-state money and split it 50-50: Make the package $50 million revenue-positive so we can improve education and infrastructure and use the other $50 million for an in-state tax cut. Which is probably not anyone’s ideal solution, but it just might be the compromise that can carry the day.

* Here are the reports from the Texas and Minnesota state tax agencies that analyze the topic of exporting tax incidence to non-residents:

- Texas -- https://comptroller.texas.gov/transparency/reports/tax-exemptions-and-incidence/ -- see Table 1 on page 47 (p53 of the pdf) which reports that 21% of Texas' $37 billion of sales tax incidence is exported to out-of-state payers.

- Minnesota -- https://www.revenue.state.mn.us/sites/default/files/2019-03/%2B2019_tax_incidence_study_Nolinks_0.pdf -- see Table 2-1 on page 26 (page 40 of the pdf) which reports that 23% of Minnesota's sales tax incidence is exported to non-Minnesotans.

Poverty Advocates Tax Reform Letter

Utah Poverty Advocates Call for Fairer Taxes and Restoration of Public Revenues

Salt Lake City - Today (September 26, 2019) at the Utah State Capitol, a group of two dozen non-profit organizations that provide services to and advocate on behalf of Utah's low- and moderate-income population released a letter to the Tax Restructuring and Equalization Task Force. The letter calls on the Task Force to consider the impact on low-income Utahns as they consider tax changes that could, in the worst case scenario, make Utah's tax structure more regressive and less able to generate the revenues needed to make critically important investments in education, public health, infrastructure, poverty prevention, and other foundations of Utah's future prosperity and success.

The text of the letter and the list of signatories appears below (and is accessible as ![]() a pdf at this link):

a pdf at this link):

Open Letter to the Tax Restructuring and Equalization Task Force (TRETF)

Tax Reforms for Low- and Moderate-Income Utahns

September 2019

Dear Senators, Representatives, and Other Members of the TRETF:

We, the undersigned organizations that work with and advocate for low- and moderate-income Utahns, urge you to consider the impact on the most vulnerable Utahns of any tax policy changes that you propose this year.

We urge you to address the two major challenges facing our tax structure as it impacts lower-income Utahns:

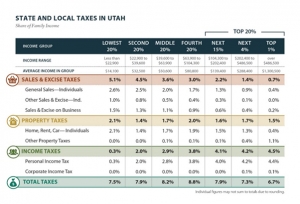

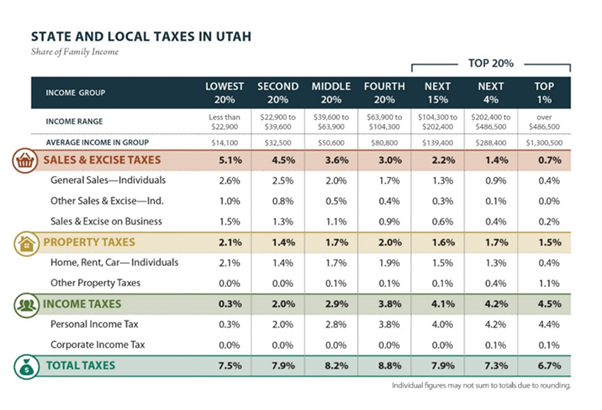

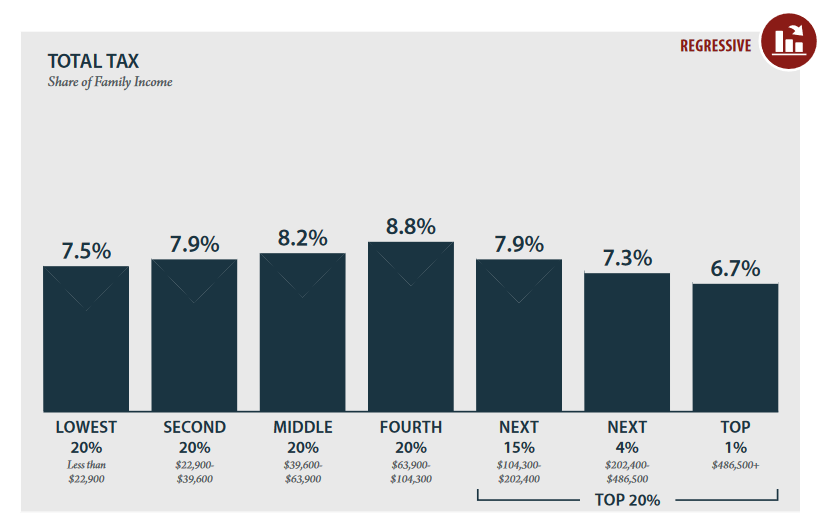

1) Utah’s current system of taxation is regressive, in the sense that it requires lower-income Utahns to pay a higher share of their incomes to state and local government than it asks of the highest-income Utahns, even though about 100,000 lower-income Utah households are forced into – or deeper into – poverty by their tax burden every year.

This regressivity could be addressed with tax policy changes including the following:

- A Utah Earned Income Tax Credit (EITC) to allow the working poor to keep more of what they earn.

- Remove the sales tax entirely from food, as 34 other states have done.

- Remove the state income tax on Social Security benefits for low- and moderate-income seniors; Utah is one of only 13 states that tax these benefits.

- Restore the income tax rate to 5% or increase it above that level. (Because the majority of all Utah income is earned by the top quintile of taxpayers, and because the Utah income tax more closely matches Utah’s income distribution than any other tax, most of such an income tax rate increase would be paid by the top-earning 20% of Utahns, while most lower-income Utahns are shielded from income tax rate increases.)

- Disclose and evaluate the effectiveness of tax expenditures (revenue lost to the taxing system because of tax deductions, exemptions, credits, and exclusions); Utah’s lack of transparency in this area of taxation earned us a C grade from the Volcker Alliance, a leading evaluator of state budgetary practices founded by former Federal Reserve chairman Paul Volcker.

2) For decades, Utah’s overall level of taxation relative to the state’s economy has been dropping, as illustrated in the chart below from the Utah State Tax Commission:

The unfortunate result is that we are left with a tax structure that fails to generate sufficient revenues to allow our state and local governmental entities to properly meet their responsibilities and fulfill their appropriate role in a number of critical areas, including the following:

- Education: Utah ranks last nationally for our per-pupil investment in K-12 education. Particular areas of weakness include:

-

- · Teacher turnover rates are higher than the national average. One study found the majority of new teachers leave within seven years.

- · Pre-K: Utah ranks 36th for our percent of lower-income 3- and 4-year-olds attending pre-school, private or public. We are also 1 of only 7 states not to have statewide public preschool programs. (The state offers only small-scale programs in a limited number of local school districts.) Yet we know from multiple research sources that every dollar invested in high-quality day care and preschools produces at least a $7 return on that investment in future years.

- · Kindergarten: Only a third of Utah kids participate in full-day kindergarten, less than half the national average, because local school districts can’t afford to offer it. Voices for Utah Children estimates that it would cost at least $75 million to offer full-day K to all Utah kids (not including potential capital costs).

- · According to the January 2019 report of the Utah Afterschool Network, the need for after-school programs exceeds the supply many times over, leaving tens of thousands of children completely unsupervised, meaning they are less likely to do their homework and more likely to engage in unsafe activities.

In addition to these input measures, Utah is also lagging behind in terms of several significant educational outcome measures:

-

- · Our high school graduation rates are lower than national averages for nearly every racial and ethnic category, including our two largest, Whites and Latinos.

- · Among Millennials (ages 25-34), our percent of college graduates (BA/BS or higher) lags behind national trends overall and among women.

Moreover, Utah is in the midst of a demographic transformation that is enriching our state immeasurably but also resulting in majority-minority gaps at a scale that is unprecedented in our history. For example, in our education system:

-

- · Our gap between White and Latino high school graduation rates is larger than the national gap.

- · Education Week recently reported that Utah ranks in the worst 10 states for our growing educational achievement gap between haves and have-nots.

- · We are beginning to see concentrations of minority poverty that threaten to give rise to the type of segregation and socio-economic isolation that are common in other parts of the country but that Utah has largely avoided until now.

B. Infrastructure: Utah’s investment has fallen behind by billions of dollars. This is another area where the Volcker Alliance ranked Utah in the worst nine states for failing to track and disclose to the public the dollar value of deferred infrastructure replacement costs. In addition. Internet infrastructure is lacking in some rural counties, limiting their integration into Utah’s fast-growing economy.

C. Mental Health and Drug Treatment: Utah was recently ranked last in the nation for our inability to meet the mental health needs of our communities, according to a recent report from the Kem C. Gardner Policy Institute. Underfunding of drug treatment and mental health services costs taxpayers more in the long run as prison recidivism rates rise because the needed services are not available. Estimates are that Utah meets only 15% of the need for these vital, life-saving services.

D. Affordable housing units fall 41,266 units short of meeting the need for the 64,797 households earning less than $24,600, yet the annual $2.2 million state allocation to the Olene Walker Housing Loan Fund has not changed in over two decades, despite inflation of over 60%. Among extremely low-income renter households, 71% pay more than 50% of their income for housing, which is considered a severe housing burden. This year, the Olene Walker Housing Loan Fund used up most of its annual $14 million budget at its very first meeting of the fiscal year (made up of both state and federal funds).

E. Health care: Our rates of uninsured children are higher than national averages – and rising – especially among the one-in-six of our children who are Latino. In Utah 35,000 or 5% of White children are uninsured (national rank = 36th place), compared to 31,000 or 18% of Latino children (rank = 46th = last place in 2017).

F. Disability services: The 2018 annual report from the Utah Department of Human Services’ Division of Services for People with Disabilities reports that the wait list for disability services grew to a record level of 3,000 individuals last year and that the average time on the wait list is 5.7 years.

G. Seniors: The official poverty measure undercounts senior poverty because it does not consider the impact of out-of-pocket medical expenses. A 2018 study found that seniors spent $5,503 per person on out-of-pocket medical expenses in 2013, making up 41% of their Social Security income. (For most seniors, Social Security is the majority of their income, and it makes up 90% or more of income for 21% of married couples and about 45% of unmarried seniors.)

H. Domestic Violence: Although Utah's overall homicide rate is significantly lower than the national average, domestic-violence-related homicides constitute over 40% of Utah's adult homicides compared to 30% nationally. Several thousand women continue to be turned away annually from crisis shelters because of lack of capacity. Additional state funding would make it possible to substantially increase the capacity of overburdened crisis shelters. We are one of the few states without domestic violence services in every county.

Given the large number of urgent needs that are not being met because of our chronic shortage of public revenues, we are concerned that Utah is missing the opportunity to make critically important upfront investments now that would allow us to reap substantial rewards in the future, and that our most vulnerable neighbors will pay the greatest price as a result.

Thus, we urge you to consider the ways that the state tax structure impacts single parents, disabled adults, low-income children, seniors on fixed incomes, and other vulnerable population groups as you decide on your tax restructuring and equalization proposals.

Finally, thank you for all the time and effort you are personally investing as volunteer members of this important Task Force, and for all that you do for our state through this and other forms of public service.

Yours truly,

|

American Academy of Pediatrics Utah Chap. Catholic Diocese of Salt Lake City Coalition of Religious Communities Community Action Program of Utah Community Development Finance Alliance Community Rebuild |

Comunidades Unidas Crossroads Urban Center Epicenter First Step House League of Women Voters Utah Legislative Coalition for People with Disabilities ICAST Habitat for Humanity of Southwest Utah |

Moab Area Hsg Task Force Provo Housing Authority RESULTS Utah Rocky Mountain CRC Self-Help Homes, Provo, UT Utah Citizens’ Counsel Utah Coalition of Manufactured Homeowners Utah Community Action Utah Food Bank Utah Housing Coalition Utahns Against Hunger Voices for Utah Children |

Response to Govenor's Budget Recommendations FY2020

On December 6, 2018, Governor Herbert released his budget recommendations for the next fiscal year (2020). The budget is based on a consensus forecast developed by the Governor’s Office of Management and Budget, the Office of the Legislative Fiscal Analyst and the Utah State Tax Commission.

In summary, the budget recommendations reflect an estimated $1 billion in surplus revenue due to Utah’s booming economy; a $200 million tax cut and a call to modernize Utah’s tax system. The budget’s theme is Growth and Quality of Life and presents budget recommendations covering the following key areas: Quality of Life, Qualified Workforce, and Tax Modernization.

Voices for Utah Children works to make Utah a place where all children thrive. While reviewing the Governor’s recommendations we asked one simple, important question: "Is it good for kids?" If it’s good for kids that means Utah’s families can fully participate in the economy and support their children. That means parents are able to ensure their children reach their full potential and grow up ready to contribute to Utah’s thriving communities.

Continuing the Governor’s theme of Growth and Quality of Life, Voices staff have reviewed the budget and make the following observations:

1. Quality of Life

Funding for Medicaid Expansion Implementation

In November, Utahns expressed their clear support for Medicaid expansion and chose to extend health insurance to 150,000 new individuals. Utah voters elected to expand Medicaid to individuals and parents, without work requirements or caps. Voters even chose a small sales tax increase to support affordable health coverage. The Governor recognizes this historic step forward for Utahns in his budget recommendations and allocates funds for expansion implementation by April 1, 2019. The policy brief accompanying the budget also explores different scenarios and “what ifs” about the provider and consumer safeguards included in the ballot initiative; however, none of these questions preclude expansion from rolling out April 1st. It is paramount that individuals and parents in the coverage gap be able to enroll in coverage as soon as possible, without any added delays or restrictions, and we thank the Governor for supporting expansion funds in the budget.

Proposition 3 did not include any additional work requirements or barriers to care, as the Governor’s budget and policy brief also notes. Our new state law does not stipulate that Medicaid enrollees meet a work requirement as a condition to health coverage. We support exploring future programs that help connect Medicaid beneficiaries with job resources, training, or helps facilitate community engagement. However, we should not rush into changes and any work support program should not preclude someone from receiving coverage. As we have seen in other states, the complexities and confusion around reporting a work requirement often result in individuals unnecessarily losing coverage- even though they are working (See Arkansas’ recent experience). We support programs that help individuals be healthy and work; but people cannot work if they are not healthy.

Funding for Children’s Health Coverage

The Governor’s budget includes important funding recommendations to ensure that Utah children are covered, as demonstrated through Medicaid consensus figures. The Governor’s recommendations are particularly timely as recent data show an alarming increase in the number of uninsured children in Utah. In fact, Utah was one of only nine states to experience an increase in our child uninsured rate. We thank the Governor for extending a welcome mat to ensure that more children can receive health insurance. Going forward, there are additional steps we hope the Governor will support, so that more children do not lose health coverage: it is critical to ensure children can avoid unnecessary insurance loss or disruptions, by implementing a policy of 12-month continuous eligibility in Medicaid; in addition, Utah must counter the ‘chilling effect’ in health coverage due to federal policies targeting immigrant communities. We thank the Governor for his previous efforts encouraging qualifying parents to sign their children up for Children’s Health Insurance Program (CHIP). It is especially critical now that the Governor continue to create a welcoming, safe environment for Utah families to obtain affordable health coverage.

E-Cigarette Taxes

The Governor recommends a sales-tax increase on e-cigarettes. As the Governor notes, e-cigarette use is on the rise and can have a significant, harmful impact on the health of our youth. We are encouraged that the Governor recommends taxing e-cigarette and related paraphernalia like traditional tobacco products. This is an important step to keeping our kids healthy. National research shows e-cigarette use can be highest among some of our most marginalized youth, including LGBTQI, gender non-conforming and transgender youth. We hope that, in addition, state agencies will also ensure that 1) we are collecting state-level data to better understand impacted kids here in Utah and 2) we are providing the right kinds of care and services, so all kids feel affirmed, loved and supported.

Integrating Physical and Behavioral Health

We applaud the Governor for addressing Utah’s bifurcated healthcare system where different entities are responsible for physical and behavioral health services. The policy brief accompanying the budget discusses efforts to better integrate these systems. We hope that these efforts will also incorporate the behavioral health care needs of specific populations including children and new mothers. The behavioral health care needs of these populations are often overlooked and under-resourced. For example, women suffering from perinatal mood disorders - commonly called “maternal depression”- often have trouble finding treatment and care. Going forward, new efforts to better integrate services should make sure kids and parents can get the unique behavioral health care they need early on, before a condition escalates.

Jessie Mandle, Senior Health Policy Analyst

School Safety

When it comes to spending on “school safety,” the Governor’s budget has given us cause for concern. Governor Herbert appears to support the recommendations of the “School Safety Advisory Committee,” a group which has drawn criticism for its lack of representation and for conducting its business outside the public view.

In November of this year, this Committee presented a $194 million bill titled “School and Student Safety Amendments,” which designated $164 million for schools to upgrade their physical facilities with student safety in mind. In his budget, Governor Herbert includes $66 million in “flexible” funding for this same purpose. We have no problem with funding for schools to modernize and improve their infrastructure, as many schools are in need of basic maintenance anyway. Why not build in new safety features while modernizing facilities?

We appreciate that the Governor has set aside $31.7 million in his budget for a “school counseling program,” which appears to reflect a similar $30 million ask from the School Safety Advisory Committee during November interim. We applaud Governor Herbert for explicitly saying that this funding should be used for counselors. Mental health professionals, social workers, counselors and other professionals are critical for building a safe and positive school climate. Investing in prevention when it comes to bullying, violence and suicide makes more sense than trying to deal with the aftermath of these ongoing challenges.

Our concern about school safety funding arises from what is not said in the Governor’s budget, but which exists in the proposed legislation from the School Safety Advisory Committee: a mandate for each school in the state to form “Threat Assessment and Student Support Teams” that are authorized to respond to “significantly disruptive behavior” from students – whatever that may mean.

This approach, which is loosely based on a specific protocol that has yielded good results in other states, could jeopardize the recent juvenile justice reforms that received a great deal of well-deserved attention and praise in the Governor’s budget document. Utah’s impressive juvenile justice reforms have included a focus on using restorative, rather than punitive, practices in schools. This approach decreases the number of youth who are referred to court for very low-level offenses (such as truancy and smoking), incurring high costs to taxpayers and negative outcomes for the youth themselves. We are very concerned that the legislation recommended by the School Safety Advisory Committee does not align with these important reforms. We all want our kids to be safe at school, but not every proposed solution creates actual safety, and some approaches actually make some groups of students less safe. Voices for Utah Children will have much more to say on this subject as we move closer to the 2019 Legislative Session.

Anna Thomas, Senior Policy Analyst

2. Quality Workforce

Education

We at Voices, are particularly happy about the recommendations for sustained and improved funding of public education. Education is the key to future career success for so many Utah kids – and our teachers are key to education. That’s why we are so pleased with the Governor’s support for boosting teacher pay. When teachers do well, students do well.

We scoured the Governor’s budget for any mention of investment in early education with no luck. We’re not panicking yet. The Governor’s Education Road Map, released a year ago this month, included an entire section of recommendations related to early learning. We expect to see more investment in this area as current state-funded early education programs become better aligned and coordinated.

Child Care

We couldn’t help but notice the absence of any mention of state investment in – or even attention to – the pressing child care needs of Utah’s workers and students. We agree with Governor Herbert that “Utah must invest in its people to achieve long-term success,” and that “a dynamic economy requires a skilled and education population.”

Having the right skills and the willingness to work isn’t enough to make our workforce successful, though. More Utah workers than ever before are now also parents. They can’t be expected to engage productively in our thriving economy unless they have access to affordable, accessible child care. The state currently does a good job of managing federal dollars that help to subsidize child care costs for working parents but invests very few state tax dollars for this purpose. The Governor’s proposed budget would do little to change this.

The irony is, Utah doesn’t just need to fill “high-paying jobs” with “highly skilled” workers. We need many more individuals who are willing to work jobs that don’t pay well enough relative to their importance to our economic development. These critical jobs are in the early care and education sector. Currently, the Utahns who provide child care to working parents all over the state, barely make enough to keep their own families out of poverty.

One easy way the Governor could bolster state investment in child care, would be to provide sufficient funding for subsidized childcare while parents are attending college. The Governor’s budget rightly emphasizes the importance of higher education in creating opportunity to otherwise “at-risk” families. However, lack of affordable child care keeps many parents – moms, especially – from going back to school to enhance their earning potential. If Utah is serious about investing in the workforce, the Governor’s budget should prioritize investment in college-based child care centers such as the Wee Care Center at Utah Valley University and the Sorenson Legacy Foundation Child & Family Development Center at Southern Utah University.

Anna Thomas, Senior Policy Analyst

anna@utahchildren.org

3. Tax Modernization

Utah’s economic structure is moving from goods based to service based. Most purchased goods generate a sales tax. Some services are taxed, but many others enjoy a sales tax exemption or a reduced tax rate. The following table illustrates a few examples.

| State Sales Tax Bases: Consumer Goods & Services as of 7/1/18 | |

| Groceries | Alternate Rate |

| Clothing | Taxable |

| Prescription Medication | Exempt |

| Non-Prescription Medication | Taxable |

| Gasoline | Exempt |

| Legal | Exempt |

| Financial | Exempt |

| Accounting | Exempt |

| Medical | Exempt |

| Landscaping | Exempt |

| Repair | Taxable |

| Real Estate Services | Exempt |

| Parking | Exempt |

| Dry Cleaning | Taxable |

| Fitness | Taxable |

| Barber | Exempt |

| Veterinary | Exempt |

| Tax Foundation 2019 State Business Tax Climate Index | |

| https://files.taxfoundation.org/20180925174436/2019-State-Business-Tax-Climate-Index.pdf | |

| https://tax.utah.gov/sales/food-rate | |

| Utah grocery sales tax is 3%, a higher rate is charged if food items are mixed or combined by seller and/or heated by seller, or utensils are provided. | |

The increase in services as an engine for economic growth is not generating enough tax revenue to keep pace with the rising cost to build and maintain Utah’s infrastructure and provide services which support communities and keep the economy humming. As Utah moves to a service based economy, transactions generating sales tax have declined from about 70% (in the 1980s) to 40%. As a percent of income, 95% of Utah’s families pay more in sales and other local taxes than the top 5% of higher income families.

Source: https://itep.org/whopays/

This is not the first time the Governor has called for a tax overhaul. Removing a few exemptions is a commonsense way to broaden the tax base. It is time for special interests to do their part to boost revenues needed to pay for investments which support Utah’s Growth and Quality of Life.

Revenue Earmarks

Earmarks are revenue assigned to fund specific government projects, services or programs. For example, gas taxes are earmarked for transportation needs while a portion of tobacco taxes are designated to fund antismoking initiatives. The recent voter approved Prop 3 calls for a sales tax increase earmarked to expand Medicaid access.

The Governor wants to reform the state’s earmark policy. He notes that 48% of new sales tax revenue growth is earmarked in FY2020 and further argues that earmarks are not transparent and do not allow policy makers to prioritize the state’s most pressing needs. He proposes that some earmarks be replaced by user fees.

The online dictionary defines fee as “a payment made to a professional person or to a professional or public body in exchange for advice or services.” A tax is “a compulsory contribution to state revenue, levied by the government on workers' income and business profits or added to the cost of some goods, services, and transactions.” Whether it’s a tax or fee, broadening the tax base must be done fairly, equitably and shared by all.

Patrice Schell Scott, State Priorities Partnership Fellow

Register to Vote by October 30th

Kids can't vote. They need people who care about them (like you!) to vote for elected officials who will address their needs. Don't miss the next election.

You can register to vote at the polls on Election Day or during the Early Voting Period, but if you register beforehand:

- October 9, 2018: last day to register to vote by mailing in a registration form.

- October 30, 2018: last day to register to vote online or at your county clerk's office.

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express, our "Making a Difference All Year Long" sponsor.

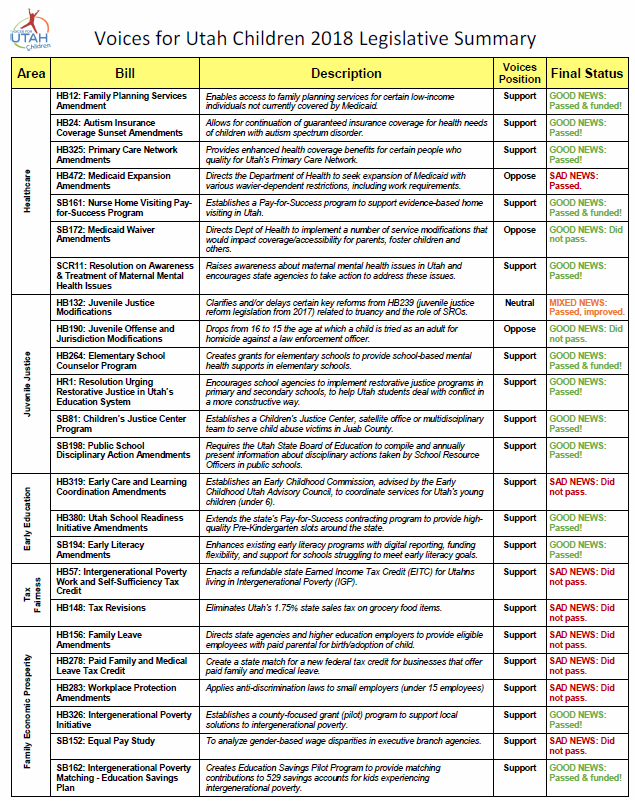

2018 Utah Legislative Update

The 2018 Legislative Session is over. Voices for Utah Children worked tirelessly to advocate for Utah’s children and families, and we had some great wins and some painful losses. Nonetheless, Utah children and families are in a better place now than they were in January.

Health

WIN: HB12 Family Planning Services Amendments (Rep. Ward)

- This legislation was championed by a number of Voices allies (YWCA, Utah Women’s Coalition, ACLU, and Planned Parenthood) to provide family planning services to low-income individuals through Medicaid

WIN: HB325 Primary Care Network Amendments (Rep. Eliason)

- This bill will direct the Department of Health to get a waiver to expand current PCN services for adults receiving coverage from the state.

DEFEATED: SB48 Medicaid Waiting Period Amendments (Sen. Christensen)

- This legislation would have re-imposed a five-year waiting period on legal immigrant children before they could enroll in health coverage. Our advocacy work helped ensure this bill never got heard

DEFEATED: SB 172 Medicaid Waiver (Sen. Hemmert)

- This bill would have done away with Medicaid’s children’s health benefit and EPSDT. This would have caused 2,600 parents and former foster youth to lose their health coverage. Voices defeated it in the House Health and Human Services Committee and again in the House Revenue and Taxation Committee.

LOSS: Keeping Kids Covered – 12-month continuous eligibility on Medicaid

- Rep. Ward appropriation requested wasn’t prioritized high enough to receive funding this year.

LOSS: Dental hygiene check-ups for kids in public education settings

- Dental Code for use by dental professionals providing hygiene check-ups for kids in public education settings - did not get prioritized high enough to be funded for this year - but we’ve strengthened our relationship with a huge association of highly motivated dental hygienists!

LOSS: HB472 Medicaid Expansion Revisions (Rep. Spendlove)

- HB472 seeks a waiver, that is highly unlikely Utah will receive from the Trump Administration. This waiver would provide Medicaid benefits to eligible individuals below 95% of the federal poverty level.

The Utah Decides Ballot Initiative is now our last hope to get Medicaid expansion done in 2018.

Early Childhood

LOSS - HB319 Early Care and Learning Coordination Amendments (Rep. Chavez-Houck)

- A priority bill to form an Early Childhood Commission for better governance and coordination among agencies offering services to Utah’s youngest kids (0 to 5).

WIN - HB380 Utah School Readiness Initiative Amendments – (Rep. Last)

- With a close collaboration with United Way of Salt Lake, this bill will continue the school readiness program, Pay-for-Success. Since 2014 this has provided thousands of at-risk kids in Salt Lake county with high-quality pre-school.

WIN - SCR11 Concurrent Resolution on Awareness and Treatment of Maternal Depression and Anxiety (Sen. Zehnder)

- With the efforts of the Maternal Mental Health Coalition, this resolution energized and inspired story-sharing and education on maternal mental health.

WIN: SB161 Nurse Home Visiting Pay-for-Success Program (Sen. Escamilla)

- This legislation will fully fund the Nurse Family Partnership by putting it forward as a Pay-for-Success Program.

Juvenile Justice

WIN: HR1 House Resolution Urging Restorative Justice in Utah’s Education System – (Rep. Sandra Hollins)

- Resolution to encourage the use of restorative justice practices in Utah schools

NOT A WIN BUT NOT A LOSS: HB132 Juvenile Justice Modifications (Rep. Snow)

- Updates to last year’s big juvenile justice reform effort - we fought hard with our allies (ACLU, Libertas Institute, YWCA, Racially Just Utah) to keep the changes to a minimum. This bill gives school a limited amount of time to update their programs to comply with HB239 from 2017.

WIN: SB198 – Public School Disciplinary Action Amendments (Sen. Anderegg)

- This legislation requires the Board of Education to produce an annual report looking at law enforcement and disciplinary action in schools. This data will be helpful as we work to reduce racial disparities in school discipline and work to build a system that produces better outcomes for all kids.

Tax and Budget

NOT QUITE A WIN BUT OH SO CLOSE: HB57 Utah Intergenerational Poverty Work and Self-sufficiency Tax Credit (Rep. Westwood/Sen. Vickers)

- This bill would have created a $6 million Earned Income Tax Credit (EITC) for 25,000 working families identified as being in the Intergenerational Poverty (IGP) cohort by the state Department of Workforce Services. These families, which pay tens of millions of dollars in state and local taxes every year, would have been able to keep more of what they earn with a tax credit averaging $240 (and up to $600 maximum). This legislation received unanimous support in both House and Senate committees, passed the House, and received a 22-4 vote on 2nd reading in the Senate. But on the final day of the session, leadership decided to leave it out of the final tax package.

NOT QUITE A WIN BUT COULD HAVE BEEN A LOSS --SCHOOL FUNDING

- The most notable fiscal outcome of the 2018 Legislative Session was a deal between legislative leadership and education funding advocates. The compromise deal included two big choices:

- Investing up to about $350 million in new education funding dollars – which should move Utah up one position in the national rankings for per-pupil K-12 funding, from 50th place to 49th if it is fully implemented.

- Shifting who pays these new dollars in a way that unfortunately more negatively impacts poor and middle class families. The Our Schools Now initiative proposal that was set aside in favor of this compromise would have raised over $700 million mostly from an income tax increase paid by the top 20% of Utahn (those who earn over $115,000). The compromise shifted these funds to come from more regressive gas and property tax increases.

LOSS: HB 148: House Bill 148 Tax Revisions- Sales Tax on Food (Rep. Quinn)

- Sought to eliminate the state sales tax on grocery food items (currently 1.75%) and make up for the $88 million in lost revenue by slightly increasing the general state sales tax rate from 4.7 to 4.92%. One underappreciated benefit of this tax change would have been to shift 20% of the $88 million, or $17.6 million, off of state residents and onto tourists and out-of-state residents who purchase Utah exports. The bill passed the House but was killed by the Senate Revenue and Taxation Committee.

WIN: Two Significant Intergenerational Poverty (IGP) bills

- HB 326 Intergenerational Poverty Initiative (Rep. Redd) establishes a one-time $1 million grant program for local IGP initiatives.

- SB 162 Intergenerational Poverty Matching – Education Savings Plan (Sen. Vickers) establishes a $100,000 matching grant program for IGP families that invest in a Utah Educational Savings Plan for their children's post-secondary education.