HOW WILL THE PUBLIC HEALTH EMERGENCY AFFECT UTAH’S ECONOMY?

HOW WILL RECENT FEDERAL ACTIONS HELP?

WHAT DOES UTAH NEED TO DO NEXT?

As Americans hunker down in their homes to avoid catching the coronavirus, and as Governors across the nation ban gatherings and apply social distancing requirements that are shutting down major industries, millions of Americans have suddenly found themselves applying for unemployment benefits as the effects of the Coronavirus Recession become as widespread as the pandemic itself. How will this partial shutdown impact Utah’s economy and the hundreds of thousands of Utahns, about a third of them children, who live below, at, or just a paycheck or two away from the poverty line?

Given the unprecedented nature of the public health threat and the economic contraction following from it, economists’ predictions cover a wide range and are being updated weekly or even daily. For example, this week saw one Federal Reserve Bank economist predict the US unemployment rate could rise from February’s 3.5% to as high as 32% by June. (By contrast, the 2008-2009 Great Recession saw a peak unemployment rate of 10% nationally and 8.4% in Utah, while the Great Depression’s peak unemployment rate reached 25% in 1933, before federal government action began to bring it down.) The investment bankers at Goldman Sachs are more optimistic (or less pessimistic), seeing unemployment rising to 15% by June. However, Goldman Sachs did downgrade its GDP prediction: last week they saw the economy shrinking at a 24% annual rate in the second quarter (April-June), but this week they predicted that the 2nd quarter contraction would be at an annual rate of 34%, followed by a partial recovery by the end of the year, resulting in a 2020 GDP contraction of “only” 6.2%, with continued rapid recovery in 2021. (GDP, or gross domestic product, is the sum total of all economic activity and the most common metric for measuring the size of a state or national economy.)

What would be the impact on Utah’s economy of a 6.2% drop in state GDP this year?

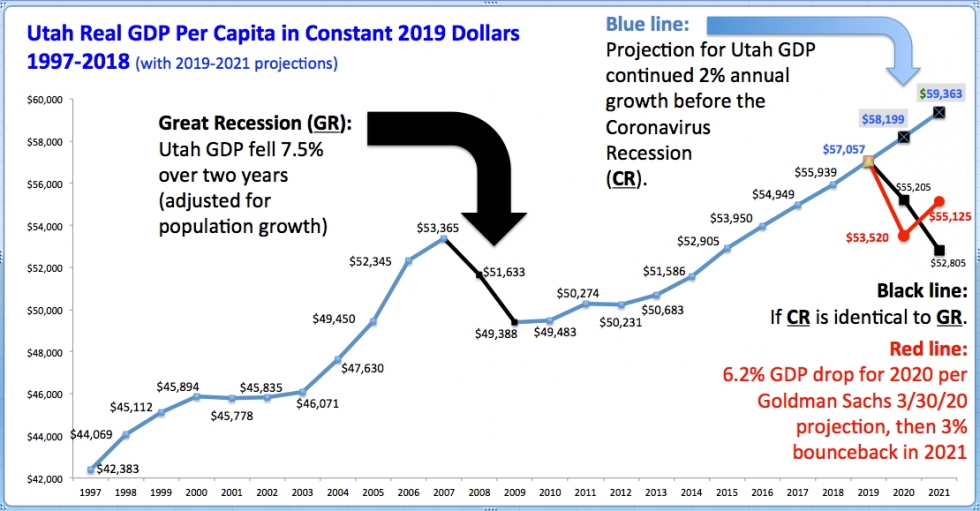

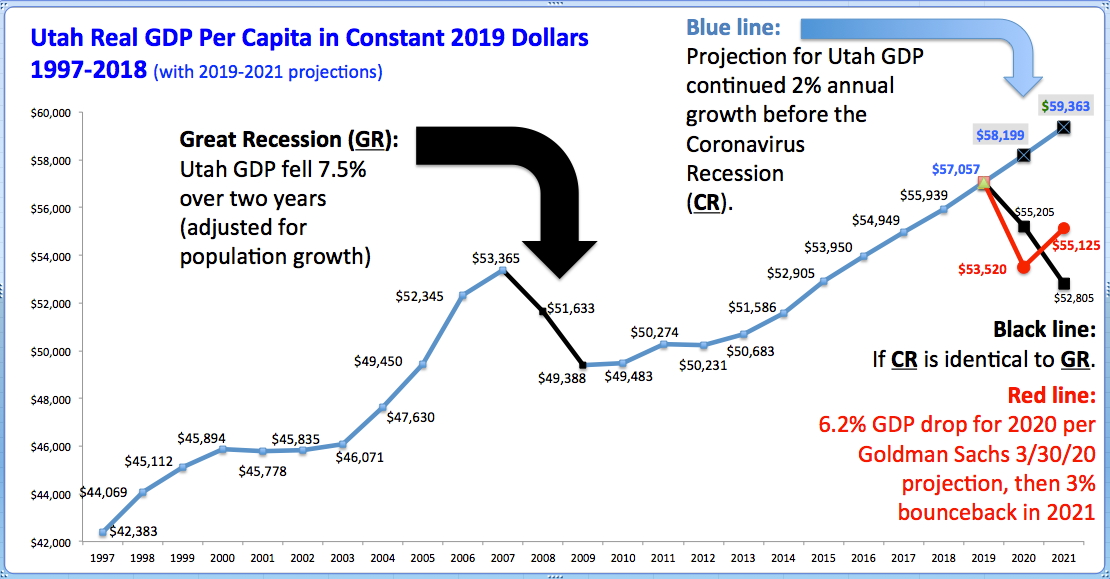

The chart below shows the trend in Utah’s GDP growth since 1997 based on data from the US Department of Commerce’s Bureau of Economic Analysis (BEA). Utah’s real (inflation-adjusted) per capita GDP (per capita so as to separate out real GDP growth from population growth) suffered more than the nation’s in the Great Recession (falling by 7.5% compared to 4.4% for the nation as a whole), and then grew by 13% through the end of 2018 (compared to 15% for the nation as a whole). In recent years, Utah’s GDP per capita has been growing at a steady rate of about 2% annually, about the same as nationally, which was expected to continue if not for the public health emergency. The blue line on the right side of the graph projects how it would have continued to grow at that pace in 2020 and 2021.

The black line shows how our GDP would shrink in 2020 and 2021 if the Coronavirus Recession were to be an identical repeat of the Great Recession of 2008-2009. But, as described above, this recession is expected to have a faster decline (due to the need to suddenly impose social distancing), followed by a more rapid recovery (thanks largely to the quick action taken by the federal government in the $100 billion FFCRA and $2.2 trillion CARES Act passed over the last two weeks). The red line shows the Coronavirus Recession's impact on Utah GDP based on the Goldman Sachs prediction this week: A one-year decline about double the size of the first year of the Great Recession in 2008, followed by recovering about half of that lost GDP in 2021, leaving us at the end of 2021 about where we would have been at the end of the first year of another Great Recession, but already well on our way to full recovery by the end of 2022 (that is, full recovery to the pre-recession level of GDP per capita, but not to the level we would have achieved had the Coronavirus Recession never happened).

The gap in GDP per capita in 2020 between what was expected before the coronavirus pandemic and what we might expect (if the Goldman Sachs projection turns out to be accurate insofar as its applicability to Utah's unique economic characteristics) adds up to $4,679 per Utahn. When we multiply that by the state’s projected 2020 population of about 3.25 million, that amounts to over $15 billion of lost GDP for the state this year.

At the household level, incomes in 2018 (the most recent year for which these figures are available) added up to just over half of state GDP. Thus, a loss of $15 billion of state GDP implies a household income loss averaging about $8,000 for Utah's roughly 1 million households compared to the pre-coronavirus 2020 projection. Needless to say, households will experience these losses very differently, depending on whether they experience job or income losses. Many households will emerge from this recession relatively unscathed, while others will find their incomes, savings, and credit ratings completely wiped out if they are not able to quickly access public assistance or find new employment.

HOW WILL THE CORONAVIRUS RECESSION IMPACT STATE AND LOCAL GOVERNMENTS?

For state and local government, how might the recession impact tax revenues? This is a critically important question for several reasons:

- Public health is a major area of responsibility – and expenditure – for state and local government. All of us are counting on state and local authorities to come through to keep us safe and healthy.

- State and local governments (including local school districts) are major employers, and their ability to borrow in a crisis is far more limited than that of the federal government. Thus, if tax revenues plummet beyond the ability of rainy day funds and bonding capacities to offset the loss, then the state, counties, and municipalities will have to make cuts and lay off potentially thousands of employees, making Utah’s recession deeper and longer and harder to climb out of.

- Our ability to recover rapidly from any recession depends in part on the quality of our public schools and universities, as well as our transportation and other infrastructure. The fact that the Great Recession in 2008-2009 hurt Utah GDP per capita more than nationally, and the fact that we have seen slower per capita GDP growth than the nation since then, adds to the worries of many Utahns that our decades of tax cutting may have hobbled our ability to make the public investments required to achieve the rising standard of living that Utah families seek.

In recent years, state taxes have been running at about 8-9% of state GDP. From this we can infer that a loss of $15 billion of state GDP for 2020 implies a loss of $1.2-1.4 billion of state tax revenue in the calendar year compared to pre-recession projections, which impacts two fiscal years -- FY 2020 (which ends June 30) and FY 2021 (which begins July 1, 2020). This is an amount considerably larger than the expected $900 million of state fiscal relief offered to Utah state government by the CARES Act passed last week by the federal government, but it is smaller than the combined total of that assistance plus existing state rainy day funds.

Calculating the precise impact of a drop in GDP on state and local tax revenues, especially in the circumstance of an unprecedented type of recession, with a steeper decline and a (hoped-for) rapid recovery, involves many unpredictables. In the Great Recession, Utah GDP overall fell by 3%, and GDP per capita dropped 7.5%, both over the course of two years of contraction. But the decline in state revenues, which in the first year of the Great Recession (2008) roughly matched the decline in GDP, ultimately was both much greater and longer-lasting: Overall state tax revenues (adjusted for inflation) fell by 9.4% (and by 15.2% on a per capita basis, which removes from the equation the ameliorating influence of rising population), and in both cases over the course of three years rather than two for GDP. Moreover, tax revenues (both overall and per capita) fell most sharply in the second and third years of the decline, meaning that the Great Recession drop in state tax revenues suffered from effects that continued even after the recession itself officially ended.

Will this be the case in a recession that is sharp and deep but (we hope) relatively brief and with a rapid recovery? Will tax revenues for FY2020 roughly match the decline in 2020 GDP, both overall and on a per capita basis, as they did in 2008? Will a rapid recovery in GDP in 2021 mean that FY21 and FY22 tax revenues can avoid the deeper declines that continued in the Great Recession even after the recession itself ended? Or will the warnings of public health experts of possible multiple waves of COVID-19 prove to be true, delaying economic recovery and extending the downturn?

HOW WILL THE RECENT FEDERAL LEGISLATION HELP UTAH?

Despite the many uncertainties, it does seem likely that the decisive federal government action in enacting the $2.2 trillion CARES Act last week will help states to recover more rapidly from the Coronavirus Recession than from the Great Recession. The major components of the CARES Act include:

- $300 billion for Recovery Rebates directly to eligible taxpayers -- $1200 per adult, $500 per child. (Be sure that you filed a tax return last year!)

- $260 billion for expanded unemployment insurance (UI) benefits – including:

- adding $600/week to bring the average benefit closer to full pay equivalent for more workers

- adding coverage for self-employed and “gig” workers

- temporarily suspending work search requirements and waiting periods so that more of the unemployed will qualify (now only about 1 out of every 4 jobless in Utah even qualify for UI).

- $215 billion for state and local government fiscal relief:

- $150 billion Coronavirus Relief Fund for state, local, and tribal governments – Utah should get about $1.25 billion, of which about $900 million goes to state government (which is about as much as the amount in Utah’s main rainy day accounts) and about $300 million to our two largest county governments, Salt Lake and Utah counties.

- $30 billion for state education systems through an Education Stabilization Fund

- $35 billion to boost the federal share of Medicaid (FMAP) (thus lowering each state’s share) by 6.2 percentage points (this was included in the FFCRA passed two weeks ago)

- $12 billion for affordable housing and homelessness prevention.

- $3.5 billion for child care (through CCDBG), with about $39 million expected to come to Utah.

- $0.9 billion for Low Income Home Energy Assistance (LIHEAP).

- $105 billion for tax credits for businesses under 500 employees to offer paid sick and family leave (also from FFCRA)

- $365 billion for small businesses to stay afloat and keep workers on payroll during the shutdown

- $500 billion for large businesses like airlines

These unprecedented federal actions add up to more than double the size of the highly-controversial-at-the-time 2009 American Recovery and Reinvestment Act (ARRA), yet they passed with nearly unanimous bipartisan support.

WHAT ACTIONS WILL UTAH TAKE?

Now the focus turns to the states: What actions will Utah take to help families and businesses while stabilizing revenues for state and local governments? The state has already been engaged in a flurry of activity regarding both the public health and economic impacts of the crisis, such as small business lending and eviction protections for tenants. Additional actions to consider should include the following:

- Will Utah start to tap our rainy day funds to cover areas not addressed by federal assistance, such as:

- Local government budget gaps that will soon be opening up in the 27 counties that are under the 500,000 population level required to qualify for the new $150 billion federal Coronavirus Relief Fund.

- Undocumented Utahns make up about 100,000 of our 3.2 million residents, yet they are excluded from all of the emergency relief measures passed at the federal level, even though we rely on them for many critical jobs in the current emergency. For the sake of public health as well as basic fairness, state and local governments should act now to include and protect these vulnerable Utahns.

- Will the state appropriate additional outreach funding -- especially targeting vulnerable populations and in a variety of languages -- so that the record number of newly unemployed and impoverished Utahns will quickly learn how they can get the help they need through Unemployment Insurance, CHIP, Medicaid, SNAP, WIC, TANF, General Assistance, Child Care, LIHEAP, and other forms of emergency public assistance? Fast action here will pay for itself over time by lessening both the human and the economic harms of the recession, making possible a more rapid recovery.

- Will the Governor and Legislature reconsider the 2018 income tax cut reducing Governor Huntsman’s 5% rate to 4.95%? Restoring that 5% rate would save jobs and avoid layoffs by bringing $50 million back into the state budget, mainly from the highest-income Utahns who can most comfortably afford it, even in a recession. (The income tax is Utah’s only non-regressive tax. It is structured to exclude lower-income Utahns and roughly match the state’s income distribution, so that 3/5 of it is paid by the top 1/5 of taxpayers, and 4/5 is paid by the top 2/5.)

- Will the state offer our own assistance to low-income households, such as through the EITC (Earned Income Tax Credit) proposal that was included in the ill-fated December 2019 legislation? The IGP EITC offered $6 million of tax relief to Utahns working their way out of intergenerational poverty and is especially needed in the current circumstances.

- Will Utah take full advantage of federal flexibility to waive the barriers to care represented by the numerous Medicaid and CHIP paperwork, premium, and copay requirements that were in effect prior to the coronavirus emergency? Early indications are promising, and we hope more good news will be forthcoming.

- How will Utah use its federal funds and possibly state resources as well to keep child care centers from closing, both to support the families of essential personnel and to ensure they remain in business after the emergency passes?

These are among the many areas where Voices for Utah Children will advocate in the coming days, weeks, and months to ensure that Utah learns the lessons of past recessions, adapts to the unprecedented nature of today's emergency, and takes the actions needed today to ensure the strongest possible economy once the Coronavirus Recession is behind us.