Tax and Budget

The state's leading child research and advocacy organization Voices for Utah Children announced its opposition to Constitutional Amendment G in an online press conference today (Monday, October 5, 2020).

Constitutional Amendment G is the proposal to amend the Utah State Constitution to end the Constitutional earmark of all income tax revenues for education. Since 1946 Utah has dedicated 100% of income tax revenues to education, initially defined only as K-12 education and, since 1996, including also higher education. The State Legislature voted in March to place on the ballot the question of also allowing these funds to be used for other purposes -- specifically for programs for children and for Utahns with disabilities.

The arguments made by proponents and opponents are summarized in an online document prepared by the state election administrators in the Lt Governor's office. According to that document, "the state spends about $600 million annually of non-income tax money on programs for children and programs that benefit people with a disability."

Voices for Utah Children CEO Maurice "Moe" Hickey explained the organization's decision to oppose the Amendment: "We believe that the proposed Amendment not only won’t solve Utah’s state budget woes, it is likely to delay the real fiscal policy changes that are needed. Over the past decade we have been continuously ranked last in the country for per pupil spending. This is a caused by our growth in number of students, combined with a lowered tax burden in the past decade. A major question we have to ask is “if the current Constitutional earmark has failed to help Utah invest more in education, how will getting rid of it improve matters?” The unfortunate reality is that getting rid of the Constitutional earmark of income tax for education does nothing to solve the real problem, which is the fact that nearly every area of state responsibility where children are impacted – education, social services, public health, and many others – is dangerously underfunded."

Health Policy Analyst Ciriac Alvarez Valle said, "Utah has one of the highest rates of uninsured children in the country at 8% or 82,000 children, and we have an even higher rate of uninsured Latino children at almost 20%. It is alarming that even during this pandemic, children and families are going without health insurance. There are so many ways to reverse this negative trend that began in 2016. Some of the solutions include investing in our kid’s healthcare. By investing in outreach and enrollment efforts especially those that are culturally and linguistically appropriate for our communities of color, we can ensure they are being reached. We also have to invest in policies that keep kids covered all year round and ensures they have no gaps in coverage. and lastly, we have to invest in covering all children regardless of their immigration status. By doing these things we can ensure that kids have a foundation for their long term health and needs. It's vital that we keep children’s health at the forefront of this issue, knowing that kids can only come to school ready to learn if they are able to get the resources they need to be healthy."

Health Policy Analyst Jessie Mandle added, "All kids need to have care and coverage in order to succeed in school. We are no strangers to the funding challenges and the many competing demands of social services funding. Without greater clarity, more detail, and planning, we are left to ask, are we simply moving the funding of children’s health services into another pool, competing with education funding, instead of prioritizing and investing in both critical areas? Sufficient funding for critical children’s services including school nurse, home visiting and early intervention, and school-based preventive care remains a challenge for our state. We have made important strides in recent years for children’s health, recognizing that kids cannot be optimal learners without optimal health. Let’s keep investing, keep moving forward together so that kids can get the education, health and wraparound services they need."

Education Policy Analyst Anna Thomas: "We often hear that UT is dead last in the nation in per pupil funding. We have also heard from such leaders as Envision Utah that millions of dollars are needed to avert an urgent and growing teacher shortage. What we talk about less is the fact that these typical conservative calculations of our state’s underfunding of education don’t include the amount the state should be paying for the full-day kindergarten programming most Utah families want, nor does it include the tens of millions our state has never bothered to spend on preschool programs to ensure all Utah children can start school with the same opportunities to succeed. Utah currently masks this underfunding with dollars from various federal programs, but this federal funding is not equitably available to meet the needs of all Utah children who deserve these critical early interventions. The state also increasingly relies on local communities to make up the difference through growing local tax burdens - which creates an impossible situation for some of our rural school districts, where local property tax will never be able to properly fund early interventions like preschool and full-day kindergarten along with everything else they are responsible for. Our lack of investment in early education is something we pay for, much less efficiently and much less wisely, later down the road, when children drop out of school, experience mental and physical health issues, and get pulled into bad decisions and misconduct. If kids aren’t able to hit certain learning benchmarks in literacy and math by third grade, their struggles in school - and often by extension outside of school - multiply. We should be investing as much as possible in our children to help ensure they have real access to future success - and can contribute to our state's future success. You don’t have to be a math whiz - third grade math is probably plenty - to see that the general arithmetic of Amendment G, and the attendant promises of somehow more investment in everything that helps kids - just doesn’t add up. We have multiple unmet early education investment obligations right now. Beyond that, we have many more needs, for children and for people with disabilities, that we must be sensitive to as a state especially during a global pandemic. How we will ensure we are investing responsibly in our children and our future, by having MORE expenses come out of the same pot of money - which the legislature tells us every year is too small to help all the Utah families we advocate for - is still very unclear to me. Until that math is made transparent to the public, we have to judge Amendment G to be, at best, half-baked in its current incarnation."

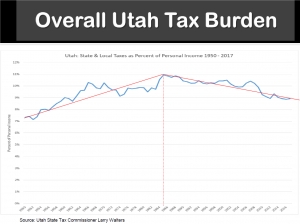

Fiscal Policy Analyst Matthew Weinstein shared information from the Tax Commission (see slide #8) showing that Utah's overall level of taxation is now at its lowest level in 50 years relative to Utahns' incomes, following multiple rounds of tax cutting. He also shared recent survey data from the Utah Foundation showing that three-fourths of Utahns oppose cutting taxes further and are ready and willing to contribute more if necessary to help solve the state's current challenges in areas like education, air quality, and transportation. He contrasted the public's understanding that there's no "free lunch" with the unrealistic election-year promises made by our political leadership -- more money for both education and social services if the public votes for Amendment G -- even though Amendment G does nothing to reverse any past tax breaks and address the state's chronic revenue shortages.

The organization shared a one-page summary of the arguments for and against the proposed Constitutional Amendment:

The organization also published a full five-page position paper that is available in pdf format.

Tax and Budget

Every day, our state and federal governments raise and spend tax revenue in ways that profoundly affect families and children. Choices states make about investing in schools, health care, child care, and other services can either help create opportunity and prosperity for people or hold them back.

Voices for Utah Children works to fight poverty by examining Utah's tax and budget policies and analyzing their impact on children, particularly those from low- and moderate-income families that are most at risk for not completing their education or otherwise not achieving their full potential. We identify evidence-based fiscal strategies to strengthen struggling families, often by means that save taxpayers money in the long run.

Family Economic Success

Economic Growth, Taxes, and Investments in Families and Children

Taxes: Every year, Utah's taxes (income, sales, gas, and property taxes) generate revenues that government then expends in ways that profoundly affect families and communities. The fiscal choices Utah makes — such as whether to invest in Utah's future or give in to the temptation to cut taxes below their current overall low level — will make a critical difference in the lives of the next generation of Utahns. If we make the best choices, we can help foster opportunity for all our children and lay the foundations for Utah's future growth and prosperity.

Recently the Utah State Tax Commission and the Utah Foundation both published research showing that taxes in Utah are the lowest that they have been in 30-50 years, following repeated rounds of tax cutting. Tax cutting is thought to be popular, especially in election years, but is it always wise? At some point we need to ask ourselves a difficult question: Is the current generation of Utahns doing our part, as earlier generations did, to set aside sufficient resources every year to invest in our children, in our future, in the foundations of our children's prosperity and quality of life? And more immediately and specifically, given the Coronavirus Recession's expected impacts on the Utah state budget, should we reconsider the 2018 election-year decision to reduce our income tax rate from 5% to 4.95%, a $50 million tax cut that mostly benefitted high-income households?

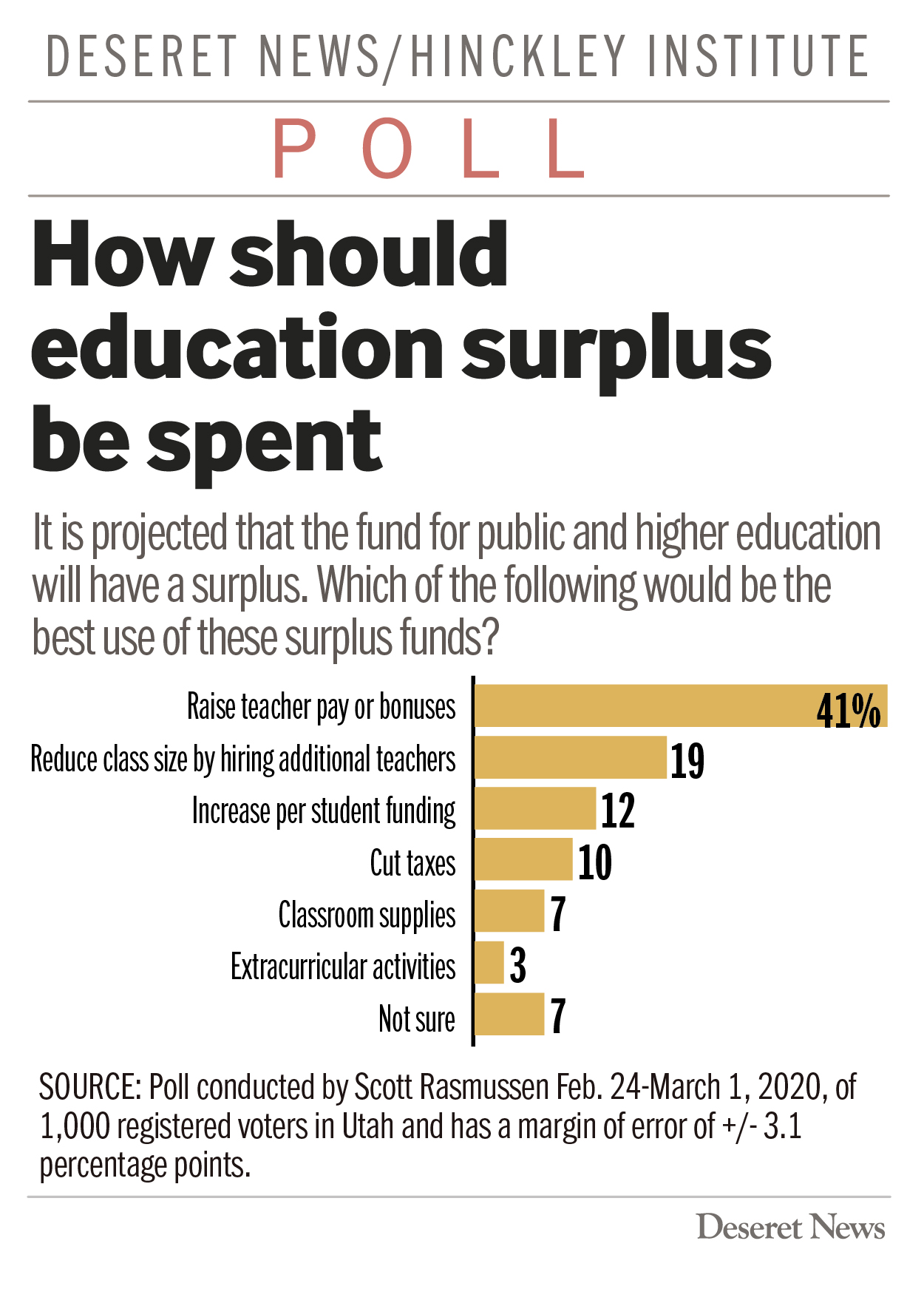

The supposed popularity of tax cutting has been called into question by 2020 polling data. For example, during the 2020 legislative session, the Deseret News found that only 10% of Utahns thought that the expected Education Fund surplus should be used for tax cuts rather than enhanced education investment. And the Utah Foundation found similar results in their election issue survey -- less than one-quarter of Utahns support tax cuts that erode the state's ability to deliver the services Utahns need, while "74% of Utahns were willing to increase their taxes for a specific benefit" (either education, transportation, or air quality).

Voices for Utah Children's fiscal policy program works to ensure that we invest sufficient resources to ensure that our kids get world-class education and health care as well as special support for children most in need.

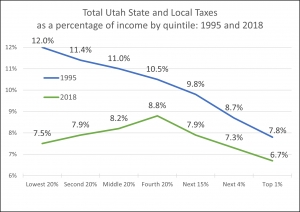

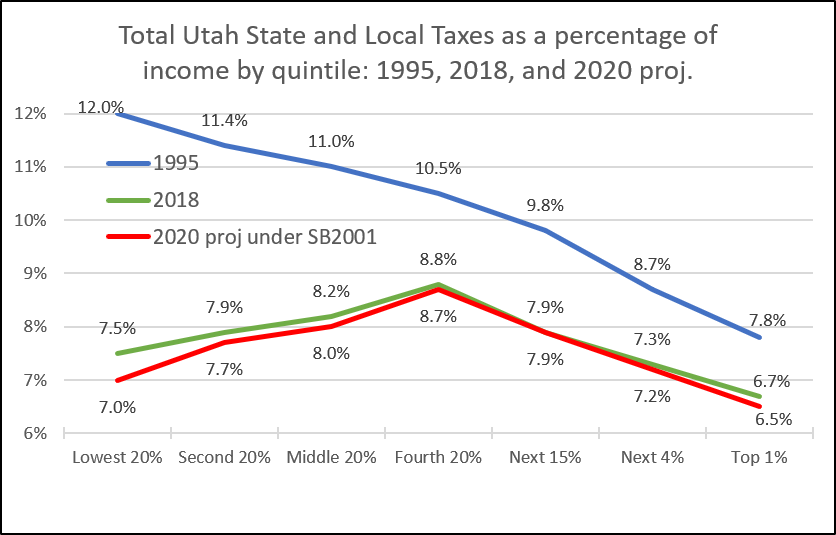

At the same time, we also work to ensure that public revenues are generated in ways that are fair. No family should be taxed into poverty as the price of educating their children. Currently, while we've moved in a better direction over the past 25 years, Utah does tax about 100,000 families into or deeper into poverty every year. In addition, the lowest-income Utahns pay a higher overall tax rate (7.5%) than those with the highest incomes (who pay 6.7% of their incomes in state and local taxes). That's one of the reasons why Voices for Utah Children supports making Utah the 30th state in the nation with our own Earned Income Tax Credit (EITC), starting with Utahns working their way out of intergenerational poverty.

Economic Performance: Voices for Utah Children examines and reports on Utah's economic performance from the perspective of how low- and moderate-income Utahns experience the economy -- some examples appear in the links below:

Why Utah Should Invest In Our Future, Not Tax Cuts

Why Should Utah Become the 30th State with Our Own Earned Income Tax Credit (EITC)?

The History of Tax Incidence in Utah 1995-2018

Inequality in Utah Compared to Other States and the Nation

Utah Working Families Economic Performance Benchmarking Project: Utah vs. Idaho

We work to equip lawmakers, journalists, advocacy organizations, other nonprofit service providers and the public with unassailable information that will help children get a quality education, help families get medical care, and help working people get the support they need to build a better life for their children.

2020 Election Guide to Issues Affecting Children

2020 Election Issues Guide

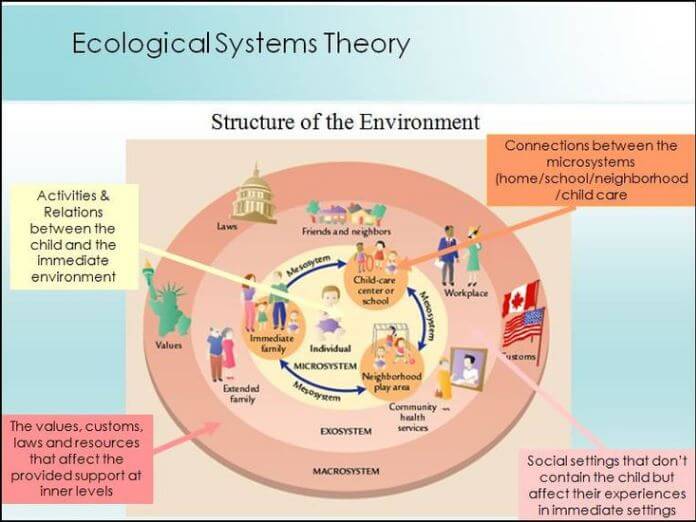

American psychologist Urie Bronfenbrenner formulated the Ecological Systems Theory to explain how the inherent qualities of children and their environments interact to influence how they grow and develop.

American psychologist Urie Bronfenbrenner formulated the Ecological Systems Theory to explain how the inherent qualities of children and their environments interact to influence how they grow and develop.

As Utah grapples with the effects of the coronavirus and COVID-19, this election year challenges us all to think bigger, broader, and longer-term. What lessons must we learn from the public health emergency? What has worked and has not in the actions already taken by state and local authorities? What weaknesses in Utah's economic and social structures were exposed by the pandemic that demand increased attention by Utah's next governor and legislators? What challenges can we now see that we should have addressed years ago to improve our resilience and ability to adapt to emergency circumstances?

While it is certainly true that the direct health effects of the coronavirus impact older adults the most, it is Utah's children who may bear the most lasting scars. Unable to attend school in person, relying on their parents or guardians to be their "home teachers" in a new sense, we already know that tens of thousands of Utah's children will fall behind in ways that will be difficult to make up. The decisions that our new governor and legislators make in the years to come will determine whether and how much our social and economic gaps expand as a result.

The public offices on the ballot in November include:

- Governor and Lt. Governor

- Half of the State Senate

- The entire Utah House of Representatives

Our elected officials play a central role in determining whether all Utah's children have the opportunity to achieve their potential. Will they have access to healthcare and education? Will their families enjoy the economic stability they need to thrive? These are all questions that will be answered by Utah's next governor and legislature.

Voices for Utah Children is providing this Election Issues Guide so that candidates for elected office can better understand the challenges facing Utah's children. We are also seeking to encourage public awareness and dialogue about the needs of children during this year's campaigns so that our new governor and legislature will begin their terms of office prepared to enact effective policies to protect their youngest constituents.

We have divided this Election Issues Guide into five sections:

Tax & Budget/Economic Performance

The Election Issues Guide can also be downloaded as a ![]() 15-page pdf at this link for easier printing.

15-page pdf at this link for easier printing.

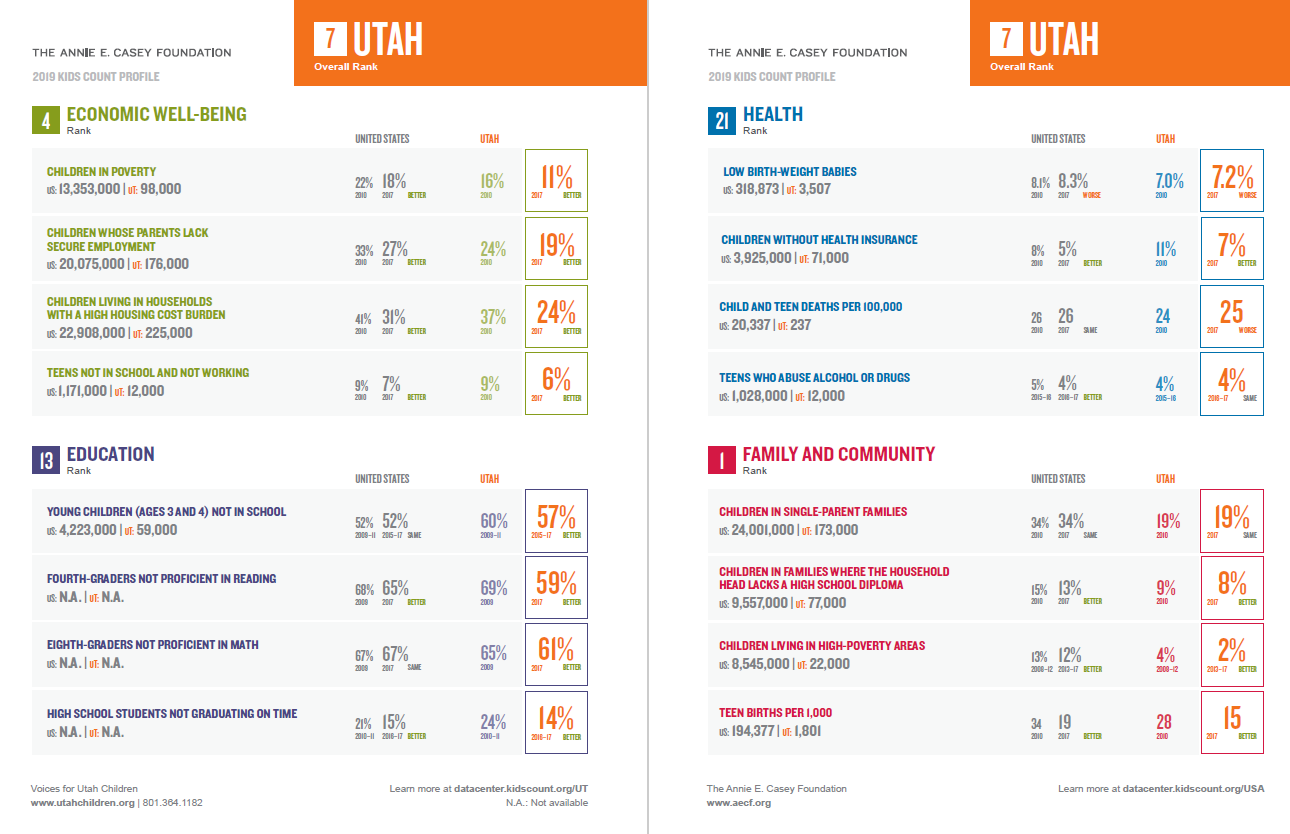

Supported by the Annie E. Casey Foundation, our KIDS COUNT® work aims to provide Utah’s legislators, public officials and child advocates with reliable data, policy recommendations and other tools needed to advance the kinds of sound policies that benefit children and families across the state.

In 2019, Utah held on to its ranking among the top ten in the annual Annie E. Casey Foundation KIDS COUNT® Data Book report, coming in at 7th highest in the nation. We especially shined in the subcategory of "Family and Community," where we ranked #1 thanks to our highest-in-the-nation share of two-parent families and low share of children growing up in high-poverty neighborhoods. We also ranked 4th highest in the subcategory of "Economic Well-Being" thanks to our relatively low share of children in poverty.

But we failed to make the top ten in the other two subcategories in the KIDS COUNT® rankings, due to the fact that public policy has fallen short in precisely those two areas: education and health care. We barely outperformed the nation for high school graduation (and fell behind after adjusting for demographics). And we fell behind in the share of children with health insurance, especially among Utah's Latino children, who suffer from the highest uninsured rate in the nation.

All the KIDS COUNT® ranking details are viewable on the chart and links below.

Terry Haven

Deputy Director

Voices for Utah Children

More Information:

Measures of Well-Being in Utah, 2019

Talking Kids Tour 2019 - A Supplement to the 2019 Utah KIDS COUNT Data Book

Every Utah child deserves the opportunity to reach their full potential, no matter where their family comes from or where they live in our state. No family should be denied care or afraid to seek the care they need. We must ensure that all Utah parents and kids have affordable health coverage and care. That is why Voices for Utah Children spearheads the 100% Kids Coverage Campaign, so that all children in Utah have insurance. Together we can promote healthy communities where all Utah families thrive.

All Utah children, families, and communities should have access to:

Pre-natal care and insurance, including mental health support for caregivers;

Pre-natal care and insurance, including mental health support for caregivers;- Continuous, comprehensive health coverage and care for all Utah kids;

- Healthy communities and environments, including access to healthy food, clean drinking water and clean air.

To learn more about the 100% Kids Coverage Campaign visit: https://utahchildren.org/issues/100-kids-covered

Contact Jessie Mandle or Ciriac Alvarez Valle

More Information:

What Does the Coronavirus Mean for Families’ Access to Health Care?

New Report Finds Number of Uninsured Latino Children in Utah on the Rise

Voices for Utah Children Opposes New Trump Administration Medicaid Block Grant Guidance

Voices for Utah Children opposes Trump Administration Public Charge Rule

Voices for Utah Children celebrates Utah Medicaid Expansion

Voices for Utah Children believes in a youth-centered juvenile justice system that meets the needs of the children involved in it, while producing positive outcomes for Utah families and protecting community safety. We are committed to the belief that children should be nurtured, educated and given an equitable chance at success in life. That means allowing young people to make mistakes, learn from them, develop accountability to themselves and their communities, and work through their own unique challenges as they prepare for their lives as adults.

Voices for Utah Children advocates for juvenile justice system that is fair, effective and equitable. Such a system creates positive outcomes for different children, using evidence-based and culturally-competent programs, that meets the needs of children from a variety of socioeconomic backgrounds, races, ethnicities, physical and mental abilities, religious paths and belief systems, and sexual orientations and gender identities. We'll know that Utah has a fair, effective and equitable system when the youth themselves, their families and their communities, believe that the system is working in their best interest. In addition, we will see existing disparities between children of different races - in terms of contact with the system, the seriousness of dispositions, and the barriers to exiting the system quickly - disappear.

While we actively engage in policy analysis and advocacy directed at the policymakers who are able to remore structural barriers to youth success, we also work to empower advocates and community members alike, arming people with information that allows them to advocate for the young people in their lives who may be system-involved or at risk for system involvement.

More Information:

April 6, 2020 COVID-19 Update on Utah's Juvenile Justice System in: English, Spanish

April 27, 2020 COVID-19 Update on Utah's Juvenle Justice System in: English, Spanish (Part 1 & Part 2)

Good News for Juvenile Justice Reformers, from the 2019 Legislative Session

Report: Utah children face barriers to accessing defense attorneys

Let's End Racial Disparities in Utah's Juvenile Justice System

Anna Thomas, MPA

Anna Thomas, MPA

Senior Policy Analyst

Voices for Utah Children

The early years in a child’s life are critically important in terms of social, emotional and cognitive development. All children deserve to start their lives with a real chance to succeed and be happy later in life, but not all children have access to the things that set them up for that kind of future. We believe that when the wellbeing of young children is at the center of public policy and community investment, our entire state does better.

That is why Voices for Utah Children focuses on promoting targeted investments in early childhood care and education, structured to meet the unique needs (and build on the unique strengths) of Utah's many diverse communities. We believe it is possible to build an early childhood system in Utah that supports families with young children by making sure they have access to affordable and appropriate options for their children’s early care and learning—whether children spend their days at home, in formal child care, at public school, or in the care of trusted family and friends.

Anna Thomas, MPA

Senior Policy Analyst

Voices for Utah Children

More Information:

There’s No “Re-Opening” Utah Without More Child Care

National Orgs Call for Emergency Child Care Sector Relief

Three Things Utah Can Do to Ensure Right-Sized Access to Full-Day Kindergarten

Kinship Care Families Need Our Support

Tax & Budget/Economic Performance

Tax and Budget: Every year, Utah's taxes (income, sales, gas, and property taxes) generate revenues that government then expends in ways that profoundly affect families and communities. The fiscal choices Utah makes — such as whether to invest in Utah's future or give in to the temptation to cut taxes below their current overall low level — will make a critical difference in the lives of the next generation of Utahns. If we make the best choices, we can help foster opportunity for all our children and lay the foundations for Utah's future growth and prosperity.

Last year the Utah State Tax Commission and the Utah Foundation both published research showing that taxes in Utah are the lowest that they have been in 30-50 years, following repeated rounds of tax cutting. Tax cutting is undoubtedly popular, especially in election years, but is it always wise? At some point we need to ask ourselves a difficult question: Is the current generation of Utahns doing our part, as earlier generations did, to set aside sufficient resources every year to invest in our children, in our future, in the foundations of tomorrow’s prosperity and quality of life? And more immediately and specifically, given the Coronavirus Recession's expected impacts on the Utah state budget, should we reconsider the 2018 election-year decision to reduce our income tax rate from 5% to 4.95%, a $50 million tax cut that mostly benefitted high-income households?

Voices for Utah Children's fiscal policy program works to ensure that we invest sufficient resources to ensure that our kids get world-class education and health care as well as special support for children most in need.

At the same time, we also work to ensure that public revenues are generated in ways that are fair. No family should be taxed into poverty as the price of educating their children. Currently, while we've moved in a better direction over the past 25 years, Utah does tax about 100,000 families into or deeper into poverty every year. In addition, the lowest-income Utahns pay a higher overall tax rate (7.5%) than those with the highest incomes (who pay 6.7% of their incomes in state and local taxes). That's one of the reasons why Voices for Utah Children supports making Utah the 30th state in the nation with our own Earned Income Tax Credit (EITC), starting with Utahns working their way out of intergenerational poverty.

Economic Performance: Voices for Utah Children examines and reports on Utah's economic performance from the perspective of how low- and moderate-income Utahns experience the economy -- some examples appear in the links below.

Matthew Weinstein, MPP

State Priorities Partnership Director

Voices for Utah Children

More Information:

Why Utah Should Invest In Our Future, Not Tax Cuts

Why Should Utah Become the 30th State with Our Own Earned Income Tax Credit (EITC)?

The History of Tax Incidence in Utah 1995-2018

Inequality in Utah Compared to Other States and the Nation

Utah Working Families Economic Performance Benchmarking Project: Utah vs. Idaho

Voices for Utah Children Statement: COVID-19 and How the State Of Utah Should Protect Families

On March 11, 2020, Governor Gary Herbert took the necessary step of declaring a state of emergency in Utah in order to address the coronavirus (COVID-19) pandemic. As the state moves forward with immediate activity to address the health implications of this global pandemic, we also urge lawmakers to consider enacting policies that will help mitigate its economic fallout for families and children in Utah.

Health Care

The immediate challenge is to ensure that all Utahns get access to critical health care. No Utahn should be denied access to care or feel afraid to get the care they need. Quickly identifying and treating those who have the virus, while taking all community public health precautions, will enable us to reduce the spread and help to flatten the curve.

We know this pandemic will present unique challenges to Utah’s health care system and to Utah families. In the past two years we have seen one of the largest increases in children lacking health insurance coverage in the nation. This outbreak should remind us that not one of us is truly safe when some of us are vulnerable. We need to immediately create a path for those uninsured children to be provided coverage until this emergency is over.

The state should ensure that the costs of testing and treatment for the coronavirus are fully covered to ensure that all Utah residents can get the care that will protect them, their families and their communities.

In these times, it is also critical that we remove any barriers to care or eligibility, especially for our most vulnerable Utahns. Utah should immediately halt its Medicaid work requirement and new premium payment requirement. At a time of such unprecedented economic change, this will only create additional barriers for families, while enforcement and implementation will waste valuable state resources. The state should suspend other waiver requests to CMS that will further deny care to individuals and families.

In addition, Utah must adopt policies that will ensure children and families can stay covered, which means extending renewal periods, grace periods for returning information and application processing times. This will not only keep families safe, but state eligibility workers as well.

Finally, we call on the state to support outreach and information to help all Utahns feels safe and welcome getting care, and also to provide information about how Utah kids and families can immediately connect with affordable coverage.

In the longer term, we should commit ourselves to covering all children and families in our state, so no one is left without coverage in times like this. And we must work in partnership to strengthen our health care system and our safety net providers, so we are equipped to meet the needs of all children regardless of ethnicity, nationality, immigration status, or where they live in the state. We must ensure families have access to the comprehensive care, including physical, dental, mental and behavioral health care, to ensure all kids can stay on track, stay healthy and thrive.

Family Economic Security

Guaranteeing all workers paid sick leave is a proven way to slow the spread of disease and would disproportionately benefit working families who earn low incomes. We are supportive of the action taken at the federal level on March 19, 2020 (the Families First Coronavirus Response Act or FFCRA) and encourage Utah to take immediate action to publicize the protections provided. Here is an outline of the provisions related to paid sick leave and family/medical leave:

Paid Sick Days for Public Health Emergencies

- Two weeks (or 10 work days) of paid sick leave

- Applies to public employers of all sizes and private employers with fewer than 500 employees

- DOL has discretion to exempt businesses with fewer than 50 employees from providing paid sick days for employees to care for a child whose school or place of care is closed

- DOL has discretion to exempt certain health care providers and emergency responders

- Purposes:

- To obtain a medical diagnosis or care if experiencing symptoms

- To comply with a recommendation from a public health official

- To care for an individual who is self-isolating because of a diagnosis or is experiencing symptoms

- When taken for this purpose, rate of pay is reduced to 2/3

- To care for a child if school or place of care is closed

- When taken for this purpose, rate of pay is reduced to 2/3

- Maximum payment is $511 per day/$5,110 total for self-care, $200 per day/$2,000 total for family care

- Impact on existing policies:

- Sick time under the bill must be made available to workers in addition to any employer provided leave

- Employer cannot require an employee to use accrued time before emergency time

- Employer cannot require an employee to find replacement workers

- The law broadly allows for caregiving for an individual under quarantine due to COVID-19. It does not limit caregiving to certain family members.

- Sunsets on December 31, 2020

Emergency Paid Leave

- Amends the FMLA to allow for paid leave in the event of a public health emergency.

- Purpose:

- The employee is unable to work/telework because the employee’s child's school or place of care is closed, or the child's usual care provider is unavailable, due to a COVID-related public health emergency.

- Family member:

- Son or daughter under age 18

- 12 weeks of job-protected emergency paid leave

- First 10 days may be unpaid

- For subsequent leave, employer must pay employee at 2/3 wage replacement, up to $200 per day and $10,000 total

- Applies to employers with fewer than 500 employees

- DOL has discretion to exempt businesses with fewer than 50 employees

- Available to employees who have been on the job for at least 30 days

- DOL has discretion to exempt certain health care providers and emergency responders

- Employers of health care providers and emergency responders may elect to exclude such employees from this leave

- Job Protection

- Employee has a right to job restoration under the FMLA

- Exception for employers with fewer than 25 employees under certain conditions

- Sunsets on December 31, 2020

Workers who do become unemployed, are furloughed, or have their work hours cut due to business downturns or sickness will be the first to feel the economic pain. We should do all we can to speed up the application process for unemployment insurance and comply with the FFCRA requirements for millions of dollars in federal aid by temporarily providing benefits with no waiting period, waiving employer penalties and job search requirements, and maximizing eligibility levels and benefits so no one is left behind. We should also protect those who face losing their employer-provided health insurance benefits because of an economic downturn.

Utah needs to adopt official language defining “essential services” immediately. Here is a sample of a definition being used by other state agencies:

“Essential services and sectors include but are not limited to food processing, agriculture, industrial manufacturing, feed mills, construction, trash collection, grocery and household goods (including convenience stores), home repair/hardware and auto repair, pharmacy and other medical facilities, biomedical and healthcare, post offices and shipping outlets, insurance, banks, gas stations, laundromats, veterinary clinics and pet stores, warehousing, storage, and distribution, public transportation, and hotel and commercial lodging.”

Another major problem is that our state has a growing homeless population, both sheltered and unsheltered. The unsheltered homeless lack the ability to self-quarantine and do not have regular access to medical care. The homeless will need shelter, medical treatment, and emergency homeless services. Therefore, the state must urgently convert its unused/underused spaces into shelters.

Lastly, we should place a moratorium on all foreclosures and evictions until we lift the state of emergency. No Utah families or individuals should be made homeless because of this crisis.

Young Children

With school and child-care facility closures, and work disruptions, a pandemic presents unique challenges for families with young children. In order to maintain a strong early learning and care system through this pandemic, lawmakers should enact practical policies to ensure that families of preschool-aged children are supported and to protect child-care workers and centers – many of which are small businesses operating on very slim margins – from an economic crisis. School-level reactions to the needs of families with young children – such as continuing to run school-based food programs – are very encouraging. We also need to support families with young children who are not yet school aged, including infants and toddlers, but who continue to have nutritional needs at this time. We recommend that state officials direct food retailers to set aside WIC-approved foods for families participating in that program, while also increasing flexibility for families with regards to food purchased as part of the WIC program.

We are pleased to note that state leaders have adjusted child-care subsidy payment policies to account for this unprecedented strain on our child-care sector. We encourage state and local leaders to invest in a wage supplement program for early childhood care and education provider. Such programs must include not only child-care center workers, but also home-based and family child-care providers. Payment policies should be adjusted so they are based on enrollment of children, rather than attendance. Finally, the state should do an immediate review of all safety net programs statewide and streamline all processes during this crisis.

Food security

In Utah, we have a large number of children that depend on school meals for consistent access to food. Based on our most recent data, 36.1 percent of our children participate in the free and reduced-price school lunch program. As schools in Utah will be closed until at least March 30, the state must take immediate steps to ensure that children enrolled in these meal programs have some other access to the meals they will be missing at school.

The state should also be taking steps to minimize food insecurity including: increasing the state Supplemental Nutrition Assistance Program (SNAP) supplement to provide more benefits for recipients; establishing a food distribution system to provide meals for food-insecure families; extending the certification for the Special Supplemental Nutrition Program for Women, Infants, and Children (WIC) to 60 days; streamlining SNAP by exempting families from certain requirements, such as work or education and training requirements; and lastly, making SNAP application available online, by mail, or telephone.

Juvenile Justice

The current situation demands that we refrain from creating unnecessary groupings of people. To that end, we strongly encourage law enforcement throughout the state to restrict arrests and citations of young people to only those most serious, injurious offenses. With very few exceptions, youth should not be taken to detention centers, as our juvenile justice professionals are already working overtime to maintain the cleanliness and safety of those facilities. In addition, as non-essential court activities have been delayed, a reduction in arrests and citations now will prevent unnecessary overwhelm of the juvenile court system when normal operations come back online.

We also strongly recommend that juvenile justice facility managers - including those who operate official state and county youth facilities, as well as community-based placements such as treatment facilities and group homes, exercise the utmost caution with the young people in their care. At the same time, this caution regarding health and safety must be balanced with an understanding of the need of these youth to maintain connections with their family, friends and loved ones. We encourage flexibility with regards to the use of technology for video and telephone visits while people engage in social distancing at the governor’s recommendation. If this situation should persist past the next two weeks, juvenile justice administrators should consider instituting health-related protocols (such as taking of temperature, monitoring for other symptoms, and issuance of personal protective equipment) that would allow family members and other loved ones to visit youth in custody.

Economy

The Coronavirus Recession has already begun, is going to hit faster than any previous recession, is immune in some ways to traditional stimulus (because social distancing limits government's ability to restore consumer spending before the pandemic is addressed), and states need to act fast to take full advantage of the coming federal actions and make the recession shorter and shallower rather than longer and deeper (such as with inaction and budget cuts).

We must resist the urge to cut expenditures on vital services like education and health care. We have seen first-hand how important these areas have been in the current crisis.

Given the immediate need for support, we believe that this is the time to use a portion of our rainy-day fund. The additional money will help officials respond to the outbreak without jeopardizing commitments lawmakers made to fund important priorities in the recently completed legislative session.

We should look at a tax increase on those most able to afford them and reinvest that revenue into specific areas identified during the crisis. This would be a solid investment in the long-term health and prosperity of our state.

Summary

Given the rapidly evolving nature of this crisis, we recognize that many of the recommendations listed above are currently being discussed at both the state and federal level. We encourage our state leaders to take bold and decisive measures to ensure the health and well-being of all the residents of our great state. The focus of Voices for Utah Children is to advocate on behalf of the children and families of Utah. We will continue to update developments as we receive information. Please feel free to contact me directly with any questions or concerns. I can be reached at .

Moe Hickey

CEO

Voices for Utah Children

Public Opinion Survey

Voices for Utah Children Public Opinion Survey

The Utah Legislature is deciding right now what to do with Utah's tax revenues for the fiscal year beginning July 1, 2020. The biggest question is: Should they cut taxes or invest in Utah’s future? Please read the main arguments on either side and click on the button below that you agree with the most….

The Arguments for Cutting Taxes |

The Arguments for Investing in Utah’s Future |

|

1) Any state budget surplus belongs to the taxpayers, so it should be returned to us. 2) Lower income tax rates will make the state more competitive and help the economy grow faster. 3) Lower taxes on businesses will make the state more competitive and help the economy grow faster. |

1) According to Utah Tax Commission data, Utah’s taxes are already the lowest they have been since the 1960s (adding up all state and local taxes as a percent of incomes). 2) Utah has fallen behind on investing in critical needs like education, infrastructure, and clean air. 3) If we make wise up-front investments in these areas today, we and especially our children will reap the gains tomorrow. |

|

Public Opinion Action Page

Survey results are clear: Utahns overwhelmingly prefer investing in our future over tax cuts:

But is the Legislature listening?

Invest in Utah's Future, Not Tax Cuts

BROAD COALITION CALLS FOR INVESTMENT IN UTAH’S FUTURE

“Taxes are low already – the economy is good – now is not the time for even more tax cuts”

Salt Lake City – On Thursday, February 20, 2020 on the steps of the Utah Capitol, a broad and diverse coalition of Utah advocates for the poor, for persons with disabilities, for education, health care, clean air, and for a variety of other popular Utah priorities held a press conference calling on the Utah Legislature to avoid cutting taxes until it has developed a comprehensive plan to address Utahns’ top concerns by investing in Utah’s future.

Participants in the press conference included (in alphabetical order):

- Action Utah

- American Academy of Pediatrics, Utah Chapter

- Catholic Diocese of Salt Lake City

- Center for Biological Diversity

- Coalition of Religious Communities

- Community Action Partnership of Utah

- Crossroads Urban Center

- HEAL Utah – Healthy Environment Alliance of Utah

- Legislative Coalition for People with Disabilities

- Sierra Club Utah Chapter

- Utah Citizens Counsel

- Utah Education Association

- Utah Physicians for a Healthy Environment

- Utahns Against Hunger

- Voices for Utah Children

The effort was inspired in part by a column in the Deseret News by Zions Bank CEO Scott Anderson, who wrote,

I hope the theme of the session that starts next Monday will be, ‘Investing in Utah’s future.’ Nothing is more important than preparing for, and investing in, the rapid growth that is occurring in Utah…. Utah taxes are relatively low — lower now than in many years. Investments in education, clean air and infrastructure will produce good jobs and preserve Utah’s strong economy.

The advocates pointed out that, according to recent reports from the Utah State Tax Commission and the Utah Foundation, taxes in Utah are the lowest that they have been in decades, following repeated rounds of tax cutting. “We understand that tax cuts are popular, but we’ve reached the point where we have to ask: Is the current generation of Utahns doing our part, as earlier generations did, to set aside sufficient resources every year to invest in our children, in our future, in the foundations of tomorrow’s prosperity and quality of life?” said Matthew Weinstein of Voices for Utah Children.

The advocates laid out a positive vision of how all Utahns would benefit from enhanced investment in our state:

Jean Hill, Catholic Diocese of Salt Lake City: “As an active participant in many of the efforts to end homelessness in Utah, the Diocese of Salt Lake City has seen first-hand the impacts of rapidly rising rents and dwindling stocks of affordable housing. If we truly want to render episodes of homelessness brief, rare and non-recurring, we must invest in housing and supportive services for those on the brink or already experiencing homelessness.”

Jonny Vasic, Executive Director, Utah Physicians for a Healthy Environment: "Salt Lake County continues to be ranked in the top 10 as having the worse air pollution in the country, in both 24-hour particulate matter and in ozone. This leads to a long list of health issues and even premature death. We cannot pass this problem off to the next generation. There are solutions, but it starts with awareness and needs the combined effort of the community with strong political will from our leaders.”

Bill Tibbitts, Crossroads Urban Center: “Utahns want our leaders to improve housing affordability and reduce the number of children and adults who spend time in shelters or sleeping in cars. We not going to solve these big problems if we put off doing something about them until tomorrow.”

Dr. William Cosgrove, American Academy of Pediatrics, Utah Chapter: “The Utah Chapter of the American Academy of Pediatrics represents more than 700 Utah Pediatric providers. We are dedicated to the health, safety and wellbeing of all Utah children. Utah’s children comprise 30% of Utah’s population, but those children are 100% of Utah’s future. In order to achieve Utah’s best future, we must invest in the physical and emotional health of our children. We, as a community, are urging our leaders to provide each child access to:

- clean air, clean water, and safe food

- safe living arrangements

- adequate time with loving and attentive parents

- exposure to rich language and books as infants and toddlers

- excellent early childhood care and education to ensure they are ready for kindergarten

- teachers who are well-trained, adequately compensated, and have the resources they need

- safe, violence-free, neighborhoods to play and learn in

A young family cannot, by themselves, provide these things to their children. They need citizens in their communities and tax resources collected by the government to be invested into critical services and resources for the benefit of children. Historically, Utah has under-funded pre-schools and K-12 schools which has slowed the development and education of a generation of children. There is no better investment opportunity, nor better return-on-investment, than fully funding the education of Utah’s children.”

Clint J. Cottam, MPA, Executive Director, Community Action Partnership of Utah: “Community Action Agencies in Utah recently asked thousands of individuals to identify barriers preventing households and communities from achieving their full potential. Every assessment, whether in predominantly urban or rural regions, cited housing as the investment most lacking throughout Utah. Stories were shared of Utahns becoming sick from mold, experiencing homelessness, forgoing basic needs like medicine and medical equipment, turning down employment, or extending their commutes due to housing quality, availability, and/or affordability. Investments in increasing the quality, availability and affordability in the state will improve health outcomes and continue to keep Utah’s economy strong.”

Deeda Seed, Senior Utah Field Campaigner, Center for Biological Diversity: “This is not the time for tax cuts. The enormous growth we’re experiencing in Utah comes with many problems including the critical lack of affordable housing, polluted air, and the loss of open space. Addressing these problems costs money, whether its building affordable housing, taking steps to clean up our air, or preserving open space. Our tax dollars should be used to support a sustainable healthy future for all Utahns and to address the impacts of growth.”

Utah Education Association President Heidi Matthews: “The growing Utah economy provides an ideal opportunity to make long-needed investments in the promise of a quality education for every Utah student. Rather than cutting taxes, we should be building futures.”

Cheryll May, Steering Committee Member, Utah Citizens Counsel: “The Utah Citizens Counsel maintains that every Utah child should have an equal opportunity for a healthy and productive life. Yet thousands of children from disadvantaged backgrounds enter kindergarten years behind their peers in basic knowledge and skills. High quality early-childhood education programs can greatly mitigate this deficit. Few Utah children currently have access to these programs. Extensive research shows that investments in such programs are cost effective. State programs supporting quality early education have been shown to save money in later years on remedial education, teen pregnancy, drug abuse, juvenile justice and corrections.”

Gina Cornia, Executive Director, Utahns Against Hunger: “Utah policy makers have always prided themselves on doing what is best for Utah families. Utahns Against Hunger urges them to embrace this perspective and reflect on how the important work they do during the session will impact the most vulnerable Utahns. Moving forward, we believe, that tax policy and budget plans should reflect a concern and a priority for those who too often go without or wait too long to for their situations to matter.”

Carrie Butler, Policy Director, Action Utah: “We at Action Utah believe that we are fortunate to live in a state rich with environmental and economic resources, and we support investment into the future for all Utahns. We encourage work on policies that matter most to a majority of Utahns, including funding for programs that assist our most vulnerable populations, funding for education, mechanisms that help reduce cost and expand access to healthcare, and programs that improve our air quality. We encourage the legislature to carefully consider these issues and prioritize funding them in responsible ways.”

Janet Wade, Legislative Coalition for People with Disabilities: “Individuals with disabilities and their families are often forgotten by policymakers when considering tax reform and budgets, but people with disabilities make up approximately 12% of the population of Utah and are an important part of the diversity in our state. Individuals with disabilities and their families require ongoing services and supports to effectively participate in our communities, schools, and workplaces. The Legislative Coalition for People with Disabilities (LCPD) believes that legislators have an ethical obligation to protect and serve this vulnerable and overlooked population, and we strongly urge the Utah Legislature to develop a long-term funding strategy to support Utahans with disabilities and their families, including those currently on the “waiting list” for DSPD services.”

Taken together, the advocates’ message amounts to a vision of a healthier, wealthier, better educated and more prosperous Utah in the future – if our leaders can resist the election-year temptation to cut taxes and avoid the public revenues losses that leave us unable to make the critically needed investments today that will pay off many times over in the future.

Finally, the advocates expressed gratitude for the hard work and sacrifice of Utah legislators, who willingly give of their time and energies in service to the people of Utah, grappling with the most difficult policy choices and budget tradeoffs, often without public understanding or appreciation. The advocates called on all Utahns to consider the example of earlier generations that sacrificed so that we could have a better state today.

This press release is also available as a ![]() downloadable pdf here.

downloadable pdf here.

This event was recorded and can be viewed at

Media coverage links:

- Deseret News: https://www.deseret.com/utah/2020/2/20/21145390/tax-cut-revenue-projects-thriving-economy-but-persistent-funding-imbalance-education-sales-taxes

- Salt Lake Tribune: https://www.sltrib.com/news/politics/2020/02/20/utah-legislature-has/

- Fox 13 TV: https://www.fox13now.com/tax-cut-the-utah-state-legislature-contemplates-budget-after-citizen-referendum

- Tribune op-ed: https://www.sltrib.com/opinion/commentary/2020/02/22/matthew-weinstein/

Utah Tax Incidence History: 1995 - 2018

Utah Tax Incidence History 1995 - 2018

Utah is in the midst of the most intense debate over taxes that our state has seen in many years. In December the Legislature passed a major tax restructuring package following a year of public hearings and legislative deliberations. Days later, citizens from across the political spectrum filed a petition to roll back the new law. Media reports are that citizens around the state are collecting tens of thousands of signatures to bring the new law before the voters in a referendum this November.

In the midst of this very active and engaging public debate, which will likely continue whatever the outcome of the petition-gathering effort, it is worth asking how the legislation that was passed fits into the history of Utah's taxes over the last several decades. Have Utah's taxes been going up or down, and for whom? Which income groups have been winners and losers in recent decades? Did the new legislation continue past trends or shift things in a new direction?

During the fall semester of 2020, two economics department undergraduate students from the University of Utah, Nelson Lotz and Gabriella Rebol, researched this question by reviewing the results of the Institute on Taxation and Economic Policy's report series Who Pays: A Distributional Analysis of the Tax Systems in All 50 States, which was published in 2018, 2015, 2013, 2009, 2003, and 1995. Each of the reports looks at how much Utahns at each income level pay in taxes as a share of their income. The report includes all taxes paid at the state and local level, including sales, excise (including the gas tax), property, and income taxes, The population is broken up into quintiles by income level, and the top 20% of earners are broken down even further. The table below shows the income levels for each of the income groups from the most recent year of ITEP’s data, 2018:

|

Income Group |

Lowest 20% |

Second 20% |

Middle 20% |

Fourth 20% |

Next 15% |

Next 4% |

Top 1% |

|

Income Range |

Less than $22,900 |

$22,900 to $39,600 |

$39,600 to $63,900 |

$63,900 to $104,300 |

$104,300 to $202,400 |

$202,400 to $486,500 |

Over $486,500 |

|

Average Income |

$14,100 |

$32,500 |

$50,600 |

$80,800 |

$139,400 |

$288,400 |

$1,300,500 |

Source: Who Pays? 6th edition 2018 Institute of Taxation and Economic Policy

The Tableau charts below show the average tax rate for each of the income groups for each of the three major types of tax and for all Utah state and local taxes combined for each year of results. The chart allows the viewer to show each year's results separately or together on the same chart so that it is easier to see what direction the trend is moving in for each successive year of data.

Discussion of Results

TOTAL INCLUDING ALL STATE AND LOCAL TAXES

Beginning with the results for the total of all state and local taxes, the data from ITEP show that from 1995 to 2018, Utah moved toward a more equitable tax system. In 1995, Utah’s tax system fit the classic definition of a regressive tax structure, with the overall effective tax rate including all state and local taxes being highest for the lowest income quintile at 12% of income and then falling steadily from there so that the highest income 1% of taxpayers paid the lowest tax rate of any income group, just 7.8% of their incomes. By 2018, however, the lowest income fifth of Utahns saw their overall tax rate fall to 7.5%, and the tax rate rose for each successively higher income level to 7.9% for the second quintile, then 8.2% for the middle quintile, and then 8.8% for the fourth quintile, those earning between $64,000 and $104,000. However, that 8.8% rate for the fourth quintile is the highest tax rate paid by any income group, and the tax rate falls sharply for higher incomes, reaching a low of 6.7% for the wealthiest 1% of tax filers, the lowest rate for any Utah income group.

Additionally, all of the quintiles have seen a substantial reduction in the total percentage of income paid in taxes from 1995 to 2018. This finding is consistent with research from the Utah State Tax Commission and the Utah Foundation finding that Utah has steadily reduced its overall level of taxation in recent decades.

Here is the percentage and dollar savings for each income group from the 1995-2018 overall tax reduction:

|

Lowest-income quintile |

Second quintile |

Middle quintile |

Fourth quintile |

Next 15% |

Next 4% |

Top 1% of filers |

|

|

Change in tax rate 1995-2018 (percentage points) |

-4.5% |

-3.5% |

-2.8% |

-1.7% |

-1.9% |

-1.4% |

-1.1% |

|

Change in annual tax paid (2018 $$) |

-$720 |

-$1,330 |

-$1,680 |

-$1,598 |

-$3,116 |

-$4,746 |

-$18,194 |

|

Share of the total tax cut going to each quintile |

7.6% |

14.0% |

17.6% |

16.8% |

44.1% |

||

|

Aggregate annual tax cut to each quintile (2018 $$) |

$180 million | $332.5 million | $420 million | $399.5 million |

$584m $237m $227m $1.049 billion total for top quintile |

||

Thus, we can see that the greatest percent-of-income tax reduction over the time period 1995-2018 went to the lowest-income Utahns, while the largest tax cut in dollar terms went to the wealthiest. The total aggregate annual tax cut by 2018 added up to $2.38 billion. In other words, if Utahns had paid 1995 tax rates on their 2018 incomes, Utah state and local governments would have received an additional $2.38 billion in revenue.

INCOME TAX

Income tax as a share of personal income has declined for Utahns of all income groups since 1995. The income tax remains the state's only non-regressive tax, lining up with Utah's top-heavy income distribution (though not as top-heavy as the nation's). Three-fifths of all personal income taxes are paid by the top one-fifth of taxpayers, which lines up with the state's income distribution, in which three-fifths of all income is earned by the top one-fifth of earners, according to Tax Commission data.

PROPERTY TAX

For all income groups, property tax has dropped as a percent of income in Utah since 1995. As a percent of income, the tax is still heaviest on the lowest earning quintile. However, the tax no longer retains its entirely regressive structure. The second quintile of income earners in the state now pay the least in property taxes as a share of their personal income compared to other income groups.

SALES & EXCISE TAXES

From 1995 to 2018, all of Utah’s income groups have seen a reduction in sales and excise taxes (mainly the gas tax) as a percentage of income. The lowest and second quintile have seen the biggest reduction in sales taxes with the lowest quintile’s sales taxes dropping from 7.5% of income in 1995 to 5.1% in 2018. In Utah, sales and excise taxes have a clear regressive tax structure with lowest quintile paying the highest rate and each successive quintile paying less.

The December 2019 Tax Restructuring: Consistent with the 1995-2018 Tax Cutting Trend

To return to the question raised above: Is the December 2019 legislative action embodied in SB 2001 consistent with the 1995-2018 tax cutting trend or a break with tradition? The answer is clearly that it continues the tax cutting trend, as the legislation is projected to reduce tax levels for every income group, as shown in this chart:

On the positive side, it is noteworthy that the largest percent-of-income tax cut in the December 2019 package goes to the lowest-income quintile of Utahns -- half a percentage point, from 7.5% of income to 7% of income. (This projection is based on the assumption that all low-income Utahns file for the new Grocery Tax Credit (GTC). If only 75% of low-income Utahns file for the GTC (the same percentage of eligible lower-income Utahns that file for the federal Earned Income Tax Credit (EITC)), then we project that the overall tax rate for the lowest-income quintile of Utahns drops to 7.2%, which is still the largest percent-of-income tax cut for any income group.)

On the negative side (from the perspective of wanting to reduce Utah’s tax regressivity while still generating sufficient public resources to invest in Utah's next generation), it must also be noted that SB2001's largest tax cut in dollar terms goes to the top quintile of Utah earners – nearly half of the entire net in-state tax cut, or about $100 million out of the total net in-state tax cut estimated by the Legislature at $208 million -- with about $60 million of that $100 million going to the top 1% of Utahns, those earning over about half a million dollars a year. This works out to an average tax cut of $3,300 per household for the top 1%, compared to an average tax cut of about $80 per household for the lowest-income quintile of Utahns, if they file for the new Grocery Tax Credit (low-income Utahns who don't file for the new GTC will end up paying about $100 per household more each year in taxes).

THIS ITEM IS AVAILABLE AS A DOWNLOADABLE AND PRINTABLE PDF FILE ![]() HERE.

HERE.

Legislature Passes Tax Package Including Revenue Losses, Grocery Tax (and Credit), EITC

Last night, December 12, 2019, the Utah Legislature passed a tax restructuring package in a special legislative session.

Voices for Utah Children was very involved in this process over the course of the year. We attended the Tax Restructuring and Equalization Task Force (TRETF) hearings, generated public comment, released our position paper in September, and later that month participated in a poverty advocates' coalition letter signed by 27 non-profits that work with and advocate for lower-income Utahns. We published two op-eds on September 14 and November 26 as well as numerous blog and Facebook posts and tweets. We also worked directly with Task Force members to evaluate and shape the Task Force proposals.

From the start, we focused on two questions:

- Does the tax proposal reduce the regressivity in Utah's tax system so that we are taxing fewer Utah families into - or deeper into - poverty? Currently, Utah's overall tax system is regressive, in the sense that lower- and middle-income Utahns pay a higher overall tax rate than upper-income Utahns.

- Does the tax proposal enable Utah to invest more in the long run in Utah's children -- their education, their health, their future prospects to become productive members of their communities and of our state? The State Tax Commission and the Utah Foundation have both published research this year documenting that our overall level of taxation stands at a multi-decade low, raising the question of whether the current generation of Utahns is doing our part, as earlier generations did, to set aside sufficient resources every year to invest in our children. As the poverty advocates' coalition letter detailed, our decades of tax cutting have left Utah with billions of dollars in urgent unmet needs in numerous areas.

So how did the final bill passed last night stack up according to these criteria?

Will it reduce regressivity?

While the idea of bringing back the full sales tax on food was not a part of our proposals, and in fact we proposed eliminating the sales tax on food entirely, our analysis of the near-final version of the bill found that, overall, it will reduce the impact of Utah's taxes for lower-income Utahns from 7.5% of their incomes to 7%, or by about $100 per year, IF they file for the new Grocery Tax Credit (GTC).

The Legislature’s analysts estimate that 30,000-50,000 low-income Utah households do not file taxes every year, because their incomes fall below the mandatory minimum. Thus, in order to maximize the number of households who file for the credit, Voices for Utah Children proposed, fought hard for, and, on the final day, won inclusion in the package of $500,000 to market the new tax credit to its target population. We also recommended that the bill be amended to add an automatic inflation adjustment for the GTC so that it would not lose its value over time, but that was not included in the bill.

Grocery Tax Credits have considerable drawbacks (mainly that they require the filing of paperwork to obtain them) and vary greatly among the half-dozen states that have them. But the one passed last night will likely be the most generous and accessible one in the nation for lower-income households, based on the amount of the credit, its eligibility rules, and the commitment to invest substantial resources to publicize it.

The bill also makes Utah the 30th state with our own Earned Income Tax Credit (EITC), amounting to 10% of the federal credit and fully refundable, aimed at the 25,000 working families in Utah's intergenerational poverty (IGP) cohort. The inclusion of this provision – which was pulled from the bill for several very tense hours Thursday afternoon – is a credit to the persistence of Rep. Robert Spendlove, the sponsor of HB 103, chair of the House Revenue and Taxation Committee, and member of the TRETF. This is something that many Utahns have sought for decades, and Voices for Utah Children is grateful to the dozens of partnering organizations that have advocated for it alongside us in recent years.

Will it invest more in children?

Unfortunately, the answer here is no. The Governor and Legislature gave in to the election-year temptation to boast about a big tax cut. The bill reduces income taxes by over $600 million and replaces less than $500 million of that revenue with new sales taxes, leaving the state with $160 million less revenue every year going forward to invest in Utah's children.

Voices for Utah Children had strongly advised against using the state's current temporary fiscal surplus to permanently reduce revenues. We see this as a missed opportunity to act now for the state's long-term future, especially given that the shift from income taxes to sales taxes brings in tens of millions of new dollars from non-Utahns, which would have made it possible to offer an in-state tax cut while enhancing revenues or at least holding them steady.

Moreover, the shift from the faster-growing income tax to the slower-growing gas and grocery sales tax raises the question of whether public revenues will keep up with our fast-growing economy and population in the years to come, a point noted by Rep. Tim Quinn at the final TRETF meeting this past Monday. On the positive side, the bill does expand the sales tax base to some services and closes some outdated sales tax exemptions, which are small but important steps in the right direction.

It is also noteworthy that, because of the income tax rate reduction from 4.95% to 4.66%, about half of the overall net in-state tax cut of about $200 million annually goes to the top quintile of Utahns, those making over about $120,000 per year, and most of that half goes to the top 1% of Utah households, those earning over about $590,000.

As detailed in the poverty advocates’ coalition letter, our state suffers from chronic revenue shortages in numerous areas due to our decades of tax cutting, and these shortages disproportionately impact lower-income households. They also keep Utah from getting out ahead of our next-generation challenges, such as closing the majority-minority gaps that are worsening over time, even as our non-white communities are growing and becoming a more integral part of every region of Utah.

Thus, it is clear that a major challenge remains before Voices for Utah Children and other advocates in the years to come to make the case to the public and policymakers that it is worth investing more in our children, not less.