The Utah Legislature is considering including $40-$50 million of retiree tax credits in a package of tax cuts this session. But an important question has arisen as to whether these credits are actually designed properly to help the people that the sponsors say they want to help.

Social Security Tax Credits: SB 11 and HB 86

In his proposed FY22 budget, Governor Spencer Cox wrote that he would like to see "a social security tax credit for low- and middle-income seniors." In the first week of the legislative session, the Utah Senate passed SB 11, including what legislators have described as a Social Security tax credit for low- and middle-income seniors.

The devil is always in the details with tax legislation. Unfortunately, a close examination of the details of the Social Security tax credit included in both SB 11 and HB 86, as those two bills are currently drafted, reveals that they fail to achieve their stated objective of providing a tax credit for low- and middle-income seniors.

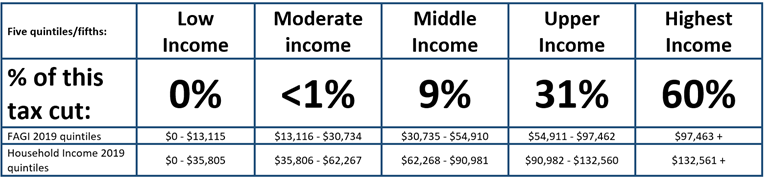

According to data from the Office of Legislative Fiscal Analyst, none of the proposed Social Security tax credit goes to low-income seniors (0%). Almost none goes to moderate income seniors (2%). About a quarter of it goes to middle-income seniors (27%). But the overwhelming majority of this $18 million tax credit -- over 70% -- goes to the top two-fifths of Utah seniors, those with incomes above $90,000 annually. The chart below from Voices for Utah Children's January 28th presentation before the House Revenue and Taxation Committee illustrates who this tax credit is targeted to in its current form by dividing Utah households into quintiles or fifths:

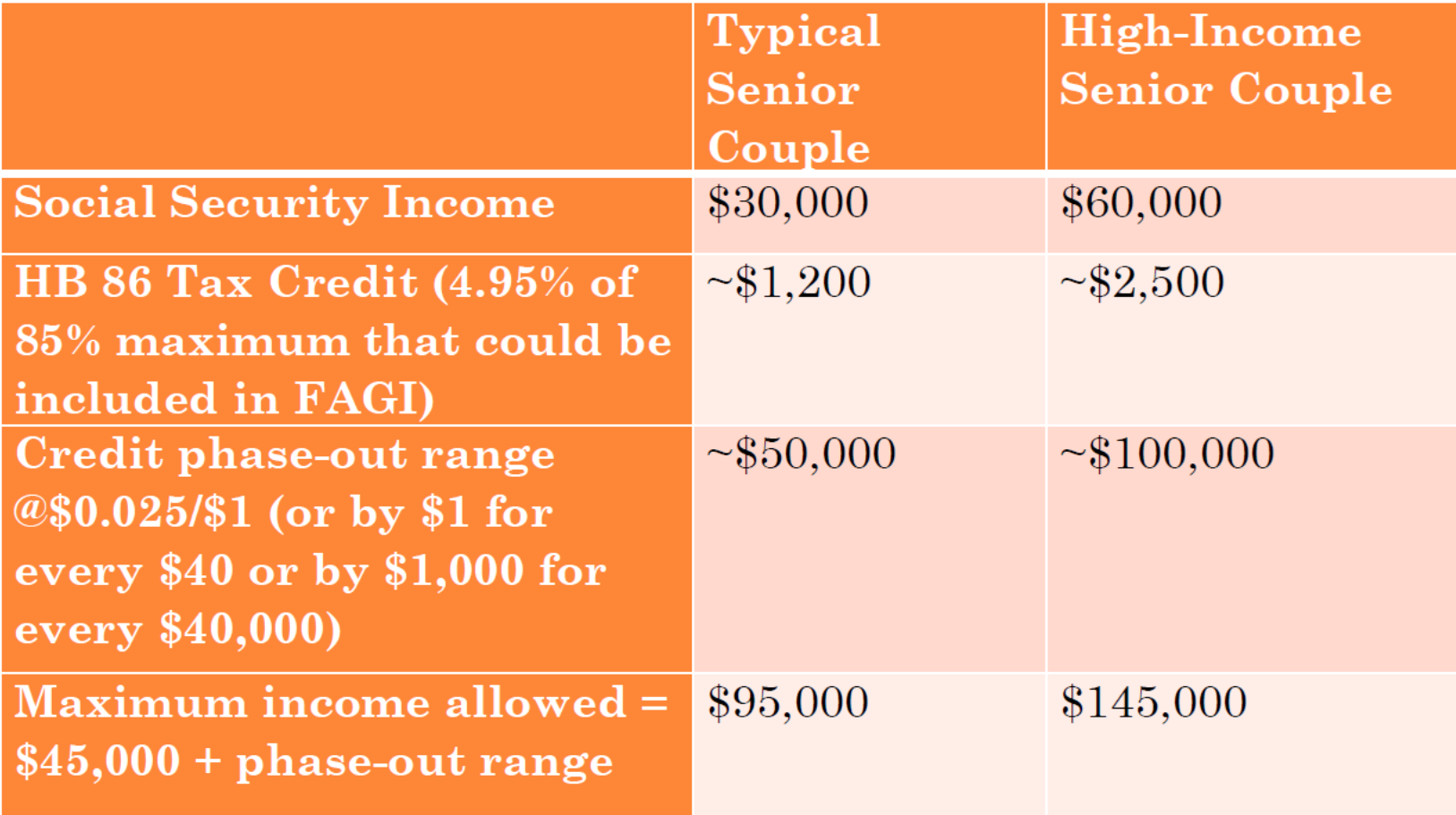

To better understand how this legislation works, the chart below shows how the credit would be calculated for two eligible households:

This chart illustrates how the very long phase-out range makes the credit available mostly to upper-income households. The other fault with the bill is that it is not refundable, which means it's not available to lower-income seniors with no state income tax liability, which is likely to include most Utah Social Security recipients. It is certainly good news that our existing tax structures already shield low- and moderate-income seniors from having to pay Utah income tax on their Social Security income, thanks to the Utah Taxpayer Tax Credit and the federal government's treatment of most Social Security income as non-taxable for low-income households. Thus, this credit would need to be refundable in order to help low- and moderate-income Utah seniors by offsetting some of the other taxes they pay, such as property, sales, and gas taxes.

And, indeed, low- and moderate-income seniors need such assistance. The federal government's official poverty rate for seniors (6.2% or 22,500 seniors, vs. 8.9% for Utah overall & 9.9% for children in 2019) actually understates elderly poverty by roughly 50%, according to the Census Bureau's own Supplemental Poverty Measure. Fully one-fifth of senior couples and nearly half of single seniors have only their Social Security to live on. They could use a tax break. It is very unfortunate that SB 11 and HB 86 do virtually nothing for them, all the more so given the statements from those bills' sponsors and proponents that helping low-income seniors is a central purpose of the bills. In addition, the loss of $18 million of revenue from this tax break that mostly benefits upper-income households will make it harder for the state to provide vital services to seniors in need.

Military Retirement Tax Credit: SB 11 and HB 161

If the Social Security tax credit offers a fairly stark contrast between stated intent and actual effect, the proposed military retiree tax credit in SB 11 is even more jarring. While this proposed credit shares with the proposed Social Security tax credit that it helps virtually no one in the lowest-income two fifths of Utah retirees, it holds the distinction of being far more skewed toward the top of the income scale. Less than a tenth of it goes to middle-income seniors. Over 90% of this proposed credit goes to retirees in the top two-fifths of the income distribution, most of them with six-figure household incomes. The chart below illustrates this in detail, based on data from the Legislature:

It is projected that recipients of the tax credit in SB 11 will each receive a credit averaging $1300 annually. This credit will leave Utah with $23 million less each year to invest in education, public health, infrastructure, clean air, or any of the myriad of critically important yet underfunded priorities on Utah's list. Needless to say, that list includes helping Utah's thousands of homeless veterans who, having returned from serving their country, should not find that their state or the nation has any higher priority than helping them get back on their feet.

Thus, while we understand the widespread sentiment that, as a matter of principle, military pensions should never be taxed, we hope that, as a practical matter, policymakers will consider the fact that current state tax law already effectively shields military pensions from the state income tax for low-, moderate, and most middle-income retirees as they prioritize among the various tax cut proposals that they are considering.

Voices for Utah Children's Tax Policy Priorities

In all of the tax policy work in which Voices for Utah Children engages, we pursue two priorities that serve our guiding principle that Utah should be a state where all children have the opportunity to achieve their full potential:

1) Revenue sufficiency: Utah's tax system needs to generate sufficient resources to finance the critically important investments that lay the foundations for the success and prosperity of Utah's next generation, including education, public health, infrastructure, air quality, and other basic needs. While we understand that paying taxes is never politically popular, we are very concerned that the deep tax cutting of the last 25 years, amounting to $2.5 billion annually not available to state and local government budgets and which has left Utah at a 50-year low for our overall level of taxation, has hamstrung Utah's ability to prepare the next generation to meet the challenges they will face.

2) Tax fairness: Utah's overall tax structure, while improved compared to 25 years ago, remains regressive overall. The highest-income Utahns still pay a lower overall tax rate than low- and middle-income Utahns. In addition, Utah taxes about 100,000 households into or deeper into poverty every year, including a disproportionate share of Utahns of color who already face numerous disparities and obstacles as they endeavor to raise their children and achieve the American dream. To alleviate these inequities, Voices for Utah Children supports policies like the Earned Income Tax Credit (EITC) that enable more Utahns to work their way out of poverty.

MEDIA COVERAGE OF THIS ANALYSIS: