In-State vs Out-of-State Effects: The Key to Tax Restructuring Success?

If someone told you that the key to the success of the Utah Tax Restructuring and Equalization Task Force may well be found in an examination of the in-state vs out-of-state effects of the current draft proposal, your eyes would probably glaze over and you might suddenly recall a dentist appointment that you had forgotten.

But wait! Please tell the dentist you’ll reschedule and take a few minutes to read on.

Kansas: Tax Cuts That Went Too Far

The greatest danger for Utah’s future in the current debate is that fans of anti-tax/anti-government Pied Piper Grover Norquist and former Kansas Governor Sam Brownback will try to take advantage of the political pressures of the coming election year to follow in the footsteps of Kansas and include in the package a large revenue reduction. After all, tax cuts are always popular, and Utah has been giving in to that temptation for years.

Yet we know what an economic disappointment those tax cuts were in Kansas (it turns out that underinvesting in education and infrastructure does not actually help grow the economy), leading to devastating losses in subsequent elections for the plan’s proponents. The suddenly more moderate (while still Republican) Kansas legislature subsequently rolled back the tax cuts (though the voter backlash went on, electing a Democratic Governor last year in that very red state).

Apparently, it is possible to have too much of a good thing, even when it comes to tax cuts.

Successive rounds of tax cuts have left Utah with our lowest tax levels in decades, according to recent data from both the Utah Foundation and the Utah State Tax Commission. According to the Utah Foundation, the tax cuts of the last two decades have moved us from having the 6th highest taxes in the nation to #31 (even as we continue to have the nation’s highest percentage of children to educate). The Tax Foundation says that today we rank in the top 10 states for our business tax climate. By all accounts, our economy is booming and generating all the jobs we need, with an unemployment rate currently measured at 2.7%. So is it wise at this stage to use our temporary budget surplus to make even more permanent cuts to state revenues? Such additional tax cuts seem likely to have one of two possible outcomes, neither very desirable: Either they could rev our job-creating engine to the point that we’re creating enough new jobs not just for the next generation of Utahns but for hundreds of thousands of Californians to move here as well, or they could undermine the educational and infrastructural foundations of our long-term economic prosperity, as was the case in Kansas. Indeed, the tax cuts of recent decades have already crippled our ability to invest in education, infrastructure, air quality, public health, poverty prevention, and so many other areas where we have urgent unmet needs.

Should We Apply the Solutions of the Past to the Challenges of Today?

Certainly there is a strong case to be made that the tax cuts of recent decades helped Utah achieve our current economic success. Perhaps our most significant economic achievement of the last 20 years is that Utah has moved from being a low-wage state to middle-wage status, based on our rank for median hourly wage over the last two decades (#39 in 2006 vs. #27 last year). But rather than applying the solutions of the past to the challenges of today, the progress we've made puts us in a new position and allows us to ask a new question: Now that we have achieved middle-wage status, how can we, in the decades to come, follow in the footsteps of states like Colorado and Minnesota and move toward becoming a high-wage state?

Utah Has Fallen Behind on Educational Attainment

The secret to those states’ success lies in their higher levels of educational attainment. But right now Utah is behind on educational attainment. It is well-known that our teacher attrition rates are too high and so are our class sizes. But it is less well-known that, adjusted for demographics, our high school graduation rate is also behind the national average. In other words, for example, if you are White or Latino in Utah, you are less likely to graduate high school than Whites or Latinos nationally. At the college level, we have fallen behind national trends for BA/BS+ attainment among our younger generation, with only 34% of Utahns ages 25-34 having graduated college compared to 36% nationally, according to the latest 2018 Census data.

Utah’s Next Great Challenge: Our Growing Majority-Minority Gaps

Moreover, Utah is in the midst of a demographic transformation that is enriching our state immeasurably but also bringing majority-minority gaps of a type and at a scale that our state has not had to confront in the past. Education Week magazine recently ranked Utah among the worst 10 states for our growing educational achievement gap between haves and have-nots. Now is the time to make the upfront investments that will help us avoid going the way of other states that failed to close those gaps when they had the chance to do so in the most cost-effective manner.

While there is little doubt that Utah does more with less better than any other state, we will not close our growing gaps and raise our educational attainment as long as we are stuck in last place for per-pupil investment. The unfortunate reality remains that our very real economic progress of recent decades has not resulted in increased investment in education. Rather, our total inflation-adjusted per-student state + local K-12 education revenues remained below pre-recession levels last year.

In-State vs. Out-of-State Effects

If we can agree that there could be real downsides to making additional cuts to state revenues in the proposed tax restructuring package, then what does this have to do with in-state vs. out-of-state effects of the proposed tax changes, and how could understanding those effects potentially save the package?

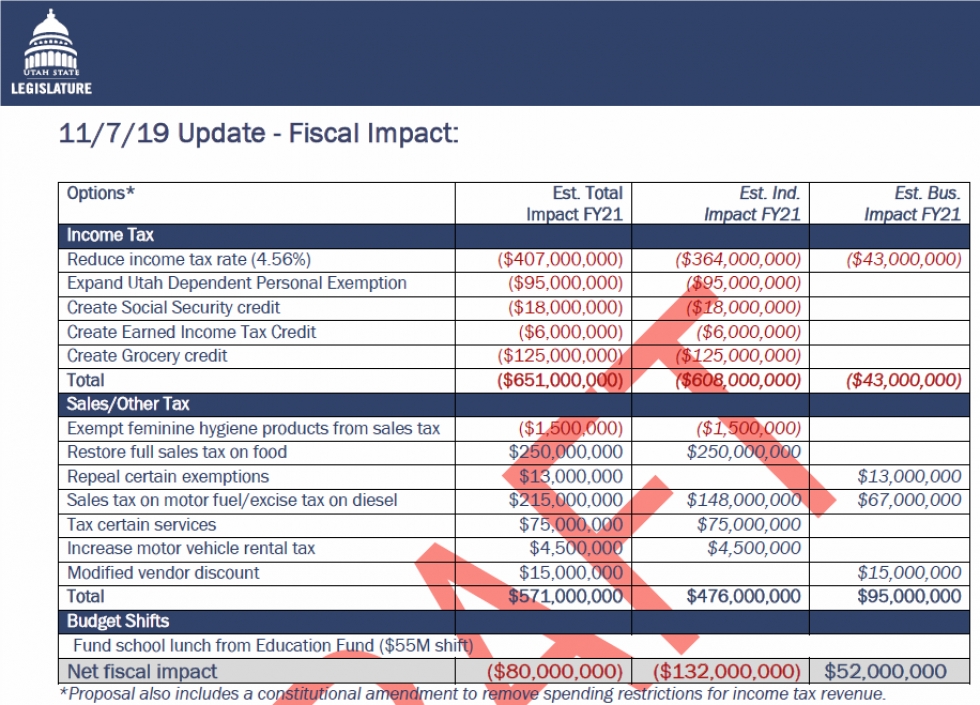

The answer is that the draft package’s roughly $600 million shift of revenues from income taxes to sales taxes also brings with it a less-noticed shift of about $100 million from in-state payers (aka Utahns) to out-of-state payers (non-Utahns). This is because a much higher share of the sales tax than of the income tax is paid by non-Utahns – about 25% of all sales tax revenues (though a much higher 40% for the gas tax and a much lower 5% for the grocery tax since tourists mostly eat prepared foods, which are already fully taxable). (That exact percent varies slightly from state to state. The state of Texas, for example, estimates that 21% of their sales tax is paid by non-Texans. while Minnesota estimates 23% for their sales tax.*)

The Implications of $100 Million of New Revenue from Out-of-State

The first implication of this $100 million shift is that the Task Force’s claim of an $80 million tax cut in their draft package actually understates the in-state tax cut (the tax cut for us Utahns) by roughly $100 million. This means that the draft package actually proposes a $180 million tax cut for Utahns -- in a package that costs the state $80 million of revenue annually.

The further implication of this is that the package could very easily be adjusted (simply by changing the proposed income tax rate) to make it revenue neutral overall – and still have a $100 million tax cut for Utahns.

But, building on the discussion above about our urgent unmet needs and chronic revenue shortages, the best implication of this in-state vs out-of-state shift is that this package could achieve one of the holy grails of tax policy – getting non-Utahns to pay for the things we Utahns need (education, infrastructure, etc.) – by using the new out-of-state revenue to get this package out of the red and permit a $100 million revenue enhancement for the state budget without costing Utahns a dime.

The Compromise That Could Carry the Day

But politics is politics, and politicians are politicians, and next year is an election year. Which brings us to the compromise that could potentially save this package: Take that $100 million of new out-of-state money and split it 50-50: Make the package $50 million revenue-positive so we can improve education and infrastructure and use the other $50 million for an in-state tax cut. Which is probably not anyone’s ideal solution, but it just might be the compromise that can carry the day.

* Here are the reports from the Texas and Minnesota state tax agencies that analyze the topic of exporting tax incidence to non-residents:

- Texas -- https://comptroller.texas.gov/transparency/reports/tax-exemptions-and-incidence/ -- see Table 1 on page 47 (p53 of the pdf) which reports that 21% of Texas' $37 billion of sales tax incidence is exported to out-of-state payers.

- Minnesota -- https://www.revenue.state.mn.us/sites/default/files/2019-03/%2B2019_tax_incidence_study_Nolinks_0.pdf -- see Table 2-1 on page 26 (page 40 of the pdf) which reports that 23% of Minnesota's sales tax incidence is exported to non-Minnesotans.