Taxes on Inherited and Generational Wealth

Most Americans inherit modest savings, perhaps a house, or nothing at all when they lose a family member. But a small number of ultra-wealthy families inherit millions, tax-free, creating dynasties of wealth and power that are hard to break up.

Estate and inheritance taxes are designed to limit extreme concentrations of wealth across generations. These taxes keep a small number of very rich families from getting richer and richer over time, by passing down their money to family members, rather than contributing to the public good.

These taxes are often attacked by politicians and their wealthy supporters. But the truth is, very few Americans ever pay taxes on the wealth that is passed down through their families when a loved one passes away. Many states have no such taxes, and only multi-millionaires pay estate taxes to the federal government.

Estate and inheritance taxes are based on a simple principle: people who inherit vast amounts of wealth - rather than actually earning it themselves - should contribute at least some of that wealth back to society. Without estate and inheritance taxes, these vast amounts of generational wealth are often never taxed at all.

What are Estate and Inheritance Taxes?

- Estate Tax is paid out of the deceased person’s estate (everything they own), before all the assets are passed along to others. The amount of the tax depends on the total value of everything in the estate, including: homes and properties, businesses, stocks, and valuables.

- Inheritance Tax is paid by the people who are chosen by the deceased person, in their will, to receive portions of their estate. The amount depends on how much wealth is given to the person, as well as how they are related to the person who has died.

Federal Taxes on Inherited Wealth

There is NO federal tax on inherited wealth (the assets a person receives from a deceased family member). There is a federal estate tax on multi-million dollar estates, but fewer than 1 in 1,000 estates are subject to this tax.

The federal government only taxes estates worth more than $13.61 million per person or $27.22 million for a couple (in 2024).

That means:

- An estate worth $5 or even $10 million owes nothing in federal taxes.

- No taxes are owed on estates that are worth less than $13.61 million for a single person.

- An estate worth more than $13.61 million is only taxed on the amount that is over that limit. For example, a $15 million estate would only pay taxes on the $1.39 million that is over the $13.61 million limit.

How Much Do Utahns Pay in Estate and Inheritance Taxes?

The vast majority of Utahns will never owe any estate or inheritance taxes, state or federal. Utah has NO estate or inheritance tax, and most estates fall well below the federal threshold.

As a result, even the richest people in Utah pay no taxes when huge amounts of wealth are passed from one generation to another.

The ultra-wealthy like to complain that estate and inheritance taxes amount to "double taxation." But that claim ignores the clear reality: most inherited wealth is never taxed during the owner’s lifetime. This wealth comes from the increased value of stocks, real estate, and other assets (unrealized capital gains). The estate tax ensures that these “capital gains” income doesn’t go entirely untaxed.

How are Estate and Inheritance Taxes Revenue Spent?

Estate taxes make up less than 1% of federal revenue. At the federal level, estate tax revenue goes into the general fund, helping to pay for infrastructure, national defense, health care, and more.

States with estate or inheritance taxes typically use the revenue to support core services like public education, health care, and public safety. By asking the wealthiest families to contribute more, these taxes allow states to keep other taxes–like sales and income taxes–lower for everyone else.

How Do Taxes on Inherited Wealth Impact Tax Equity?

Estate and inheritance taxes are some of the most progressive tools in the tax system. They focus on unearned wealth, not wages or work, and are paid only by the wealthiest households. That makes them especially powerful for promoting equity.

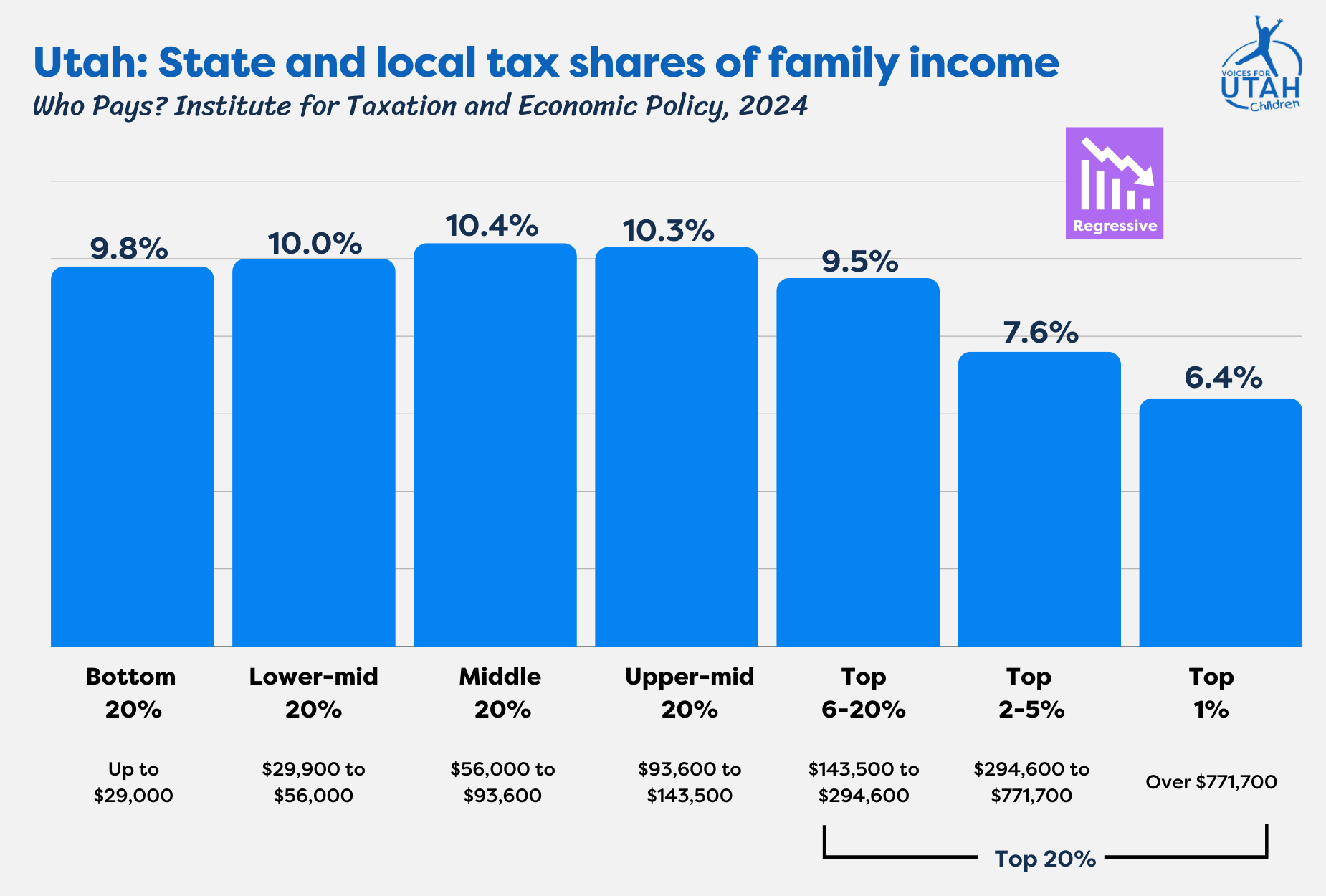

Research from The Institute on Taxation and Economic Policy shows that Utah's tax code is upside down: low–and middle-income families pay a larger share of their income in state and local taxes than the wealthy do. Most state revenue comes from working families through income, sales, and property taxes–while large inheritances often go untaxed.

A state-level estate or inheritance tax could help rebalance this by ensuring the wealthiest families also contribute to schools, infrastructure, and other public needs. In Utah, a family must have a net worth of at least $1.76 million to be in the top 1%–over three times the median net worth of Utah homeowners. If a state estate tax exempted the first $2 million of an estate, more than 99% of Utah families would pay nothing. And those ultra-wealthy Utahns who inherit large fortunes could still live very comfortably after paying their fair share.

Without action, wealth in Utah–like in the rest of the country–becomes more concentrated across generations. Estate taxes can slow this trend by making sure that at least some of the most extreme accumulations of wealth are used to help the entire community, before the rest is passed along to a few lucky family members.

Estate and Inheritance Taxes & Racial Equity

Wealth in the U.S. is highly concentrated–and overwhelmingly held by white households, due to generations of discriminatory policies in housing, education, and employment. As a result, Black, Latino, and Indigenous families are far less likely to inherit significant assets, reinforcing racial wealth gaps. Without estate or inheritance taxes, large fortunes pass down untaxed, widening inequality. Modestly taxing the largest inheritances is one of the few tools states have to curb intergenerational wealth concentration and invest in public goods that benefit everyone.

Resources

A Visual Guide to Tax Modernization in Utah (Kem C. Gardner Policy Institute)

Estate and Inheritance Taxes (Tax Foundation)

How Property Taxes Work (Institute on Taxation and Economic Policy)

Policy Basics: The Federal Estate Tax (Center on Budget and Policy Priorities)

State Taxes on Inherited Wealth (Center on Budget and Policy Priorities)

Utah: Who Pays, 7th Edition (Institute on Taxation and Economic Policy)