Public investment is critical in shaping the future of children, families, and communities.

Voices for Utah Children advocates for balanced economic growth by promoting fair taxation, investment in education and healthcare, and equitable policies that support low- and moderate-income families. We work to ensure Utah’s fiscal decisions lay a strong foundation for opportunity, prosperity, and a better quality of life for all Utahns.

Key Priorities

-

Advocate for a tax system that supports families by easing the burden on low- and middle-income households while ensuring the wealthiest contribute their fair share.

-

Prioritize investing state dollars on building opportunities and dismantling barriers for children and families to thrive.

-

Monitor how tax dollars are collected and spent at all levels of government to promote transparency and fair funding for kids.

Tax Policy Basics: A Guide to Utah's Tax System

Taxes can be confusing, but they affect nearly everything in our communities, from school funding to family budgets. Our Tax Glossary breaks down the key terms you’ll hear most often in conversations about Utah’s tax and budget system.

Tax Fairness

Despite repeated rounds of tax cutting that have brought Utah’s tax rates to their lowest levels in decades, we believe the state must prioritize investments in children and families over short-term tax reductions. We advocate for fair taxation policies and refundable family tax credits to help lift families out of poverty and address disparities in the tax burden between low- and high-income Utahns.

Tax Cuts Hurt Kids

Between 2018 to 2025, the state legislature cut the state income tax four times. These seemingly small cuts have resulted in an annual revenue loss of over $1.4B. Now, Utah’s legislative leaders are clear about their intentions to eliminate the income tax entirely.

Making Taxes Fair for All Families

Some tax policies and structures promote fairness and equity. Other approaches to taxes contribute to social inequality. It’s unfair and regressive when tax policies burden lower-income people more than very wealthy people.

Empower Utah Families with Better Tax Credits

By making our family state tax credits refundable, state leaders could tangibly enhance the lives of these families, providing them with essential financial support needed for their daily well-being.

LEARN MOREMore on Tax Fairness

Funding for Kids

At Voices for Utah Children, we focus on ensuring public revenues are used to give all kids access to a world-class education, healthcare, and the resources they need to thrive. Smart fiscal choices, like fully funding education, healthcare, and support systems for vulnerable populations, are critical to fostering opportunity and laying the groundwork for long-term prosperity.

Voices for Utah Children's Budget 2023

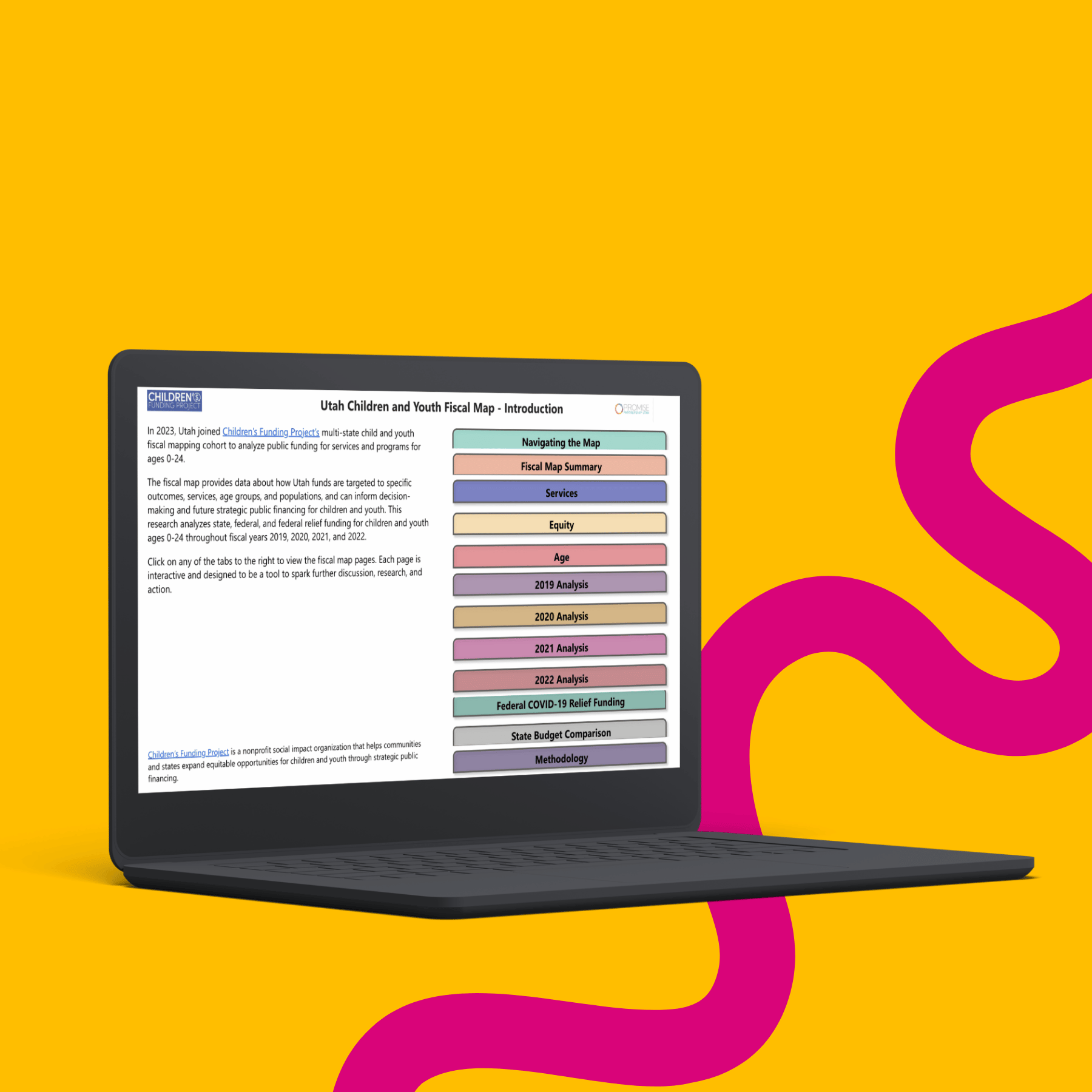

From fiscal year 2008 to 2022, we divided all state programs concerning children into seven categories to quantify the level of public funding and identify trends. Additionally, our partners at The Children’s Funding Project and Promise Partnership of Salt Lake created a public funding fiscal map to analyze programs for children.

Blog Series: Vouchers and School Privatization in Utah

This series will provide information about: how the program is meant to work; how Utah voters were steamrolled into paying for school vouchers; and the vast body of research showing that school voucher programs do not produce positive education outcomes.

LEARN MORETracking Utah's K-12 Education Funding

Utah returns to ranking last in the nation for per-pupil education spending. While the national average is $15,633, Utah’s spending stands at $9,552 per student, placing the state 51st for Fiscal Year 2022.

LEARN MOREMore on Funding for Kids

Previous Initiatives

Invest in Utah's Future Coalition

Invest in Utah’s Future Coalition advocates that the Utah Legislature prioritize Utah’s long and growing list of unmet needs over permanent tax cuts, undermining our long-term capacity to invest in Utah’s future. Click below to visit Invest in Utah's Future Coalition website.