In Utah, like most states, sales tax helps to pay for essential public services like schools, healthcare, parks, and transportation.

What is Sales Tax?

Sales tax is an extra percentage added to the price of certain goods and services when purchased. In Utah, the state sales tax rate is 4.85%, which applies to most goods (like cars and furniture) and some services (like dry cleaning and car maintenance).

Some goods and services in Utah are subject to selective sales taxes–specific rates applied to certain items, like groceries and car rentals–or excise taxes, which are per-unit taxes rather than a percentage of the price, such as those on gasoline, tobacco, and alcohol. Some services, including healthcare, legal and accounting services, advertising, landscaping, and haircuts, are not taxed.

In addition to the state sales tax, cities and counties can add their own sales taxes to help pay for local needs. These may include:

- General local sales tax: 1% in all cities, towns, and counties.

- County tax: 0.25% in all counties.

- Special-purpose taxes (varies by location):

- Recreation & Arts – Taxes for parks, zoos, and cultural programs

- Tourism – Extra taxes on hotels, rental cars, and resorts

- Transportation – Taxes for public transit, highways, and airports

- Other local needs – Funding for rural hospitals, correctional facilities, and city utilities

To calculate the sales tax on a taxable item, the cost of the item is multiplied by the tax rate, which, because of these local taxes, varies based on locatio. For example, if the state sales tax is 4.85% and a city adds 1.25%, a customers pays a total 6.10% total in sales tax. That means a $10 book would cost $10.61 at checkout.

To view local sales tax rates, visit Utah Sales Tax Rates.

How is Sales Tax Revenue Spent?

Most sales tax money goes into Utah’s General Fund, which the Utah Legislature uses to pay for social services, higher education, corrections, healthcare, natural resources, and transportation. Some of the money also goes directly to local governments, paying for roads, public safety, and specific community programs like homeless shelters or food pantries.

How Much Do Utahns Pay in Sales Taxes?

Everyone who makes a purchase in Utah pays sales tax, including residents, businesses, and tourists. Utah’s average sales tax rate is about 7.2% when combining state and local taxes. Sales, use, and excise taxes make up about 49% of all state tax revenue.

Does Sales Tax Impact Everyone Equally?

A balanced tax system uses a mix of property tax, sales tax, and income tax to ensure stability, fairness, and responsiveness. Sales taxes play a key role in that mix because they are responsive–when the economy is strong and people spend more, tax revenue increases, helping to support growth. During tough times, people spend less and pay less in taxes.

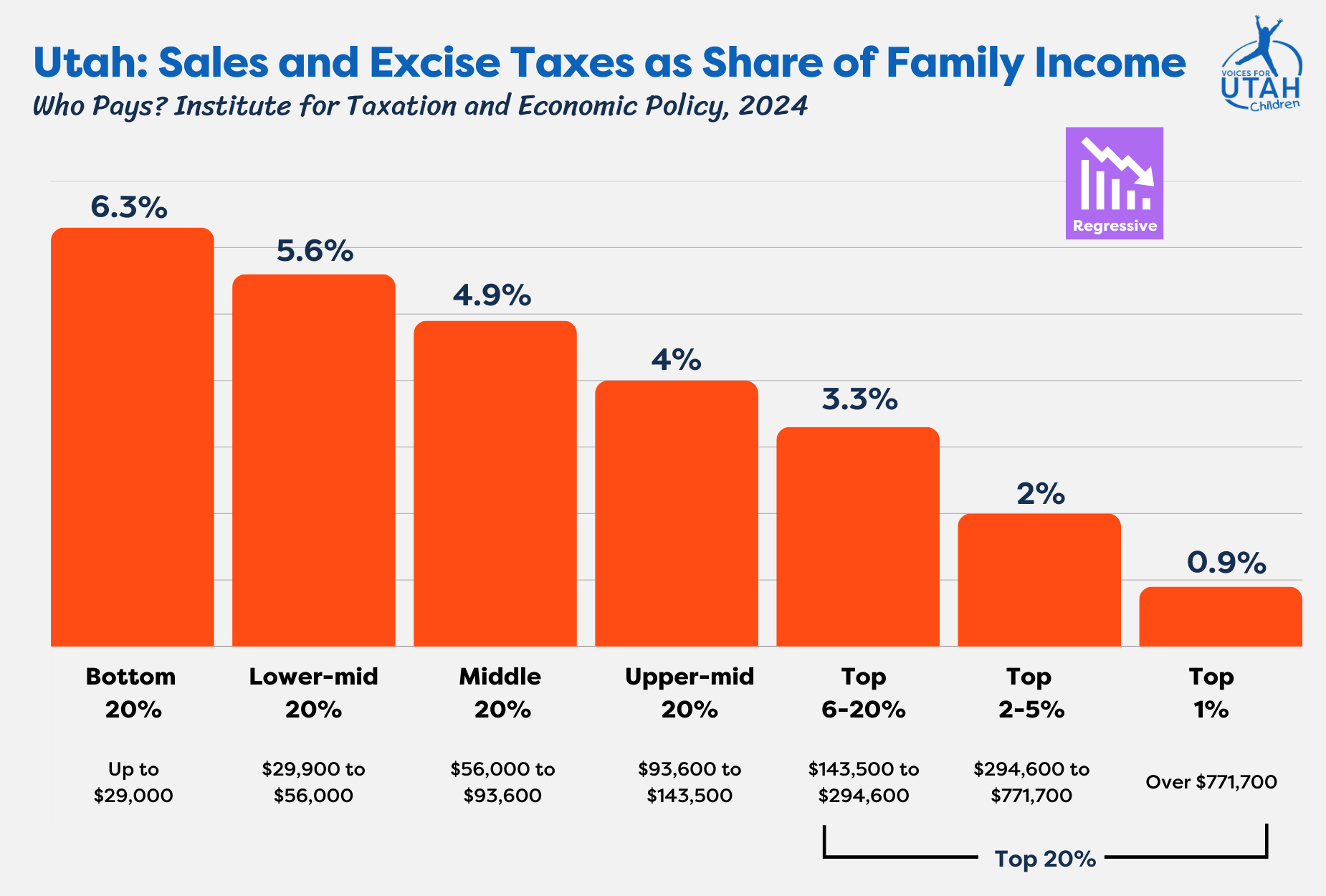

However, sales tax is considered inherently regressive, meaning it takes a larger share of income from lower- and middle-income families. Think of it this way: $200 in groceries is a major expense for someone earning $40,000 a year, but it’s barely noticeable for someone making $1 million. The tax rate is the same–but the impact isn’t.

Analysis from The Institute on Taxation and Economic Policy shows low-income Utahns pay more of their income on sales and excise taxes than the wealthiest. That’s because lower-income families spend most of what they earn on everyday needs, while higher-income households save more and spend a smaller portion of their income–making less of it subject to these taxes.

Sales Tax & Racial Equity

Because Black, Hispanic, and Indigenous households are disproportionately represented in lower-income groups due to historical and ongoing discrimination, regressive taxes like sales tax worsen racial inequities. A tax system based on spending rather than the ability to pay places a greater financial burden on communities of color.

Are There Any Sales Tax Relief Programs?

Utah has no sales tax relief programs. However, Utah doesn’t charge sales tax on some essential items, which provides some relief:

- Unprepared food (groceries): Taxed at a reduced statewide rate of 1.75%, plus any local taxes. Some states have decided not to tax groceries altogether.

- Prescriptions & medical devices: Exempt from sales tax.

- Certain agricultural and manufacturing items: Exemptions apply for qualifying businesses or farmers.

Utah relies heavily on the sales tax to fund state services. For that reason, state leaders are reluctant to offer any direct sales tax relief programs.

Resources

Annual Tax Reports (Utah State Tax Commission)

A Visual Guide to Tax Modernization in Utah (Kem C. Gardner Policy Institute)

How Sales and Excise Taxes Work (Institute on Taxation and Economic Policy)

Sales and Use Tax Rates (Utah State Tax Commission)

The Everyday Tax (Utah Foundation)

Utah: Who Pays, 7th Edition (Institute on Taxation and Economic Policy)

Utah Compendium of Budget Information (Utah State Legislature)