Tax credits reduce the amount of income tax a family owes. But not all tax credits work the same way. One key difference is whether the credit is refundable–that is, whether it can result in a refund even if a family doesn’t owe any income taxes.

What is a "Refundable" Tax Credit?

A refundable tax credit means a family can receive the full value of the credit, even if they don’t owe any income tax when they file their taxes. If the credit is more than the amount owed, the leftover amount is paid out as a refund–money that can be used for rent, food, car repairs, or other essentials.

Refundable = Money back in your pocket, even if your tax bill is $0

What is a "Nonrefundable" Tax Credit?

A nonrefundable tax credit can only reduce your tax bill to zero–it won’t pay you back anything beyond that. If a family doesn’t owe any taxes after deductions, they can’t use the tax credit. If a family only owes a little in income taxes, they can only use the nonrefundable credit to pay down whatever they owe.

Nonrefundable = Use it or lose it if your tax bill is low

How Does Tax Credit Refundability Impact a Family?

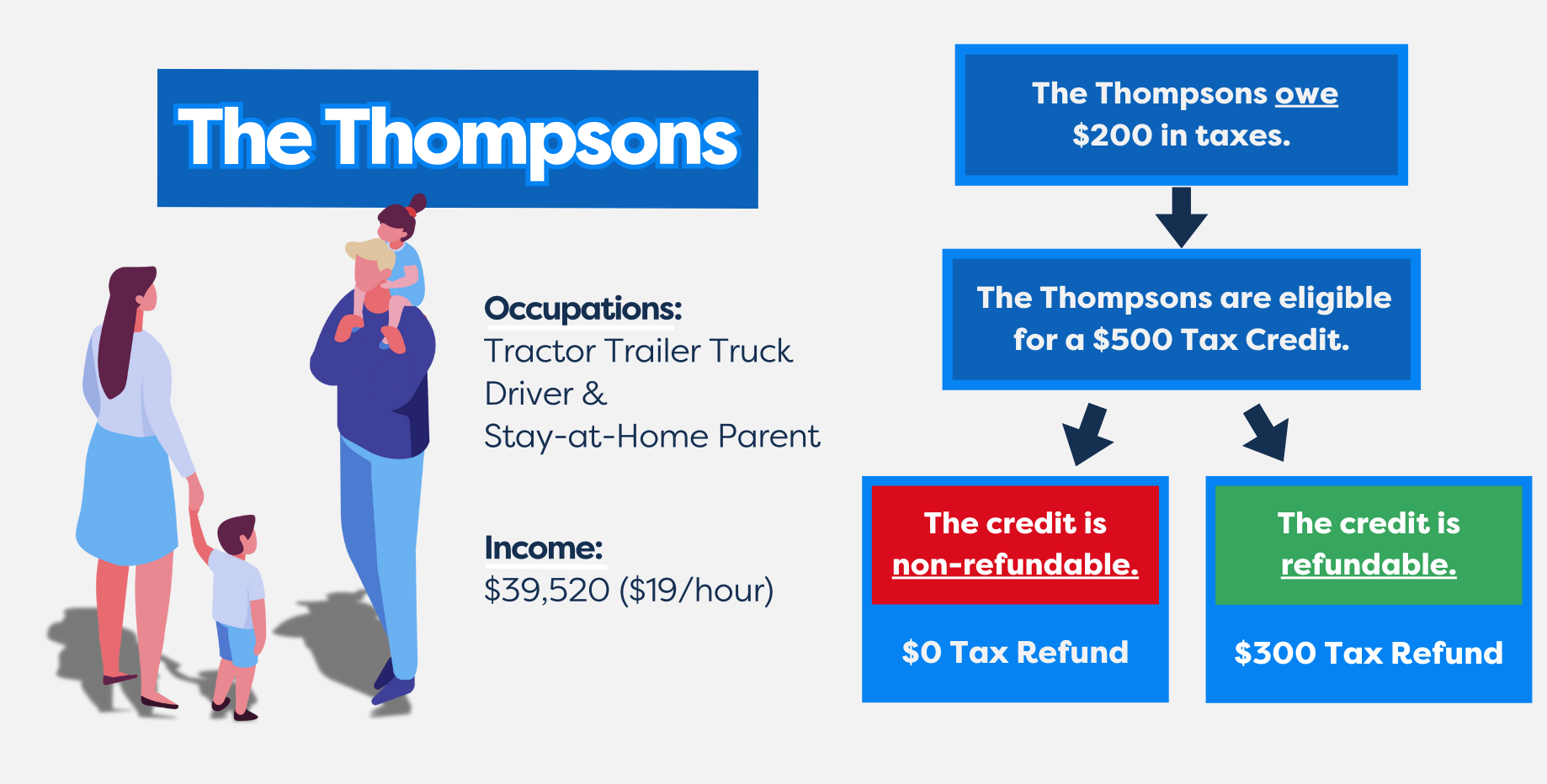

In the illustrated example below, the Thompsons have two young children and earn $39,520 for the year. After deductions, they owe $200 in income tax.

Now, imagine they qualify for a $500 tax credit. Refundability can greatly impact how much they owe in taxes and whether they'll keep more of their earnings through a refund.

If the $500 tax credit is nonrefundable, it will be applied to offset what the Thompsons owe in taxes. Since they owe $200, the credit will help reduce the amount they owe to $0 – a positive outcome. But because the credit is nonrefundable, they do not get the remaining $300.

It’s much better for this young family when that $500 tax credit is refundable. If refundable, the $500 tax credit can go towards the amount they owe in taxes ($200) and the remaining $300 would go back to the Thompsons as a refund. This $300 can help with expenses like car repairs, new winter coats for the kids, and baby formula. For families living paycheck to paycheck, even a few hundred dollars can mean the difference between catching up and falling behind.

Why Refundability Matters

Refundable tax credits are especially important for low- and middle-income families who may not owe much income tax–but still pay a large share of their income in other taxes like sales, gas, and property taxes. There’s a misconception that low-income families or undocumented families don’t pay income tax. But everyone pays sales, gas and property taxes.

Without refundability, families who need support the most often miss out entirely. In Utah, 80% of families pay a greater share of their income in taxes than the wealthiest 1%. Refundable credits are one of the few tools that can help correct this imbalance.

Refundability can be transformative. During the pandemic, the federal Child Tax Credit was temporarily expanded to be fully refundable and reach more low- and moderate-income families. The impact was historic:

- Child poverty from 9.7% in 2020 to 5.2% in 2021–the lowest on record.

- In Utah, the federal CTC expansion helped lift 32,000 children from poverty.

But after the expansion expired, child poverty jumped to 12.4% nationally. Studies showed that 91% of low-income families (earning under $35,000) used their monthly CTC payments on food, housing, utilities, clothing, or education.

Are There Refundable Credits in Utah?

Only one of Utah’s 70+ income tax credits is refundable: the Refundable Adoption Tax Credit. The federal government has several refundable tax credits, including the Earned Income Tax Credit, Child Tax Credit, and Premium Tax Credit.

Resources

9 in 10 Families With Low Incomes Are Using Child Tax Credits to Pay for Necessities, Education (Center on Budget and Policy Priorities)

Expanding the Child Tax Credit is the Best Way to Give Utah’s Families Relief from Rising Costs (Economic Security Action)

Expansions to Child Tax Credit Contributed to 46% Decline in Child Poverty Since 2020 (US Census)

Refundable tax credits (Internal Revenue Service)