Imagine you and a millionaire go out to dinner and are asked to split the bill 50/50. That might seem equal– but is it fair?

A truly fair system considers how much each person can reasonably afford, not just whether the numbers match.

This is the core idea behind a progressive tax system: fairness isn’t about everyone paying the same amount or percentage–it’s about the impact of what they pay.

Flat vs. Progressive Tax: What's the Difference?

Take this example:

- A person earning $40,000 pays 10% in combined taxes = $4,000

- A person earning $400,000 also pays 10% = $40,000

Same rate, very different outcomes. For the lower-income earner, $4,000 could mean skipping a medical bill, delaying car repairs, or going into debt. For the higher earner, $40,000 barely touches their lifestyle–they still have plenty left over for savings, investments, and vacations.

It might feel like someone paying $40,000 in taxes is more burdened by taxes–after all, their mortgage or car payments might be bigger, too. But the key difference is those higher expenses are usually lifestyle choices, not necessities. In contrast, people earning $40,000 are often spending every dollar just to meet basic needs–rent, groceries, utilities, gas. There’s no cushion. A $4,000 tax bill could mean skipping meals, delaying medical care, or going into debt. A $40,000 tax bill might sting–but they’re far less likely to face eviction or food insecurity because of it.

That’s the difference between equality and equity.

In a progressive tax system, people contribute based on what they can truly afford:

- A $40,000 earner might pay 5% = $2,000

- A $400,000 earner might pay 15% = $60,000

The goal is to ensure everyone contributes–but without pushing anyone into hardship.

That’s what a fair tax system does: it adjusts for reality, not just math. That’s why fair tax systems ask more of those who can afford it–not because their money doesn’t matter, but because it doesn’t threaten their basic survival.

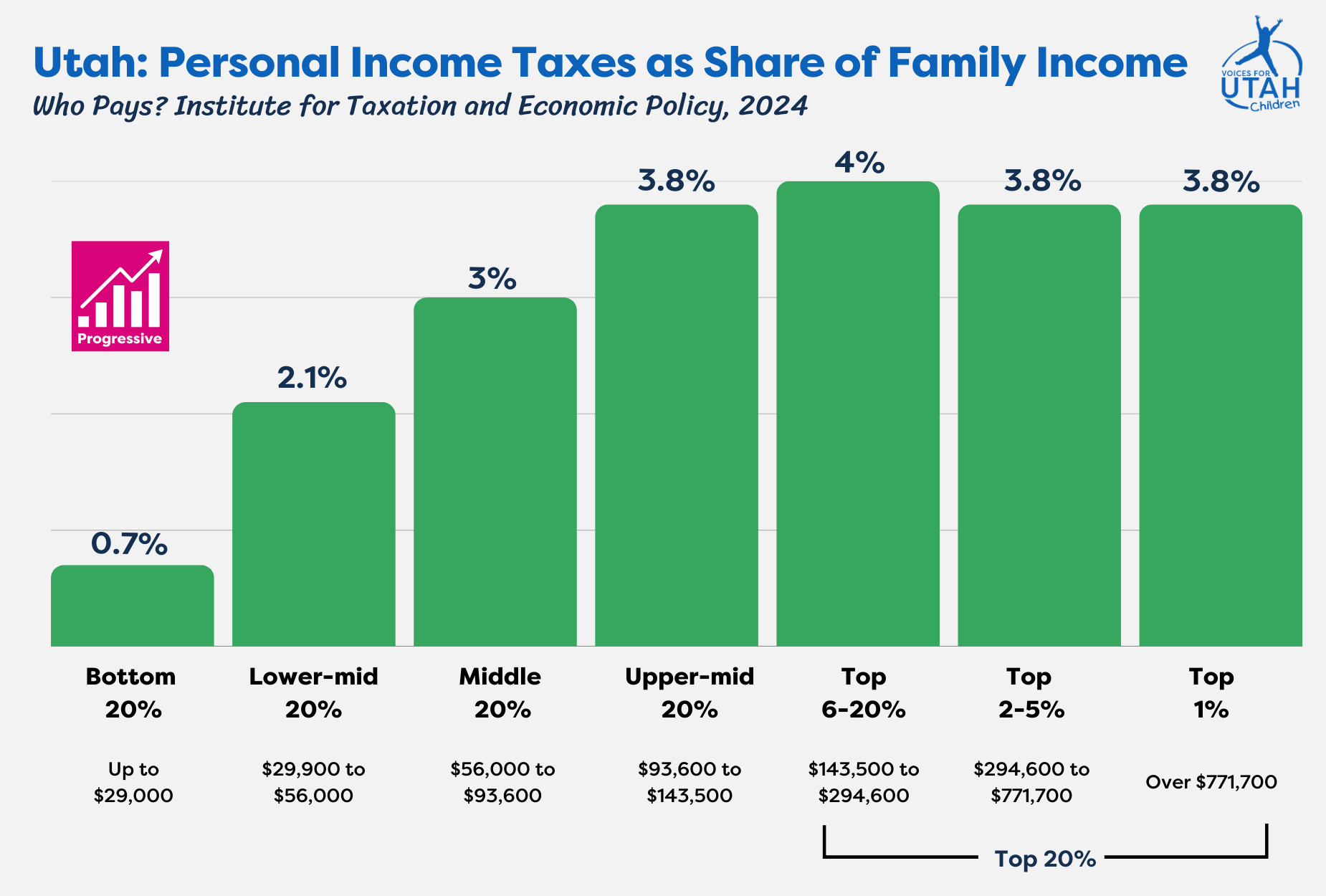

Income Tax: Progressive in Theory, Complicated in Utah

Income tax is typically the most progressive tax, meaning people with higher incomes pay a larger share of their income in taxes. At the federal level and in states with progressive income tax rates, rates increase as income increases. For example, someone earning $40,000 might pay 3% on their income, while someone earning $400,000 might pay a higher rate–say, 7% or more–on the top portion of their income. This approach is based on the ability to pay: the higher their income, the more they contribute.

But Utah’s flat tax system–where everyone pays the same rate–complicates things. The flat income rate of 4.5% means everyone pays the same percentage regardless of income. So, someone earning $40,000 pays $1,800 in income tax. Someone earning $400,000 pays $18,000. While the higher-income earner pays more in total dollars, both pay the same percentage. But that 4.5% is a much heavier burden for someone living on $40,000 a year–it impacts their ability to afford housing, food, and child care in a way it simply doesn’t for someone with ten times the income.

The Utah Taxpayer Tax Credit helps offset this, especially for low- and moderate-income earners. ITEP research shows that Utah’s income tax is still mostly progressive, with lower-income families paying a smaller share of their income than top earners.

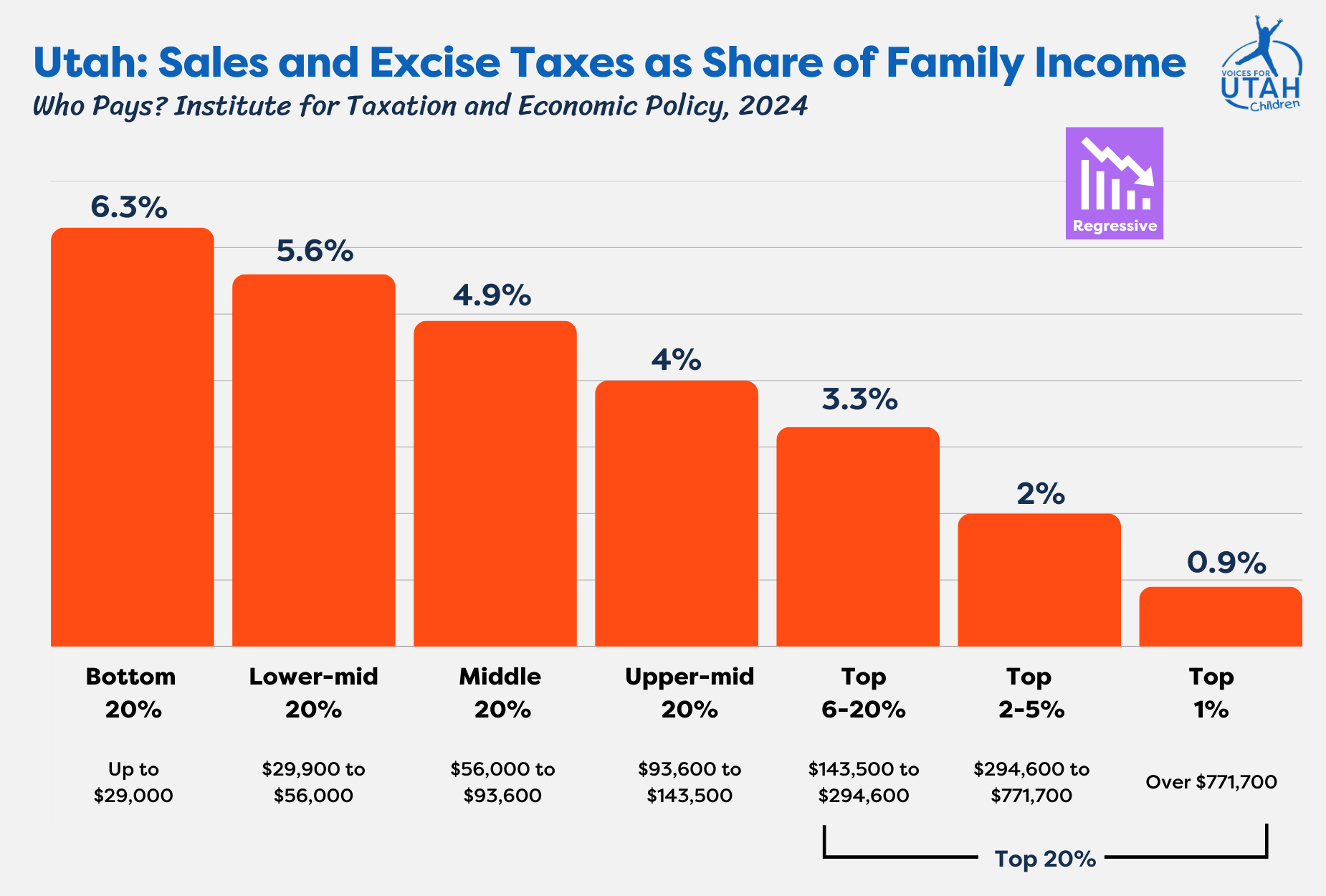

Sales Tax: Regressive and Unequal by Design

Sales tax is one of the most regressive forms of taxation because everyone pays the same rate–regardless of income. But it takes a much bigger bite from low-income families.

Think of it this way: If both a millionaire and someone earning $40,000 spend $200 on groceries, they both pay the same amount in sales tax. But for the lower-income household, that $200 might be a big part of their weekly budget–while for the millionaire, it’s pocket change. The sales tax rate is the same, but the burden isn't.

Research from The Institute on Taxation and Economic Policy shows low-income Utahns pay more of their income on sales and excise taxes than the highest earners. This is because low-income Utahns spend more of what they earn just to get by. By contrast, high-income households might spend more in total dollars but save a much larger share of their income–meaning a smaller portion of their income is taxed through sales or excise taxes.

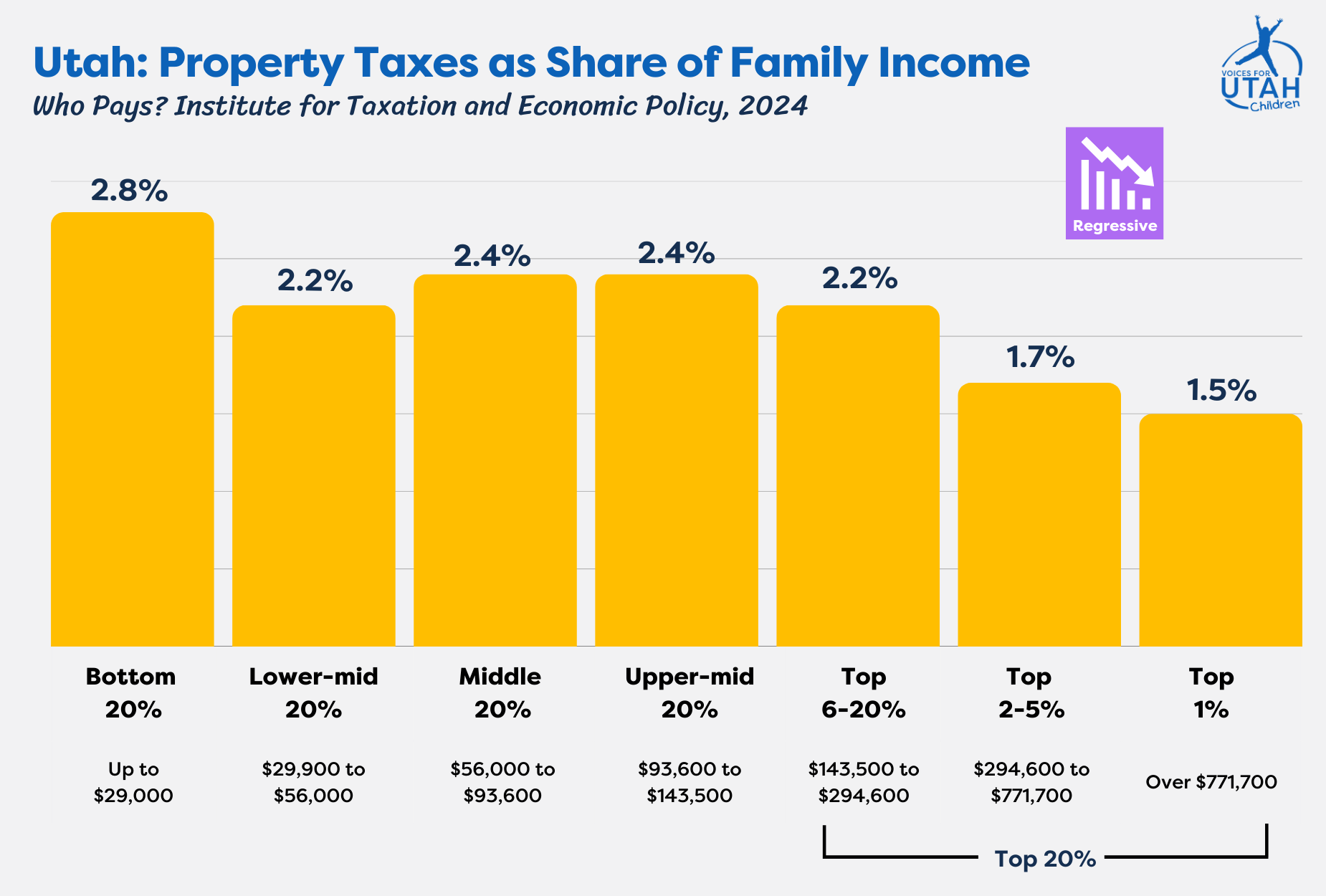

Property Tax: Not Always Based on Ability to Pay

Property taxes can be progressive–wealthier households usually own more valuable homes–but they’re often regressive in effect.

For example: A homeowner with a $200,000 house and a $50,000 income pays the same property tax rate as someone with a $2 million home and a $500,000 income–but the lower-income homeowner is spending a much bigger chunk of their income on housing costs and taxes. Both pay the same rate, but the lower-income household is sacrificing far more. The rate is equal–but the sacrifice isn’t.

Other challenges with property taxes (that are often targeted through tax relief programs):

- A person owes the same amount even if they lose their job or retire

- Renters pay indirectly through higher rent

- Seniors on fixed incomes may struggle to keep up as values rise

ITEP research shows that property taxes take up a larger share of income for low- and middle-income Utahns. That’s because housing costs make up a bigger part of their budget.

Utah’s Overall Tax System: Regressive and Imbalanced

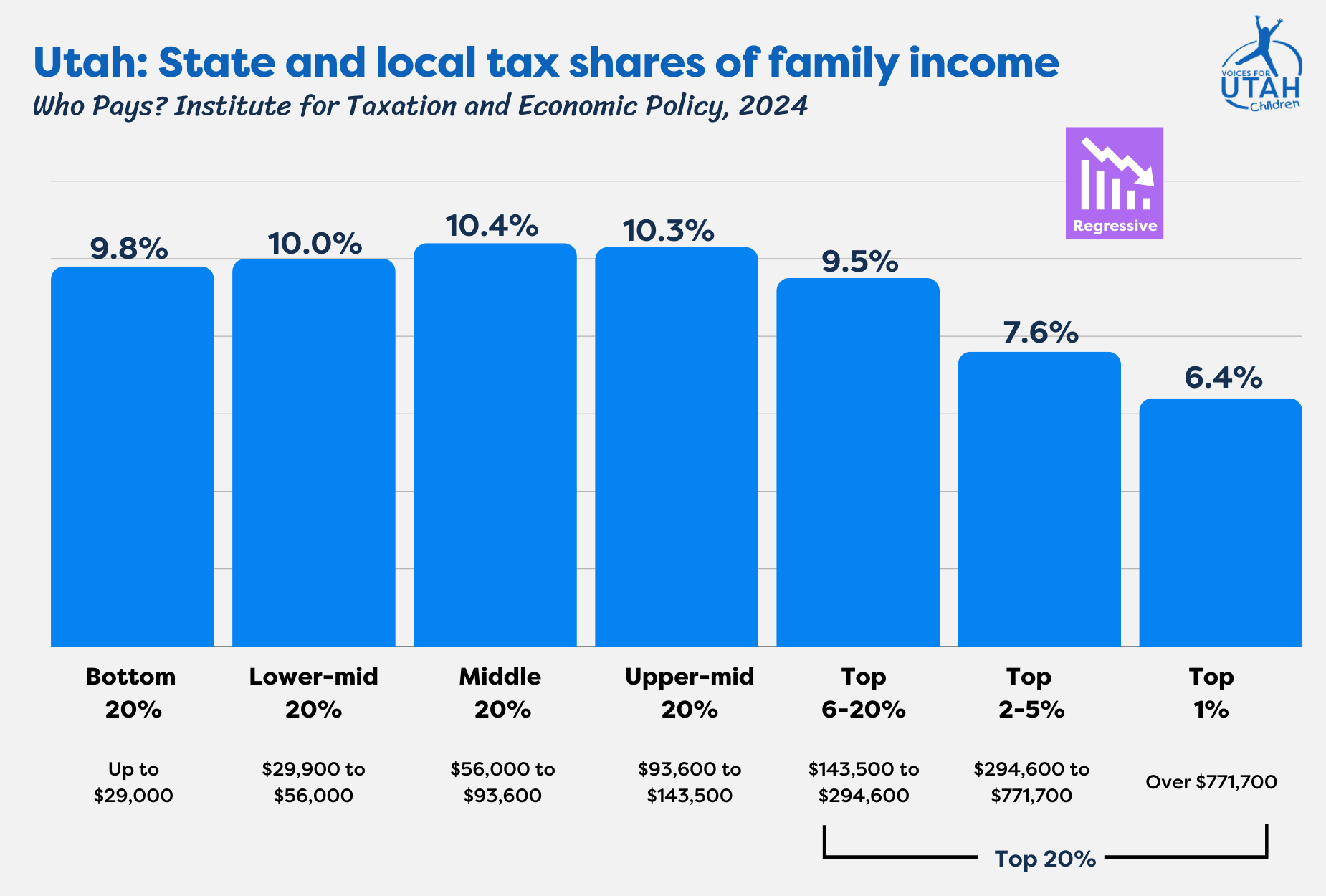

When adding up all forms of taxation, Utah’s overall tax system is regressive. Lower- and middle-income families pay a greater share of their income in state and local taxes than the wealthiest.

Lawmakers often argue the wealthy deserve tax cuts because they “pay the most.” But in reality, when we look at the share of income, it’s lower- and middle-income families who are carrying the heavier load.

Fairness Isn’t Just Math. It’s Impact.

A fair tax system doesn’t just consider how much a person earns–it considers how much they can reasonably contribute without sacrificing basic needs.

That’s why progressive tax systems are important. They don’t punish success–they ask those who have benefited the most from our economy to give back in proportion to what they can afford. Yes, wealthy individuals often pay more in total dollars–but that amount represents a much smaller share of their income and has far less effect on their daily lives. For low- and middle-income families, a smaller tax bill can mean the difference between stability and crisis.

What matters is not just how much someone pays but how much it costs them to pay it.

Equitable taxation ensures that essential public services–like education, infrastructure, and health care–are strong and accessible for everyone. These services are what make economic success possible in the first place. When all children have the tools to thrive, the entire economy grows stronger. That’s not a burden–it’s an investment with shared returns.

Resources

Blog: Making Utah Taxes Fair for All Families (Voices for Utah Children)

Utah: Who Pays? 7th Edition (Institute on Taxation and Economic Policy)