Tax and Budget

Racial and Ethnic Equity for Children in Utah

What We Learned from the 2016 Legislative Session

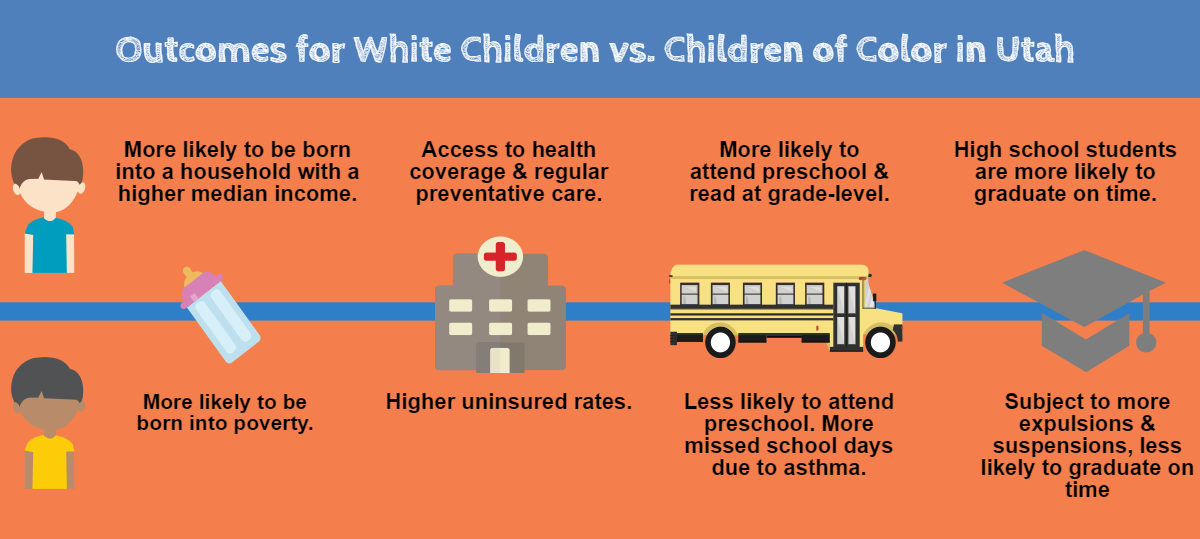

- Children of color in Utah face more poverty compared to non-Hispanic White children. As Utah becomes a more diverse state, children are affected by significant racial and ethnic disparities.

- The 2016 General Session failed to adequately meet the needs of children of color in Utah. There were some important steps forward but also missed opportunities and inaction.

- We saw gains for children’s preschool education, health coverage, school safety and criminal justice. There were missed opportunities to expand kindergarten, address our public defender crisis, expand health coverage for all low-income families and keep more families out of poverty.

- Going forward advocates have a responsibility to integrate an equity lens into our work and build coalitions that will strengthen opportunities for all families.

- Our Legislature, Governor and State Agencies should be more conscious of communities of color and low-income Utahns in their public policy decisions by reviewing the impact of bills and policies on all groups.

- In order to correct growing disparities and invest in Utah’s diverse future, lawmakers need to access data disaggregated by race and ethnicity and work with affected communities when developing policy.

Children’s Racial and Ethnic Equity in Utah

Was the 2016 Legislative Session Good for All Children?

Voices for Utah children starts with one basic question in our advocacy efforts: Is it good for kids?

For over 30 years we have been a statewide advocate, informing policymakers that they can and should act to keep children safe, healthy and help them succeed.

But as Utah’s demographic make-up changes, so too are the questions we have to ask. Is it good for all children, or just some children? Which children are making gains in our state while others are falling behind?

The number of Utah children who are non-White is growing. Since 2000, the percentage of children of color in Utah has grown from 17 to 25%. The Hispanic population is growing even faster. Hispanic children have grown from 11 to 17% of the total child population.

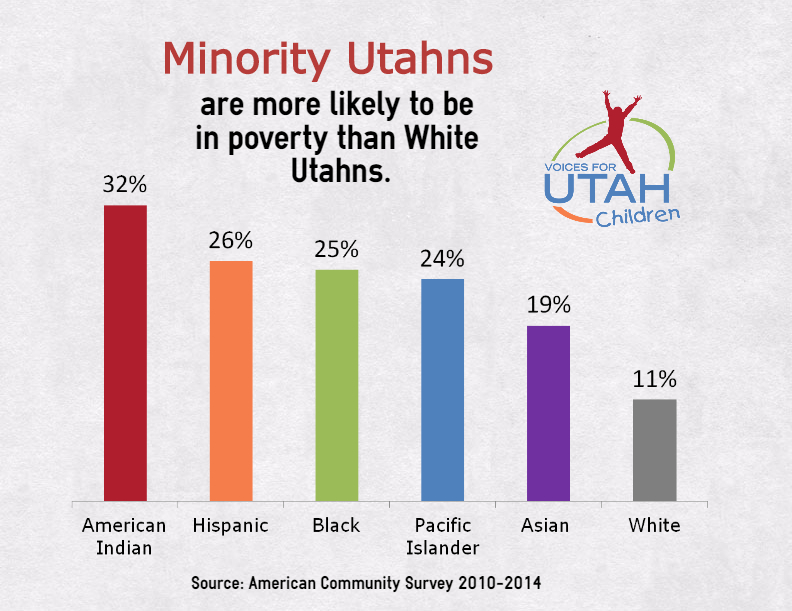

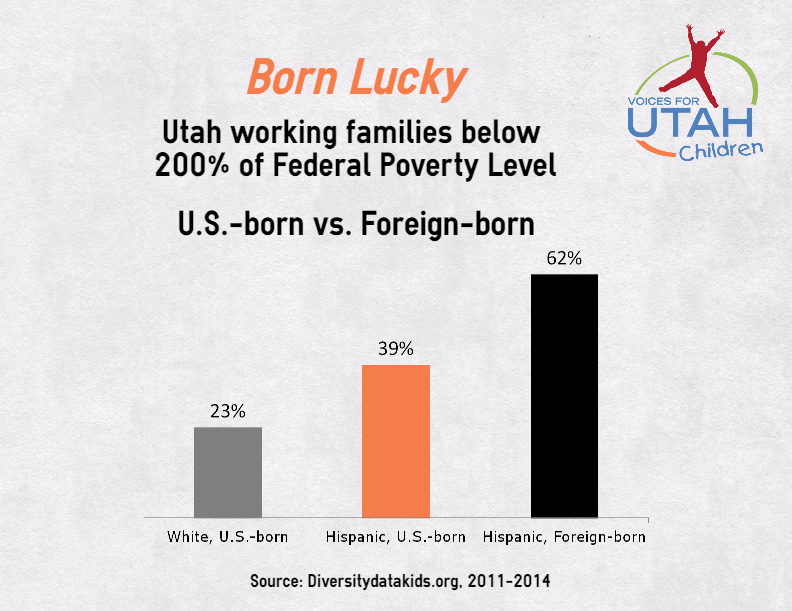

Unfortunately, there is a growing social and economic divide along racial and ethnic lines in Utah. Although Utah is a welcoming state, with a prominent international population, there are disparities among our diverse populations. Families of color face higher poverty rates compared to their White, non-Hispanic counterparts. The median household income for White, non-Hispanic families is significantly higher than all other racial and ethnic groups. White children are two to three times less likely to live in extreme poverty. Endnote 1

As a result, children of color have worse health outcomes, lower educational attainment, and are more likely to face school discipline and be involved in the juvenile justice system. What can we do to reverse this trend and create a Utah where all children can thrive?

Public policies can help. Public policies play an important role in expanding opportunities for all children, strengthening our schools and public safety net. Endnote 2 But public policies can also create barriers for families. Laws can make it harder for some groups or communities to access care; funding cuts can reduce services. Or simply by maintaining the status quo, policies can perpetuate unnecessary barriers or hidden obstacles for families.

In the recent 2016 Legislative General Session, lawmakers introduced bills that expanded opportunities for children and families and others that created more barriers. At Voices for Utah Children, we look at these laws and ask not only, are they good for children? But also, are they good for everyone, or only some? And under what conditions? Endnote 3

In this report, we will reflect on the 2016 General Session and its potential impact on children from all racial and ethnic backgrounds. We examine legislation in four major issue areas: early childhood education, health, economic equity, and juvenile justice reform. Endnote 4 Using data which is disaggregated by race and ethnicity, this report will consider legislation that expands opportunity for children and youth, as well as missed opportunities for change.

Early Childhood Education

Expanding Opportunities for High-Quality Preschool Programs

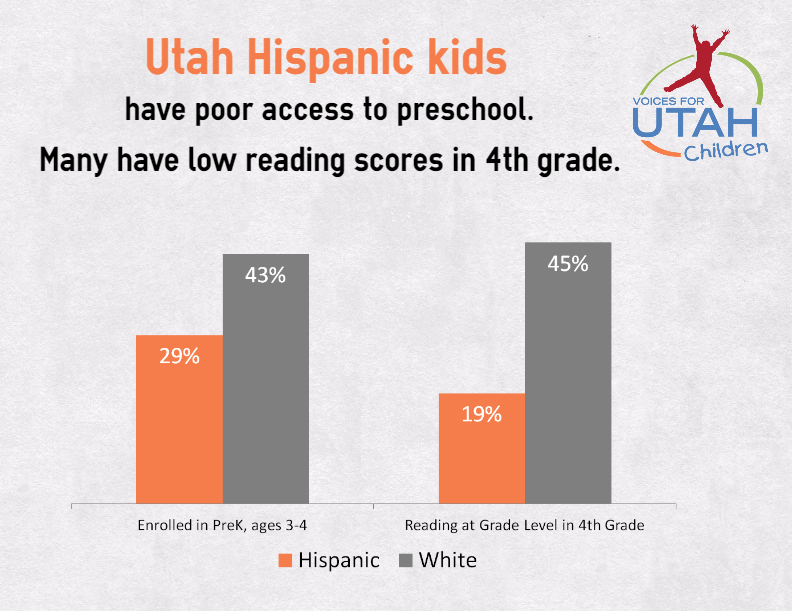

Early education opportunities can reduce racial and ethnic disparities. High-quality preschool helps children gain valuable cognitive, social, emotional and academic skills. Endnote 5 But with an attendance rate of 40%, Utah has one of the lowest rates of preschool attendance and the rate is even lower among children of color. Only 29% of Hispanic children ages 3 - 4 are attending preschool, compared to 43% of White, non-Hispanic children. One factor driving this discrepancy is that there are not enough affordable, quality preschools, especially in high-needs communities.

The Utah Legislature took steps to address this problem through SB 101, which makes more affordable, high-quality preschool slots available. SB 101 creates a grant program to expand high-quality preschool programs for at-risk children. It also provides scholarships for children who have been identified as living in intergenerational poverty. SB 101 was funded through Temporary Assistance for Needy Families (TANF), which directs funds to low-income children. However, the racial and ethnic gap in school readiness may not be fully accounted for by income, as research shows. In the future, Utah needs more programs, and supporting data, which can examine gaps in school readiness between children of different backgrounds, and ways to address those gaps in high-quality preschool programs. Endnote 6

Missed Opportunity: Expanding Optional Extended-Day Kindergarten and Readiness Assessments

While SB 101 made significant gains for early education, the Legislature missed a critical opportunity to advance continuity in quality programming beyond preschool. HB 42 would have increased funding for quality optional extended-day kindergarten programs and created a statewide kindergarten entry and exit assessment tool.

While SB 101 made significant gains for early education, the Legislature missed a critical opportunity to advance continuity in quality programming beyond preschool. HB 42 would have increased funding for quality optional extended-day kindergarten programs and created a statewide kindergarten entry and exit assessment tool.

Full day kindergarten can help reduce racial and ethnic disparities in academic performance. In Utah, less than 15% of 5-year-olds participate in full day kindergarten programs. Endnote 7 Utah has one of the lowest rates of full day kindergarten participation in the nation. Overall there are not enough high-quality, full day, early education programs available in Utah, especially for at-risk children. This contributes to the achievement gap in later years. For example, 81% of Hispanic children are not reading at a proficient grade level by the 4th grade, compared to 55% of White, non-Hispanic children.

Moreover, Utah also lacks comprehensive data to understand children’s kindergarten readiness. By calling for a statewide entry and exit assessment tool, HB 42 would have allowed schools to better determine children’s kindergarten readiness. A statewide assessment can help educators develop appropriate interventions. Without sound, standardized statewide tools, we cannot adequately assist children most at risk of falling behind. Endnote 8

Juvenile Justice Reform

Expanding Opportunities: School Discipline and Juvenile Sentences

Nationwide, we see troubling racial and ethnic disparities in the juvenile justice system, and Utah is no exception. For example, Black children make up a disproportionate share of the juvenile justice system. Despite being only 1% of the total child population in Utah, Black youth make up 23% of the population in juvenile detention or correctional facilities.

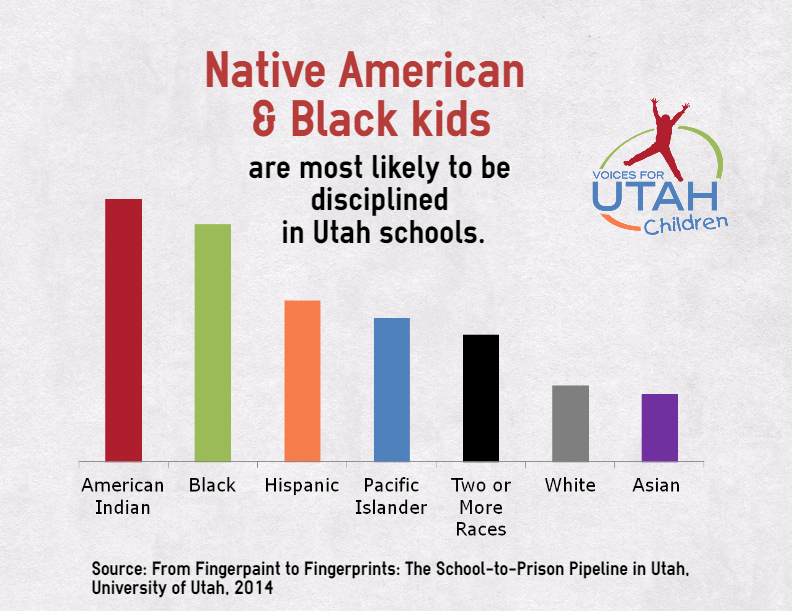

One significant factor leading to youth involvement in the juvenile justice system is school disciplinary action. There is a direct correlation between youth discipline in school and the likelihood that a child will become involved in the criminal justice system. Yet this too disproportionately impacts children along racial and ethnic lines. Children of color consistently face greater school disciplinary action compared to their White, non-Hispanic peers. Endnote 9 For example, American Indian and Black students are more likely to receive disciplinary action in Utah schools than other racial groups.

Given these findings, HB 460 is an encouraging step forward. HB 460 will provide training for school resource officers and school administrators. The law requires that the State Board of Education create a curriculum to help train officers in schools. HB 460 states that the training can include cultural awareness, resources for students exposed to trauma and restorative justice practices. Its aim is to prevent school disciplinary issues from escalating into larger, criminal justice issues. Appropriate training for school resource officers and administrators could reverse existing practices negatively affecting children of color.

Another promising step this legislative session is HB 405, which prohibits children from receiving life sentences without parole. HB 405 represents an important step in ensuring that the criminal justice system recognizes the unique needs of youth and children.

Missed Opportunities to Avoid Harsher Sentencing for Children of Color

There were also some significant missed opportunities for juvenile justice reform. In particular, SB 155 failed to address the crisis of public defenders in Utah. The law proposes to further study the problem and offers small county-level grants for adult indigent defense. While important, however, this will not help youth. All adults and children have the right to counsel if charged with a crime that might lead to jail, but Utah has failed to fulfill this Constitutional requirement. If a child does not have adequate access to a defense attorney, he or she could receive a harsher sentence. Low-income children of color are more likely to find themselves in the criminal justice system, and therefore more likely to experience harsher sentencing. The ‘school to prison pipeline’ in Utah is fueling some of our most alarming racial and ethnic inequities. We need systems committed to addressing these disparities and helping all children succeed.

Economic Equity

Missed Opportunities to Restore Funds for Public Programs

Families of color face higher poverty rates. Although Hispanic children make up only 17% of the total child population, they represent at least 39% of children living in poverty. Among Hispanic children, 31% live below the poverty threshold compared to 8% of non-Hispanic Whites. From the data available by racial and ethnic categories, we know that poverty in Utah is not experienced equally among all racial and ethnic groups.

What can our public policies do to help all Utahns? As a starting point, we need to ensure that there are enough public dollars available in our General Fund for the programs and services proven to help people achieve independence, meet their families’ needs, and move out of poverty. According to the Utah Foundation, public revenues in Utah are at a multi-decade low due to tax cuts enacted over the past decade. The 2016 Legislature failed to pass legislation that would have restored revenues. Instead, the 2016 Legislature focused its attention on several tax cutting measures, passing HB 61 to reduce corporate income taxes by about $3 million annually and coming close to passing HB 180 to expand a business sales tax exemption by $83 million annually.

Even as legislators give serious consideration to tax cuts that reduce funds available for education, health care, and initiatives that help families work their way out of poverty, the practice of earmarking – permanently diverting General Fund revenues to the Transportation Fund to avoid allowing transportation revenue sources like the gas tax to keep up with inflation – continues nearly unabated. Even though the Legislature’s own Tax Review Commission recommended eliminating almost all existing earmarks, the only proposal that passed this year was a compromise bill that restores about 4% of earmarks to the General Fund, while at the same time more deeply entrenching the earmarking phenomenon by redirecting transportation earmarks for water infrastructure instead.

Missed Opportunities to Help Utah Families Work Their Way Out of Poverty

Despite continued advocacy, there was no legislation in the 2016 session for a state-level Earned Income Tax Credit (EITC). The EITC is a policy proven to help millions of U.S. working families stay out of poverty. National data show that the EITC can help mitigate racial and ethnic disparities; almost half of all EITC-eligible households were headed by racial or ethnic minorities. Endnote 10 Families of color are more likely to be eligible for, and greatly benefit from, the EITC. A state-level tax credit for working families in Utah would keep even more families out of poverty.

Paid leave was yet another missed opportunity to help families stay out of poverty. Many families do not have access to unpaid leave, and many who do have access are unable to afford it. The 2016 Legislature considered HB 188, which would have provided paid family leave for eligible executive branch agency employees. Families in the executive branch, which includes state divisions, departments and higher education systems, would be able to take leave, without losing pay. The topic will be further studied by the Legislature during the 2016 Interim.

Paid leave was yet another missed opportunity to help families stay out of poverty. Many families do not have access to unpaid leave, and many who do have access are unable to afford it. The 2016 Legislature considered HB 188, which would have provided paid family leave for eligible executive branch agency employees. Families in the executive branch, which includes state divisions, departments and higher education systems, would be able to take leave, without losing pay. The topic will be further studied by the Legislature during the 2016 Interim.

White, non-Hispanic parents in Utah are more likely to be eligible and financially able to take unpaid leave than other families. Discrepancies in family leave policies take the greatest toll on foreign-born parents of color: 20% of Hispanic foreign-born parents are both eligible and can afford unpaid leave, compared to 31% of White foreign-born parents. Among U.S.-born parents, 33% of Hispanic parents and 37% of White parents can afford to take unpaid leave. Endnote 11 Parents who are ineligible or cannot afford leave are at risk of losing pay--or their job-- when they stay home to care for their child.

Health

Expanded Opportunities for Children’s Coverage

Utah has the highest rate of uninsured Hispanic children in the nation. Utah’s uninsured rate for Hispanic children is nearly two and a half times the national rate; it is higher than the rate in every other state and the District of Columbia. Children’s health coverage is the critical foundation for all children to get the care they need to achieve optimal health.

The 2016 Legislature removed the 5-year waiting period for legal immigrant children to receive CHIP or Medicaid. Appropriations bill HB 2 included intent language directing the Department of Health to enroll children as soon as they qualify. Previously, legal immigrant children were subject to a waiting period before they could receive CHIP or Medicaid. Eligible children include legal permanent residents and some additional immigration categories, although undocumented children are not included. The policy change will mean hundreds of children can get coverage. Five years is too long for children to wait.

In addition, the 2016 Legislature allocated $25,000 in one-time outreach funding to help enroll more children in CHIP or Medicaid. The Department of Health’s outreach budget was eliminated in 2010. The funding, allocated to the Department of Health, will be matched by federal dollars to total $50,000 and can be used to reach more Hispanic children.

The Legislature also directed the Department of Health to examine barriers to children’s coverage, including ‘churn’ or a frequent pattern of disenrollment and then re-enrollment from Medicaid. Children may lose Medicaid coverage because of fluctuations in their family’s income. Hispanic children are more likely to experience churn because of a change in their family’s temporary income status. At least 31% of Hispanic children have parents who lack year-round employment, compared to 18% of White children. The Department of Health’s study on churn could help reduce disruptions in children’s coverage and care.

Missed Opportunities: Expanding Coverage for All Parents

The 2016 Utah Legislature took first steps to cover more Utahns caught in the insurance coverage gap. HB 437 changed Medicaid eligibility to cover an estimated 4,000 additional parents, effectively raising the eligibility ceiling for parents with children up to 60% of the Federal Poverty Level. Unfortunately, the Legislature rejected more comprehensive bills that would fully close the coverage gap. As a result, thousands of working parents are still left without health insurance. Over one-quarter of the parents who would benefit from a full Medicaid expansion plan are Hispanic. When parents have insurance they are better able to care for their children. In addition, when parents have coverage, they bring their children along; enrollment numbers for children go up when parents have health coverage. Coverage for parents helps the whole family.

Recommendations Going Forward

Different communities may need different resources

to achieve similar outcomes.

The 2016 Legislative Session expanded opportunities for some children, but there were also many missed opportunities to improve the lives of children from all racial and ethnic backgrounds. These initial steps, while important, still leave much work ahead. Endnote 12

Across every issue area reviewed, we found significant social, economic, and health disparities affecting children of color. Utah laws and policies do not adequately address the growing diversity of our state. The face of Utah’s most vulnerable is changing. We need laws that embrace our diverse future.

This report is both a reflection of our own advocacy practices, as well as a call to action for lawmakers.

As advocates, we have a responsibility to integrate a lens of racial and ethnic equity into our own work and build coalitions that will strengthen opportunities for all families.

Together with community partners, we hope to contribute to a growing dialogue about racial and ethnic equity in the coming year and to advance policies that can help reduce disparities.

Our lawmakers also have a responsibility to create a more equitable Utah. To secure a future that is safe and healthy for all children, we call on our Legislature, Governor and State Agencies to:

- Work with coalitions and affected communities.

Ensure that those most affected are actively involved in developing policies. To create sustainable solutions, families from all communities must be consulted, engaged and able to meaningfully participate in the policy process. - Collect, disaggregate and disseminate data by race and ethnicity.

Our policymakers need access to the best data and analyses. Too often population measures of children’s well-being are not disaggregated by race or ethnicity. Several state-level initiatives have already begun to make progress in this area. We need to expand these efforts so we can track progress and find solutions. Without disaggregated data, we have an incomplete picture of the needs and outcomes affecting all Utah children. - Review the racial and ethnic impact of public policies.

Our lawmakers and policymakers should review the impact of proposed policies on different racial and ethnic groups. Racial and ethnic impact assessment tools can highlight which groups benefit, and under what conditions. These targeted measures can correct disparities and help our legislators make informed decisions for all communities in Utah.

Printer-friendly version:

![]() Racial and Ethnic Equity for Children in Utah: What We Learned from the 2016 Legislative Session

Racial and Ethnic Equity for Children in Utah: What We Learned from the 2016 Legislative Session

1. Unless otherwise noted, data and indicators are from the national Kids Count Data Center: http://datacenter.kidscount.org/data#UT/2/0/char/0

2. Arkansas Advocates for Children and Families. (2015) “Missing the Mark: Race Equity and Missed Opportunity in the 2015 Session. Research Brief July 2015. Available at: http://www.aradvocates.org/publications/missing-the-mark-race-equity-and-missed-opportunities-in-the-2015-session/

3. DiversityDataKids.org. “What is Research Evidence and Why Does It Matter for Equity?” The Heller School for Social Policy and Management at Brandeis University. Available at: http://www.diversitydatakids.org/files/Policy/Head%20Start/Research%20Evidence/What%20is%20Research%20Evidence.pdf

4. Voices for Utah Children focused on these major issue areas during the 2016 Legislative Session. This report does not represent a comprehensive review of all legislation.

5. Heckman, J. J. (2011) "The American Family in Black & White: A Post-Racial Strategy for Improving Skills to Promote Equality." Daedalus, 140(2), 70-89.

6. Magnuson, K. A., & Duncan, G. J. (2005) "Can Family Socioeconomic Resources Account for Racial and Ethnic Test Score Gaps?" The future of children, 15(1), 35-54.

7. Utah Foundation. (2015) “Lessons From Our Neighbor: Learning From Colorado’s Educational Success.” Research Report 731, July 2015. Available at: http://www.utahfoundation.org/uploads/rr731.pdf

8. Utah Department of Workforce Services. (2015) “Fourth Annual Report on Intergenerational Poverty, Welfare Dependency and the Use of Public Assistance.” Utah Intergenerational Welfare Reform Commission Annual Report. Available at: https://jobs.utah.gov/edo/intergenerational/igp15.pdf

9. University of Utah S. J. Quinney College of Law. (2014) “From Fingerpaints to Fingerprints: The School-to-Prison Pipeline in Utah.” Public Policy Clinic Report. Available at: https://www.law.utah.edu/news/from-fingerpaint-to-fingerprints-the-school-to-prison-pipeline-in-utah/

10. Holt, Steve. (2006) “The Earned Income Tax Credit at 30: What We Know.” Research Brief February 2006. Washington DC: The Brookings Institution Metropolitan Policy Program. Available at: http://www.brookings.edu/research/reports/2006/02/childrenfamilies-holt

11. DiversityDataKids.org. (2014) “Working Parents Who Are Eligible For and Can Afford FMLA Unpaid Leave.” Utah Map. Available at: http://www.diversitydatakids.org/data/map/510/working-parents-who-are-eligible-for-and-can-afford-fmla-unpaid-leave-share/#loct=2&cat=28,24&tf=17

12. The following were references and models for this report: Arkansas Advocates for Children and Families. “Missing the Mark: Race Equity and Missed Opportunity in the 2015 Session.” Available at: http://www.aradvocates.org/publications/missing-the-mark-race-equity-and-missed-opportunities-in-the-2015-session/; “Facing Race: The 2015 Oregon Racial Equity Legislative Report.” Available at: https://facingraceoregondotorg.files.wordpress.com/2016/01/2015facingraceweb.pdf; “Strong Families New Mexico 2015 Legislative Report Card.” Available at: http://strongfamiliesmovement.org/nm-reportcard

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express for sponsoring our 30th Anniversary Year.

2016 Utah Legislative Session

The 2016 Utah Legislative Session is underway January 25-March 10. Learn more about issues affecting children that will be addressed during this session:

Tax and Budget Issues

Creating a State Earned Income Tax Credit (EITC)

Health Issues

Restore Funds for CHIP and Medicaid Outreach

12-month Continuous Eligibility

Education Issues

Optional Extended Day Kindergarten

Bills

News Contact Lawmakers Sign Up for E-Alerts

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express for sponsoring our 30th Anniversary Year.

The Earned Income Tax Credit is a federal tax credit for low- and moderate income families that encourages and rewards work. The credit was created in 1975 under President Ford. Because of its remarkable ability to reduce poverty and promote family health and self-sufficiency, it has been expanded since then by President Reagan and all subsequent presidents.

For parents, the EITC’s empirically demonstrated effects include:

For parents, the EITC’s empirically demonstrated effects include:State EITCs Offset Regressive Effects of Income, Sales and Property Taxes

Twenty-four states have created state EITCs to supplement and enhance the impact of the federal program. State EITCs work similarly to and leverage the federal EITC. States rely

Twenty-four states have created state EITCs to supplement and enhance the impact of the federal program. State EITCs work similarly to and leverage the federal EITC. States relyAn Innovative Proposal: Using a State EITC to Promote College Savings and Incent Post-Secondary Education in Utah

An innovative proposal under discussion for Utah combines two key elements proven to reduce intergenerational poverty:

An innovative proposal under discussion for Utah combines two key elements proven to reduce intergenerational poverty:

The EITC Has Bipartisan Support

Federal EITC Facts for Utah

Read other issues briefs about two-generation strategies here.

Voices for Utah Children is proud to be a part of the Aspen Institute Ascend Network. The goal of the Aspen Institute Ascend Network is to mobilize empowered two-generation organizations and leaders to influence policy and practice changes that increase economic security, educational success, social capital, and health and well-being for children, parents, and their families. Learn more at http:/ /ascend.aspeninstitute.org/network

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities.

How can you be involved?

Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to Network events with food, socializing, and opportunity to meet child advocacy experts. And don't forget to join our listserv to stay informed!

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express for sponsoring our 30th Anniversary Year.

The 2015 Children's Budget Report: Adding Up Our Commitment to Kids

Why a “Children’s Budget”?

Children, it is often said, are Utah’s most precious resource. They represent the workforce, consumers, and leaders of tomorrow. For that reason, the investments we make in our children today have enormous economic and social implications for Utah’s future. That is why our federal, state, and local units of government pool taxpayers’ resources to establish an education system, provide for the health and other basic needs of our most vulnerable children, and intervene in children’s lives when their safety is at risk.

This report, Children’s Budget 2015, examines public investment in children from FY2008 through FY2014. It is an update of earlier reports by Voices for Utah Children published in 2009 and 2011. This report does not assess the effectiveness of these programs or gaps in services. Rather, it objectively quantifies the level of public funding for children in Utah and identifies trends over the seven-year period.

There is a strong case to be made that no one cares more about kids than Utahns. Utah has the highest fertility rate in the country and the most children as a percentage of its population, 31% vs. 24% for the nation . Utah saw the second fastest growth rate in its child population of any state from 2000 to 2010 , second only to Nevada (which grows mostly by in-migration rather than through births). Given the high priority Utahns place on children, understanding how much is spent on children by the state and for what purposes is critically important for policymakers and the general public.

Information on funding for children is important for several reasons. It can:

1. Assist policymakers in assessing whether their funding decisions reflect, in the aggregate, their priorities with respect to children.

2. Illustrate how specific programs compare with spending on children overall.

3. Aid policymakers in examining how much is spent on children for specific purposes (i.e. for early education or child welfare) or how funding for children compares to total state and federal spending in the state.

Examining how much Utah invests in children can help the state evaluate how efficiently it is enhancing the potential of our future workforce and maximizing our investment in human capital and economic development. Public investment in children in Utah should be understood as an important component of our economic development strategy that impacts the state as a whole, both in the present and the future.

In this report, Voices for Utah Children divides all state programs concerning children into seven categories, without regard to their location within the structure of state government. The seven categories are as follows, in descending order by dollar value (based on the sums of both state and federal funds):

• Education, which makes up 90% of the state-funded portion of the Children’s Budget and 77% overall counting both state and federal funds

• Health

• Food and Nutrition

• Early Childhood Education

• Child Welfare

• Juvenile Justice

• Income Support

We then add up the expenditures in each of these areas, separating state from federal dollars, and we compare the figures over time from FY2008, the last year before the state budget began to be affected by the Great Recession, through FY2014, the most recent year for which final expenditure data was available.

Our most important finding is the following:

While the state economy has recovered from the Great Recession in a number of respects, state investment in children has not. Specifically, real (inflation-adjusted) state investment in children in FY2014 remained 6% below what it had been in FY2008, at $5,424 per child in FY2014, compared to $5,746 in FY2008.

Making up that $322 per-child gap between the FY2008 level of public investment in children and the level in FY2014 would have required an additional state expenditure in FY2014 of approximately $293 million.

This finding that state government investment in children has not yet recovered from the recession is not the only example of how Utah still remains below its pre-recession performance, even five years after the recession ended. For example, real median wages also remain below pre-recession levels and poverty rates have remained elevated well above where they were at the same point in previous economic expansions.

For more information, see the complete report:

Utah Children's Budget Report 2015

For 30 years now, Voices for Utah Children has called on our state, federal and local leaders to put children’s needs first. But the work is not done. The children of 30 years ago now have children of their own. Too many of these children are growing up in poverty, without access to healthcare or quality educational opportunities. How can you be involved?

- Celebrate the 30th Anniversary of Voices for Utah Children with us at our Children’s Champion Award Luncheon on September 30, 2015.

- Make a tax-deductible donation to Voices for Utah Children—or join our Network with a monthly donation of $20 or more. Network membership includes complimentary admission to the luncheon.

We look forward to the future of Voices for Utah Children and we hope you will be a part of our next 30 years.

Special thanks to American Express for sponsoring our 30th Anniversary Year.

A Federal Balanced Budget Amendment Would Result in Funding Cuts for Children's Programs

HJR7 is a resolution under consideration by the Utah Legislature that would call for a federal Constitutional Convention to consider a balanced budget amendment. It may sound like it's simply sending a message about Utah's support for dealing with the federal debt, but in fact it goes quite a bit further than that. By calling for an unprecedented Article V constitutional convention, HJR7 would make Utah the 26th state of the 34 required to convene a federal constitutional convention, which could end up passing far-reaching changes to the U.S. Constitution on any number of issues. Moreover, a federal balanced budget amendment would likely lead to sudden severe cuts in federal, state, and local budgets, inevitably affecting children first and foremost, particularly lower-income children.

HJR7 is a resolution under consideration by the Utah Legislature that would call for a federal Constitutional Convention to consider a balanced budget amendment. It may sound like it's simply sending a message about Utah's support for dealing with the federal debt, but in fact it goes quite a bit further than that. By calling for an unprecedented Article V constitutional convention, HJR7 would make Utah the 26th state of the 34 required to convene a federal constitutional convention, which could end up passing far-reaching changes to the U.S. Constitution on any number of issues. Moreover, a federal balanced budget amendment would likely lead to sudden severe cuts in federal, state, and local budgets, inevitably affecting children first and foremost, particularly lower-income children.

More Information

What’s Wrong with Calling for a Constitutional Convention to Enact a Balanced Budget Amendment?

Contact Lawmakers

Utah Jobs: Quantity vs. Quality

Evaluating the performance of Utah’s economy from the perspective of Utah’s families and children is a matter of examining both the quantity and quality of jobs created since the state’s Great Recession employment trough in January 2010.

The principal findings of the report are as follows:

QUANTITY OF JOBS:

Controlling for differences in population growth rates, Utah’s rate of job creation in the recovery has lagged slightly behind that of the nation as a whole. Utah’s jobs-to-population ratio has fallen from 48.2% in 2007 to 45.2% in 2014, a steeper decline than that of the national economy. Utah’s ratio of new-jobs-to-new-population during 2011-2014 was 88% (148,958 new jobs compared to 168,556 new population during those four years), while for the nation as a whole, for the nation as a whole, the ratio was 92% (8,766,917 new jobs compared to 9,509,999 new population).

QUALITY OF JOBS:

Utah wages have recovered from the Great Recession more quickly than the nation as a whole but remain below pre-recession levels. Averaged across all occupations, the real (inflation-adjusted) median wage in Utah was 2.7% lower in 2013 than it was in 2009, the peak year for wages. At the national level, things are even worse, with wages down by 3.4%.

Utah wages have recovered from the Great Recession more quickly than the nation as a whole but remain below pre-recession levels. Averaged across all occupations, the real (inflation-adjusted) median wage in Utah was 2.7% lower in 2013 than it was in 2009, the peak year for wages. At the national level, things are even worse, with wages down by 3.4%.

Wage inequality has grown in Utah. In both Utah and nationally, lower-wage occupations saw significantly larger declines in their real median wages than did mid-wage and higher-wage occupations, comparing 2009 to 2013. Occupations in the top three quintiles saw their median wages decline by about 1-1.5%. By contrast, occupations in the bottom two quintiles saw their median wages decline by 4-6%, and by more in Utah than nationally. This finding is consistent with the persistently elevated poverty rates that Utah has experienced since the recession ended.

New jobs in Utah pay much less than the ones they replaced. Jobs lost from 2008 Q1 to 2010 Q1 had an average wage of $53,277 while jobs gained from 2010 Q2 to 2014 Q2 had an average wage of $41,342, a decline of about 22%. This is largely due to the fact that higher-wage construction and manufacturing sectors saw significant job losses during the recession, while the fastest growing job sectors since then have included lower paying industries such as health care and retail trade.

Encouraging news on full-time/part-time: The share of the labor force working part time has dropped from a post-recession peak of 26% in 2012 to about 21% in 2014, which is below pre-recession levels. Involuntary part time levels, though, are still slightly higher than pre-recession levels at roughly 3% last year.

Productivity up, but wages down: Along with the nation as a whole, Utah is experiencing a troubling gap between productivity growth and wage growth. While the real median wage in Utah remains below its pre-recession peak, Utah saw 2.5% annual growth in private sector productivity over the time period 2009-2012.

OVERALL ECONOMIC OUTPUT

Recovery in overall economic output per capita in Utah remained behind the national recovery as of the end of 2013, the last year for which this data is available. Per capita real GDP peaked in Utah at $45,652 in 2007 and reached $45,165 in 2013, while for the nation as a whole, the comparable figures are $49,213 in 2007 and $49,115 in 2013. Thus, in 2013, the US was at 99.8% of the pre-recession level, while Utah was at 98.9%. Utah ranked 35th among the states by this measure of economic recovery.

View the complete report:

Using Pay for Success to Finance Nurse Home Visiting

Pre-term and low birthweight infants face significant risks for medical and developmental disabilities which are expensive to government and private entities throughout a child’s life. Nurse home visiting, in which nurses and peer counselors provide support and education to high-risk pregnant women in their homes, have had excellent results over the past 30 years in preventing poor birth and long-term outcomes. Such programs that could significantly reduce state expenditures.

Pre-term and low birthweight infants face significant risks for medical and developmental disabilities which are expensive to government and private entities throughout a child’s life. Nurse home visiting, in which nurses and peer counselors provide support and education to high-risk pregnant women in their homes, have had excellent results over the past 30 years in preventing poor birth and long-term outcomes. Such programs that could significantly reduce state expenditures.

This paper, co-authored by Voices for Utah Children Early Childhood and Education Senior Policy Analyst Janis Dubno, explains how Pay for Success (PFS) finance could be used to pay for expanding nurse visiting programs. PFS finance involves a partnership between philanthropic and business entities (organizers and investors) and governments to provide performance-based investments in social programs, with payments made to the investors from cost avoidance savings that governments enjoy as a result of the program, or because the program meets certain prespecified outcome improvements. The key idea in a PFS project is that private investors (the managed care organization and/or senior and subordinated lenders) are repaid only from success payments, amounting usually to 80% to 90% of total cost avoidance savings.

This is the latest in a series of ReadyNation papers on using Pay for Success (PFS) social impact finance to improve early child health and education outcomes. This paper focuses on using PFS finance to scale-up effective early health interventions. PFS is a new financial and contracting arrangement that increases investment in evidence-based programs resulting in measurable social outcomes. Savings from these outcomes can repay investors and fund continued services. ReadyNation is leading a project to provide technical assistance to state and city teams developing PFS contracts. See www.ReadyNation.org/PFS.

For more information, read the complete paper:

Early Health “Pay for Success” Social Impact Finance: Scaling Up Prenatal Health Care in Virginia

Janis A. Dubno MBA, Robert H. Dugger PhD, Debra L. Gordon MS, David Levin MD, and Philip A. Peterson FSA

Nurse Family Partnership

Nurse Family Partnership (NFP) is a voluntary evidenced-based community health program that provides ongoing home visits (from pregnancy through age 2 of the child) from a registered nurse to low-income, first time mothers to provide the care and support they need to have a healthy pregnancy, be a responsible and caring parent, and to become more economically self-sufficient. A nurse visits the women approximately weekly and bi-monthly during their pregnancy and after birth, and then monthly visits during the first two years of their children’s lives. The program is a two-generation intervention and improves outcomes for both the mother and the child. NFP produces very strong outcomes for very high risk, low-income populations.

Economic analyses performed by the Washington State Institute for Public Policy, the Brookings Institute and the Rand Corporation determined that NFP provides a return on investment for taxpayers of $2.37 to $5.70 (high-risk population) per $1 invested in the program.

Download the printer-friendly report:

Nurse Family Partnership

Proven Outcomes

National outcomes associated with NFP, verified through independently evaluated randomized controlled trials, include long term family improvements in health, child welfare, education and self-sufficiency. When brought to scale, NFP can achieve:

• 23% reduction in smoking during pregnancy

• 26% reduction in pregnancy-induced hypertension

• 18% reduction in first pre-term births

• 58% reduction in infant deaths

• 30% reduction in second teen births

• 37% reduction in childhood injuries treated in emergency departments up to age 2

• 30% reduction in child maltreatment

• 38% reduction in language delay of the child by age 2

• 45% reduction in crimes and arrests, ages 11-17

• 51% reduction in alcohol, tobacco and marijuana use, ages 12-15

• 15% reduction in TANF and Food Stamp payments

• 9% reduction in Medicaid costs through age 1

Locally, Salt Lake County has a small NFP program. In 2012, 10.68% of the comparable Medicaid clients had a preterm delivery, compared to 7.5% of NFP clients, a reduction in incidence of 30%. Preterm babies require expensive medical services and a 30% reduction in incidence results in significant cost savings to Medicaid. In addition, the following outcomes for the mother have been documented in Salt Lake County:

• 52.5% increase in employment of clients younger than 18 after starting the program

• 18.9% increase in employment of clients 18 and older after starting the program

• 40% decrease in maternal smoking

• 50% reduction in reported incidence of domestic violence during pregnancy

Government Cost Savings and Avoidance

The outcomes listed above produce significant cost savings in Medicaid, Criminal Justice, Child Welfare, Food Stamps and TANF. Based on national data, Medicaid is the largest recipient of cost savings per family served (55% of cost savings accrue to Medicaid).

Nurse Family Partnership in Utah

The Office of Home Visiting in the Utah Department of Health received $1,097,713 in federal funding through the Maternal, Infant and Early Childhood Home Visiting (MIECHV) Program for Fiscal Year 2013. Of that, $300,000 was allocated to Nurse Family Partnership to serve 75 families in Salt Lake County (the remaining $700,000 was allocated to Parents as Teachers (PAT) - a home-visiting school readiness program). The average cost per family per year for NFP is $4,000. In 2012 (the most recent data available), 4,867 mothers were eligible for NFP statewide. Based on this, an investment of $19,468,000 would be necessary to serve all eligible families.

Recommendation

Voices for Utah Children recommends an ongoing state appropriation of $2,000,000 per year for Nurse Family Partnership, to serve 500 high risk, low-income first time mother statewide. To date, 21 states have appropriated state funds for NFP and/or home visitation.

More Information

What's Still Eating Utah's General Fund?

How Unfunded Earmarks Are Undermining the Budget Process and Affecting Utah Families and Children

This explosion of earmarks has been primarily for the purpose of meeting the state’s transportation needs. The earmarks in question are all “unfunded” earmarks, meaning that none of them was created with a new revenue source to finance it, even though they address newly identified investments required to keep up with the state’s growing economy and population.

This enormous diversion of resources has meant that everything else financed by the General Fund, including education, public safety, drug treatment, aid for the disabled, support for vulnerable families, and many more, has been given short shrift, leaving critical needs unmet and allowing the state to fall behind in a number of important areas, threatening to undermine progress toward the state’s most important goals.

The rise of unfunded earmarks bears considerable resemblance to the decision made by an earlier generation of policy makers in 1996 to divert Education Fund revenues to fund higher education as well as K-12 education.

The report concludes with a call for a return to best practices in the annual budgeting process so as to allow policymakers to adapt to changing circumstances in good times and bad. Read the complete report:

What's Still Eating Utah's General Fund?

What Does the General Fund Do?

All Utahns benefit from an adequate General Fund. The state programs it pays for provide functional and efficient courts, a statewide system of colleges and universities, and the enforcement of rules regarding commercial transactions, environmental protection, water safety, control of contagious diseases, and much more. The GF also provides a safety net for families in need, including the disabled and those in need of drug treatment and mental health services.

The Economics of the Healthy Utah Plan: A Preliminary Analysis

This economic analysis of the Healthy Utah Plan was funded by Voices for Utah Children and completed by Sven E. Wilson, PhD. The Healthy Utah plan is the governor's proposal to use Medicaid expansion funds to provide health insurance to people who are currently not covered by Medicaid and who do not earn enough to qualify for subsidies.

The report offered the following conclusions and recommendations:

There is a lot of uncertainty related to the Healthy Utah plan. Usually the presence of uncertainty argues for exercising caution. Shouldn’t the state exercise caution in moving forward on bold, new plans?

Yes. But caution does not mean inaction. The costs to inaction in this case are millions of dollars in foregone benefits to state residents with each passing week. Those losses are certain, and they are not coming back.

The ACA is drastically re‐shaping American health care. Most Utahns, according to opinion polls, believe these changes are not for the better. But the state has no power to undo the ACA or to ignore its requirements or the taxes associated with it.

What the state does have the power to do is reclaim part of the funds that state residents are already contributing to fund the ACA. The Healthy Utah plan may or may not be the ideal option to make that happen, but it clearly brings hundreds of millions of dollars into the state to help low‐income residents who have no other means of obtaining health insurance. It does so at minimal risk to state budgets and at considerable gain to the state economy.

The economic case for moving forward with Healthy Utah at this time is compelling. Policymakers can move forward with confidence—even with the uncertainty that faces us.

Download the complete report here:

The Economics of the Healthy Utah Plan: A Preliminary Analysis