Tax and Budget

A Rough Legislative Session for Utah Kids (Again)

The 2024 Utah Legislative Session ended at midnight on Friday, March 1. For the Voices for Utah Children team, this session included supporting a lot of community engagement, working hard to protect the programs that protect Utah kids, and trying not to get distracted by outlandish efforts to "solve" problems that don't actually exist in Utah.

As usual, there were many, many missed opportunities for state leaders to improve the lives of Utah kids. Nonetheless, we managed to pull off some great victories - as always, in partnership with many supportive community members, our great partner organizations and supportive public servants.

We hosted six different public engagement events at the Capitol over seven weeks. Working closely with our community partners, we stopped some truly terrible legislation that literally threatened the lives of Utah kids who rely on Medicaid and CHIP. Thanks to many supportive child care professionals and working parents, we kept Utah's child care crisis in the media spotlight throughout the session.

For a deeper dive into our efforts in various policy areas, as well as a recap of what happened to the many different bills we were tracking, check out the virtual booklet below!

Voices Opposes Legislative Efforts to Suppress Public Ballot Initiatives

Our organization recognizes the importance of standing against policies that jeopardize the well-being of Utah’s children. We believe that regular community members have the right and responsibility to influence decisions about policies that affect their lives.

The ability of everyday Utahns to influence public policy directly, through ballot initiatives, should be part of our state’s democratic process. However, the state legislature for years has passed laws that make it more difficult for members of the public to pose questions to their fellow voters statewide, by conducting ballot initiatives.

This year, the campaign to suppress public ballot initiatives takes the form of two complementary bills, both sponsored by Rep. Jason Kyle (R-Huntsville). HJR14, “Proposal to Amend Utah Constitution - Statewide Initiatives,” would amend our state constitution so that a simple majority of Utah voters can no longer approve new or expanded funding streams for state programs. The bill increases the threshold for a winning ballot initiative from 50% to 60%, when the ballot initiative seeks to increase revenue for state programs through a new tax or by expanding an existing tax. HB284, “Initiative Amendments,” would require a ballot initiative that increases taxes to specify where the money will come from to pay for the tax increase.

Ballot Initiatives in Utah Are Already Nearly Impossible

Utah is already one of the most difficult states in which to conduct a public ballot initiative. Whether the ballot initiative reflects the desires of Utahns to revert to our old state flag, or to expand Medicaid coverage to more people in need, organizers face high barriers before the voting public can weigh in.

For example. Utah law currently requires ballot initiative organizers to collect a total of 134,298 signatures, and they must meet specific signature thresholds in at least 26 out of 29 Senate districts. (between about 3,000 and 5,600 handwritten signatures per district, depending on the Senate district).

Even when organizers manage to clear all the hurdles to get a public ballot initiative before Utah voters, the Legislature has shown that it feels no obligation to respect voters’ desires. Ballot initiatives to legalize medical cannabis, expand Medicaid coverage to more Utahsn, and to create an independent redistricting commission (to push back on legislative gerrymandering) all successfully passed in 2018. The legislature walked back all of these efforts, either completely undoing, or mangling the implementation of, each successful initiative.

Why Voices Opposes HJR14 & HB284

Decisions made at the state level regarding investments in education, healthcare, childcare, and other essential services have profound consequences for future generations. By adding yet more hurdles for members of the public seeking to impact state laws, HJR14 and HB284 risk undermining the public’s constitutional right to directly petition their government.

If HJR14 is approved, the proposed amendment will appear on voter ballots this November. Utah voters will be able to decide whether to limit their own access to this incredibly important tool for democratic influence over public policies that affect us all.

Voices for Utah Children opposes the passage of HJR14 and HB284, recognizing the importance of preserving Utahns’ right to safeguard the interests of its children through ballot initiatives. This is particularly important now, as the legislature increasingly ignores public comment, public outcry and public sentiment when introducing and passing their bills.

Your voice matters! You can participate in the democratic process right now by weighing in on these bills, either by providing a public comment during the committee hearings or by writing your legislator to express your objections.

VIEW OUR LEGISLATIVE TRACKER TO LEARN MORE!

FAQs on HB 153: Child Care Revisions

Representative Susan Pulsipher’s HB 153: Child Care Revisions narrowly passed the Utah State Legislature on February 28, 2024, and was signed by the Governor on March 14, 2024.

Initially proposed as a child tax credit expansion initiative, HB 153 has evolved into a more complex bill with significant implications. This FAQ aims to address questions about the passed bill and explain its key components.

What does HB 153 do?

There are three main components to this bill:

- Child Tax Credit Expansion: HB 153 expands Utah’s child tax credit to include 4-year-olds. Currently, children aged 1-3 are eligible if their family meets certain income criteria and has a tax liability. This expansion will make the credit available to 0.4% more families, benefiting 1.1% more children, with an average annual tax savings of $456 per eligible family.

- Unlicensed Provider Capacity Expansion: HB 153 increases the cap on the number of unrelated children an unlicensed provider can care for from 6 to 8 (current law remains at 10 children cap if also caring for related children). With this change, Utah now ranks as the second-worst state nationally in unregulated care capacity, trailing only South Dakota.

- New Unlicensed Provider Oversight: In response to concerns from the child care community, HB 153 introduces new requirements for unlicensed providers. They must now undergo criminal background checks through the Office of Child Care Licensing. Additionally, a new stipulation limits the number of children under 3 years old being cared for to 2. Previously, unlicensed providers operated without formal oversight or state requirements.

When will this go into effect?

Each component of the bill will go into effect at a different time:

- Child Tax Credit Expansion: Initially introduced under HB 170 in 2023, the Child Tax Credit, applicable to children aged 1-3, cannot be claimed until families file their 2024 taxes, in 2025. For families with eligible 4-year-olds, the credit won't be claimable until they file their 2025 taxes, in 2026.

- Unlicensed Provider Capacity Expansion: Starting May 1, 2024, unlicensed providers will be permitted to care for up to 8 unrelated children.

- New Unlicensed Provider Oversight: Background check requirements and restrictions on the number of children under the age of 3 in care will take effect on July 1, 2024.

How will this new oversight of unlicensed providers function under HB 153?

The Office of Child Care Licensing (OCCL) within the Department of Health and Human Services already oversees residential child care licenses, which are required for providers caring for 9 or more children. OCCL also oversees the Residential Certificate program which is currently required for providers caring for 7-8 children. HB 153 now makes Residential Certification optional.

Additionally, HB 153 essentially adds a new layer of regulated care, mandating background checks for providers caring for under 8 children who do not hold a license or certificate. Current law does not require background checks for anyone caring for under 6 children. HB 153 mandates the same level of background checks as licensed child care providers, covering all staff, volunteers, and individuals older than 12 residing in the residence.

The process and enforcement mechanisms are still unclear. The bill directs the Department of Health and Human Services to establish rules for criminal background check submission. Similar requirements exist in Idaho, but enforcement is limited to instances where an unlicensed program is reported to the state.

Stay tuned for further guidance from the Office of Child Care Licensing regarding this process.

Will this increase access to child care? Will it decrease the cost of child care?

The answer is uncertain. While the state has previously expanded unlicensed child care capacity, the lack of tracking of unlicensed child care makes it impossible to gauge effectiveness.

Regulations are often blamed for high child care costs and limited availability, but studies show no direct correlation between state regulations and child care supply levels. Utah's Office of Child Care Licensing continuously strives to make licensing as easy to obtain as possible without compromising quality and safety standards.

There's no evidence to suggest this change will alleviate the child care crisis. In fact, experts predict it may decrease available child care by incentivizing programs to downsize and forego licenses.

Is this licensing change safe?

Just as there are undoubtedly reputable unlicensed providers, incidents can occur in licensed facilities as well. However, licensed providers benefit from established systems for monitoring and support, facilitating continuous improvement. The challenge with unlicensed providers lies in the lack of oversight—without clear regulations, identifying potential risks becomes difficult.

Unfortunately, the impact of unlicensed child care expansion often goes unrecognized until horrible things happen and it's too late. Without state oversight, it’s important for parents to learn about the differences between licensed and unlicensed child care. Below is a comparison chart outlining key distinctions, but we encourage parents to leverage OCCL's resources for informed decision-making.

| Residential Certificate Child Care Provider | Unlicensed Child Care Provider Under HB 153 | |

| Background checks required for all child care staff, volunteers, and household members 12+ | X | X (if enforced) |

| Inspections of facility for safety | X | |

| 2.5 hours of preservice training* | X | |

| 10 hours of annual training* | X | |

| Always requires at least one caregiver present to hold current pediatric first aid and CPR certification | X | |

| Public access to rule violations available to parents | X | |

| Verified local business license, health department clearance, and fire clearance (when required by city) | X | |

| Must carry liability insurance or disclose lack thereof in writing to parents | X | |

| Requires quality equipment, materials, and play areas that are safe, clean, adequate in size | X | |

| Verified safe caregiver-to-child ratios | X | |

| Requires that no provider use corporal punishment or emotional abuse to discipline a child | X | |

| Requires staff to mandatorily report any instance of suspected child abuse or neglect | X |

* Training covers CPR, First Aid, home safety, emergency prevention, shaken baby syndrome prevention, sudden infant death syndrome prevention, care for children with disabilities, infectious disease control, child development, homelessness detection, and child abuse awareness.

This FAQ will be regularly updated with new questions and any developments from the Office of Child Care Licensing. If you have additional questions, please don't hesitate to reach out to Jenna at .

The Governor’s 2024 Budget: Hits and Misses for Utah Families

Governor Cox unveiled his budget last week, and the general direction of the budget is positive. Voices for Utah Children is interested in some specific components of the budget that directly impact Utah children and their families:

Public Education

$854 million increase, including a 5% jump in per-pupil funding and $55 million for rural schools

This is a much-needed investment in public education. We support the focus on rural schools and are anxious to see the details as they emerge. Public education consistently polls as a top priority for Utahns of all political parties and backgrounds.

Support for Utah Families

$4.7 million to expand Utah’s child tax credit and $5 million for accessible child care

We appreciate the fact that the Governor has begun to address the urgent needs of Utah families with young children. However, both allocations fall far short of the amount required to truly support and elevate these young families’ current needs. A truly impactful child tax credit would require an investment of at least $130 million, and the benefits in reducing child poverty in Utah would be substantial. Our recent report on child care in Utah clearly illustrates the need for bold action to support families in the workforce, who are struggling with the cost and unavailability of child care. The Governor’s $5M project will help very few Utah families and does not address the true need.

Housing

$128 million for homeless shelters and $30 million for deeply affordable housing

We support the Governor in his effort to better support the homeless residents of our state. We encourage a greater focus on expanding support for homeless children specifically. Early care and education opportunities for young children as well as more supportive programs for their parents and caregivers are critical to helping families find stable housing and better future opportunities. Investing in deeply affordable housing will help many Utah families.

Behavioral/Mental Health

$8 million for behavioral and mental health

This is not enough to address the current mental health needs of Utahns – in particular, those of our children and the folks tasked with raising them. We need more mental health professionals and greater access to services. We know this is a major concern for the Governor and we encourage increased strategic investment in this area.

It is also important to acknowledge and applaud some items the Governor wisely left out of his proposed budget:

No Proposed Tax Cuts

Utahns want to see more invested in our children while they are young, to prevent greater challenges later in life. It is our children who suffer most, when politicians toss our tax dollars away on polices that mostly benefit the wealthiest 1% of Utah households.

No Proposed Funding for Vouchers

Public funds should not be redirected to private entities. Utah needs an annual audit of the current program, to assess who is benefitting from school vouchers. In other states, the results are not good – vouchers are looking more and more like a tax break for wealthy families.

Bold Investments Needed for Utah's Children

Governor Cox's budget focuses on increasing funding for education, families, and affordable housing.

These are all areas where we believe bold investment is needed. We support the Governor in addressing these issues, but cannot overlook how this budget falls short in the face of the ongoing struggles faced by Utah families with children.

We encourage our Legislature to use the Governor’s budget as a roadmap and increase the allocations to the amount needed.

Our 2024 Legislative Agenda

At Voices for Utah Children, we always start with this guiding question: "Is it good for all kids?" That remains our north star at the outset of the 2024 legislative session, and is reflected in our top legislative priorities.

So, what’s good for all kids in 2024?

A Healthy Start!

A healthy start in life ensures a child's immediate well-being while laying a foundation for future success. We are steadfast in our commitment to championing policies that prioritize every child's physical, mental, and emotional well-being. Central to this commitment is our focus on improving Utah’s popular Medicaid and CHIP programs, which are pivotal in the lives of many Utah children and families.

This legislative session, a healthy start for kids looks like:

- Empowering Expectant Mothers: We support a proposal from Rep. Ray Ward (R-Bountiful) to increase access to health coverage for low-income and immigrant mothers-to-be.

- Increasing Access to Health Care: We support bills that aim to improve access to the vital healthcare services children and parents need, especially for those on Medicaid and CHIP.

- Protecting Health Coverage: We oppose any effort to defund, and exclude deserving children from, the Medicaid and CHIP programs that help thousands of Utah kids every year.

Early Learning and Care Opportunities!

The formative years of a child's life lay the foundation for their future, shaping their cognitive abilities, socio-emotional skills, and passion for learning. We will support efforts to increase access to home visiting programs and paid family leave, but ensuring consistent, quality, and affordable child care is our top priority.

This legislative session, early learning and care opportunities for kids looks like:

- Bolstering Access to Quality Child Care: We support the efforts of both Rep. Andrew Stoddard (D-Sandy) and Rep. Ashlee Matthews (D-Kearns) to extend the successful Office of Child Care stabilization grant program that has supported licensed child care programs statewide.

- Investing in High-Quality Preschool: We support an anticipated legislative proposal to streamline Utah’s existing high-quality school-readiness program and to make it available to more preschoolers statewide.

- Recruiting and Retaining Child Care Professionals: We support Rep. Matthews’ proposal to expand access to the Child Care Assistance Program for anyone working in the child care sector.

- Building New Child Care Businesses: We also support Rep. Matthews’ proposal to continue funding for work to develop and support new child care programs in rural, urban, and suburban areas.

To view a more comprehensive list of our 2024 early care and learning legislative priorities, click here.

Economic Stability for Families with Children!

Economic stability forms the bedrock of thriving families and vibrant communities. To ensure that young families in Utah have the support they need to afford basic necessities, we will advocate for increasing families’ access to Utah's earned income and child tax credits.

This legislative session, economic stability for families looks like:

- A Little Extra Help in the Early Years: We support HB 153, Rep. Susan Pulsipher’s (R-South Jordan) bill to expand Utah’s new Child Tax Credit, (currently only for children ages 1 to 3), to apply to children between 1 and 5 years of age. We also strongly recommend helping even more Utah families with young children by making the tax credit available for families with any child between birth and 5, and expanding it to include the thousands of lower- and moderate-income families who are currently excluded.

- Credit for Working Families with Kids: We support HB 149, Rep. Marsha Judkins’ (R-Provo) bill to expand Utah’s Earned Income Tax Credit so that more lower- and middle-income families with children can benefit.

Justice for Youth!

We want to ensure that all youth, including those who come into contact with the juvenile justice system, have access to interventions and supports that work for them and for their families. We are dedicated to advancing policies and recommendations that contribute to a more fair and equitable juvenile justice system for all Utah youth.

This legislative session, justice for youth looks like:

- Prioritizing School Safety: We are monitoring bills from Rep. Wilcox (R-Ogden) and the School Safety Task Force, including: HB 14, “School Threat Penalty Amendments” and HB 84, “School Safety Amendments.” We remain hopeful that these efforts will support a secure learning environment for all students, without contributing further to the School-to-Prison Pipeline.

Be an Advocate!

As we chart the path forward, one thing remains abundantly clear: the well-being, growth, and future of Utah's children rely on the decisions we make today. Each legislative session presents an opportunity—a chance to reaffirm our commitment, reevaluate our priorities, and reimagine a brighter, more inclusive future for all.

Together we can continue to make Utah a place where every child's potential is realized, their dreams are nurtured, and their voices are heard.

Below are some ways you can get involved this session.

Stay Informed with our Bill Tracker

Stay informed about important legislation we are watching and reach out to your local representatives to let them know how you feel about legislation that is important to you. We make it easy for you to subscribe and watch bills that you are most concerned about.

Join us for Legislative Session Days on the Hill

Join us at the Capitol, where we offer attendees the opportunity to engage in the legislative process on a specific issue area (health and/or child care). You'll have the chance to attend bill hearings, lobby your legislators, connect with fellow community advocates, and watch House and Senate floor debates. Click the button below for the dates/times of our meetings and to RSVP.

Celebrate Utah's Immigrant Community

In collaboration with our partners at UT With All Immigrants, the Center for Economic Opportunity and Belonging, and I Stand with Immigrants, we are organizing Immigrant Day on the Hill. Join us to discover ways to engage in Utah's civic life. Enjoy food, explore resource tables, participate in interactive activities, and entertainment. Everyone is invited to attend this free event!

Event Details: February 13, 2024, 3:30pm-5:30pm at the Capitol Rotunda, 350 State St, Salt Lake City, UT 84103

Making Utah Taxes Fair for All Families

Most of us don't enjoy paying taxes. We do it, though, because pooling our money together through taxes makes it possible for us to have roads, schools, libraries and parks, fire fighters and law enforcement, and so many more public goods that none of us could afford on our own.

Tax policy (the ways we choose to collect taxes) impacts everyone, and often in many different ways. You may have very recently paid sales tax on your groceries, gas tax at the pump, property taxes on your home or through your rent, and of course, income tax on the money you earn.

From state to state, tax policy is unique; no two states collect taxes the same way. Tax policy also changes a lot over time. Different types of taxes affect people differently, depending on whether they have higher or lower incomes.

Some tax policies and structures promote fairness and equity. Other approaches to taxes contribute to social inequality. When tax policies burden lower-income people more than very wealthy people, who can more easily afford to pay higher taxes, we consider that unfair. Sometimes those kinds of tax policies are called "regressive."

States with the most unfair tax structures typically have:

- have no or little income tax,

- have no refundable tax credits, and

- rely on high sales and excise* taxes.

How Fair is Utah's Tax Structure?

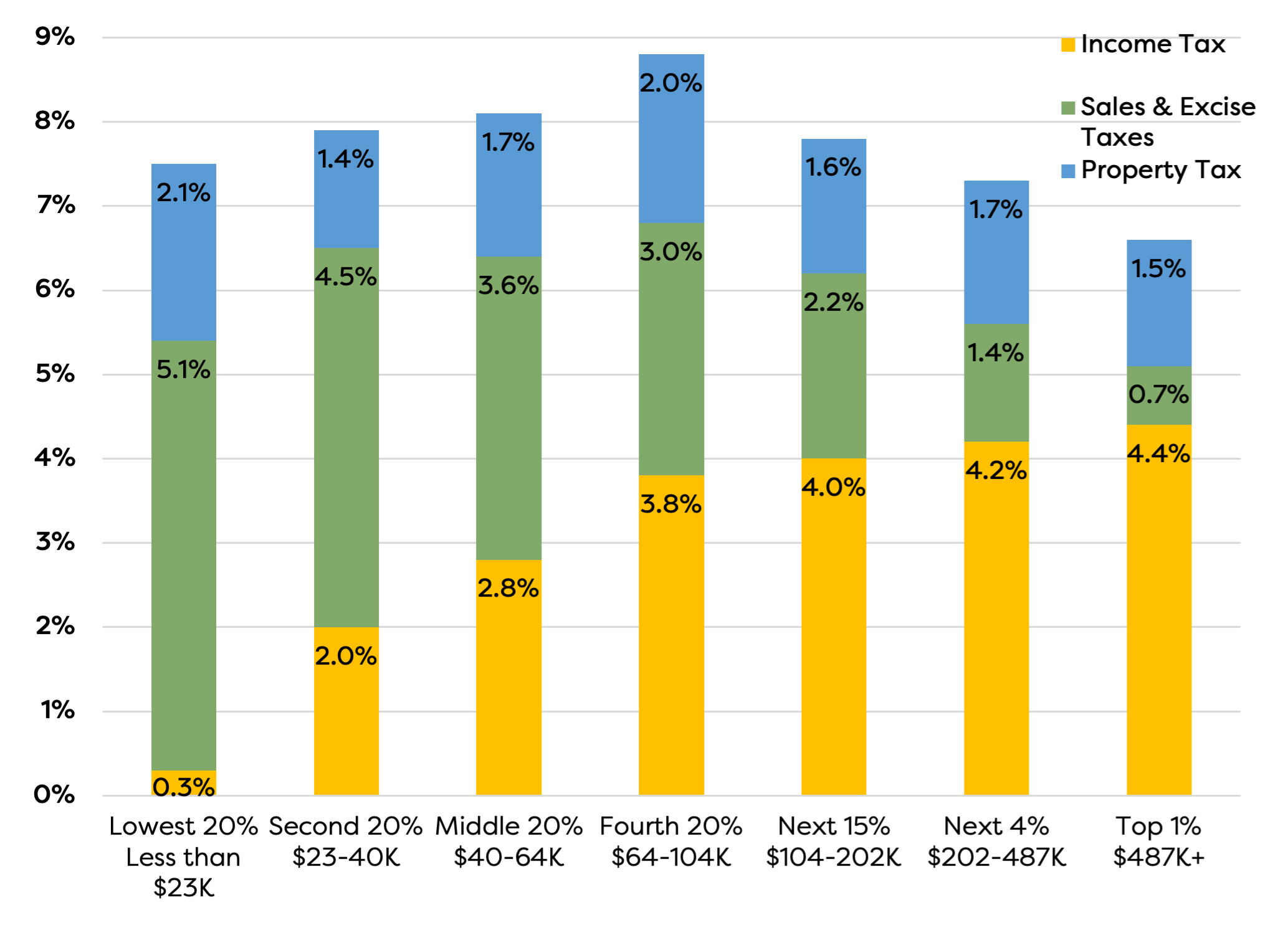

Analysis by the Institute on Taxation and Economic Policy (ITEP) shows that in Utah, low- and middle-income families pay more of their income in taxes than the wealthiest households.

We judge Utah's tax fairness holistically, by looking at all the taxes that are paid by families at different income levels. This is the "effective tax rate," or the share of overall household income a family spends on income, sales/excise and property taxes in a year. The table below shows the effective tax rate of Utah households, depending on how much income they earn each year.

In Utah, 20% of families make less than $23,000 per year. These families pay approximately 7.5% of their total income in state and local taxes. By comparison, the top 1% of Utah families - which are earning more than $487,000 per year - pay an effective tax rate of only 6.6%.

But the Utah families who pay the most in taxes are those in the middle. Middle-income households (making between $40,000 and $104,000 per year) have an effective income tax rate from 8.1% to 8.8% - the highest effective tax rate of all income levels.

Towards Fairness: Tax Credits that Actually Work for Working Families

Towards Fairness: Tax Credits that Actually Work for Working Families

One way to make our state tax structure more fair is through carefully constructed income tax credits. When tax credits cut out families that pay less in income tax - like our non-refundable Earned Income and Child Tax Credits - then the families who are struggling most, benefit the least. Some legislators argue that families who don't pay as much income tax don't "deserve" to fully benefit from tax credits. But those families clearly pay more in overall taxes than any other income group.

Babies don't pay any taxes - but the households they live in do. Working families with young children deserve a tax system that supports them as they care for and raise the future leaders of our state. Having a fair tax structure in Utah means making sure children, and the households they are living in, have enough money to afford the things they need.

Learn How Better Income Tax Credits Help Families

Glossary

Effective Tax Rate: the share of income a family spends on taxes. This is calculated by dividing the amount families pay in taxes by their annual household income.

* Excise Tax: a tax directly levied on certain goods by a state, such as fuel, liquor, or cell phone plans. They are paid by the merchant before the goods can be sold and passed to the consumer through higher prices before the sales tax is added.

Nonrefundable Tax Credit: reduces the taxes owed - allows a taxpayer to only receive a reduction of their tax liability until it reaches zero.

Refundable Tax Credit: allows a taxpayer to receive a refund if the credit they receive is greater than their tax liability.

Tax Credit: a dollar-for-dollar amount that a taxpayer claims on their tax return to reduce the income tax they owe. You can use this to reduce your tax bill and potentially increase your refund amount.

Tax Liability: the amount of taxes owed by a taxpayer to the government before taking into account allowable tax credits.

Tax Policy: policies that determine how we to collect taxes.

Take Action on EITC Awareness Day

January 26th is Earned Income Tax Credit (EITC) Awareness Day! The EITC is a vital tool in reducing child poverty, and improving the long-term outcomes for children across our state.

Some tax policies - like the EITC - promote fairness and equity. Others make social inequality worse - we call those policies “regressive;” Regressive policies disproportionately hurt lower-income individuals while disproportionately benefiting rich people. That simply isn’t fair.

Utah was ranked 29 out of 50 states (plus the District of Columbia) in a recently released report from the Institute of Taxation and Economic Policy (ITEP) —-ITEP uses a “tax inequality index” to measure the effects of each state’s tax system on income inequality. Data from ITEP shows that lower and middle-income households pay a larger portion of their income in taxes overall, when compared to wealthier households. Middle-class families pay the highest effective tax rate (income tax, sales tax, other taxes and fees), while the wealthiest 1% of Utah households pay the least of all (see table below).

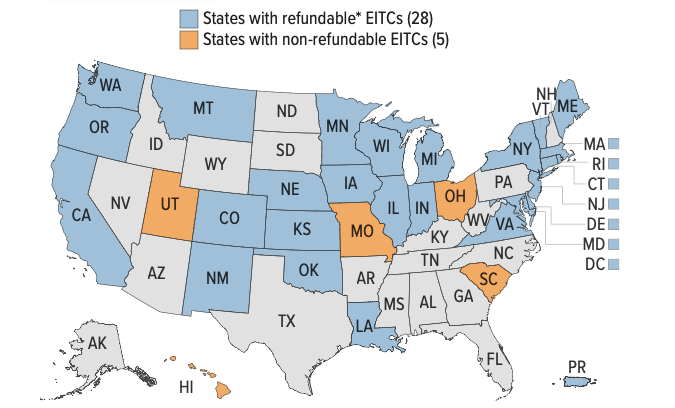

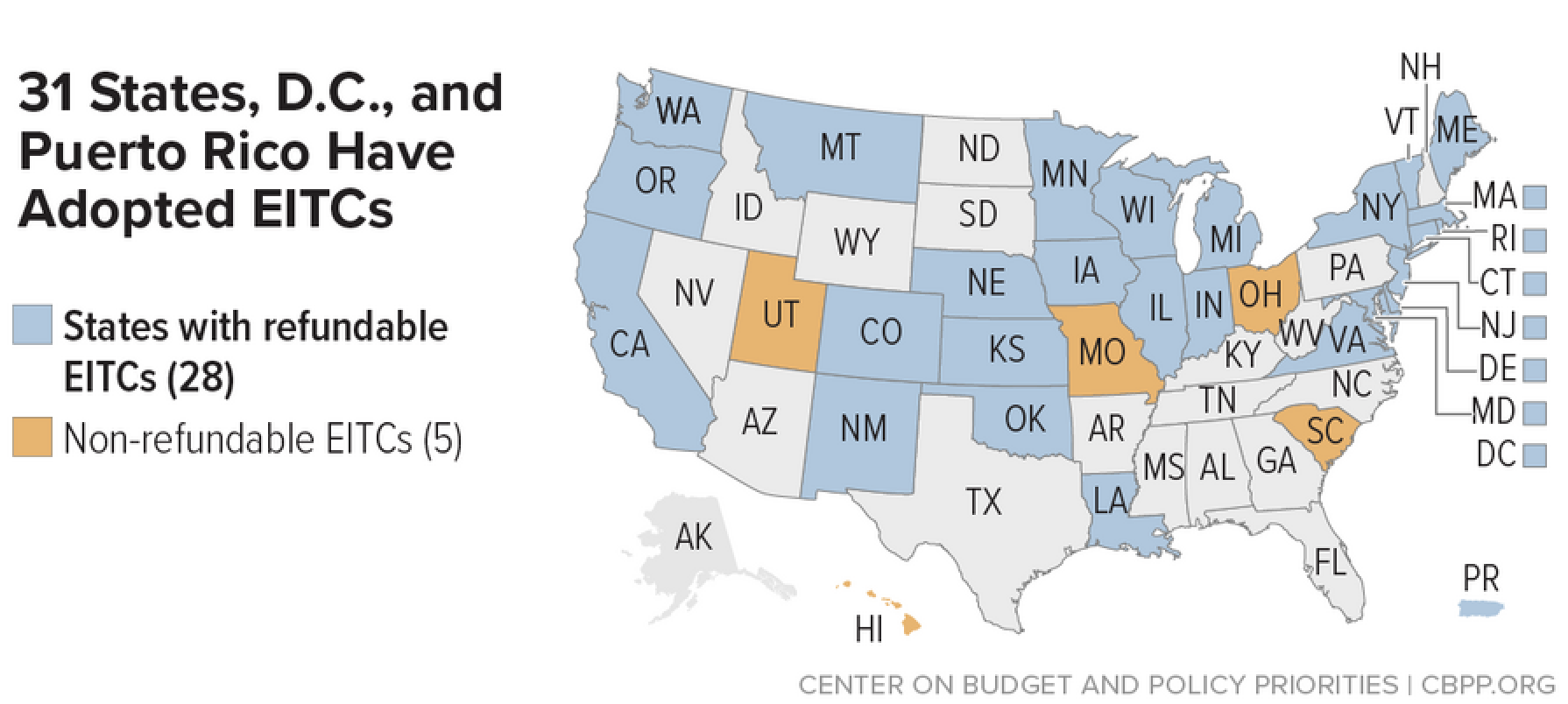

Thirty-one states and the District of Columbia have a state Earned Income Tax Credit (EITC). Utah is one of only five states that excludes the poorest working families from benefiting from their state EITC, by making their EITC non-refundable. By contrast, many states have taken steps to ensure that their state EITC includes as many low- and middle-income families as possible. In 2024, Utah legislators will have a chance to help more Utah families, too - by making our state EITC refundable.

Support HB 149: Make Utah's EITC Refundable!

This year, Representative Marsha Judkins (R-Provo) is championing HB149, which would transform Utah’s EITC into a refundable credit. This bold change will help many more families to afford essential necessities for their children's well-being, such as food, clothing and medical care.

On this EITC Awareness Day, let's make some noise! Reach out to your state legislators, remind them why this policy is impactful for families and children, and help us advocate for a more fair and equitable tax system.

To learn more about the Earned Income Tax Credit, see here.

Empower Utah Families with Better Income Tax Credits

When it comes to improving the lives of hardworking Utahns, we need policies that help those who are struggling to make ends meet. A refundable Earned Income Tax Credit (EITC) could do just that.

Let's start by discussing what the earned income tax credit is and how it benefits working families and children.

What is an Earned Income Tax Credit?

You may already know about the federal Earned Income Tax Credit (EITC). It is a refundable federal income tax credit for low- and moderate-income working people, that was created to support people who are in the workforce but need extra support to meet their families' needs. To claim the federal EITC, you must have earned income and everyone on your tax return must have a social security number.

The amount of your credit will be determined by your family's earnings, as well as the number of children you have. The EITC credit may help to reduce the amount you owe on your federal taxes - and if the EITC amount is higher than the federal taxes you own, you can actually get money back from the government.

The EITC is a critical policy tool to support financial stability in working families. Even just a few hundred dollars a year can help families stay current on bills, purchase groceries, afford car repairs, or pay down debt.

How does Utah's Earned Income Tax Credit work?

Because the federal EITC has been so effective at supporting working families, many states have created their own Earned Income Tax Credits in order to help these families even more. Currently 31 states offer a state EITC. Utah enacted a limited EITC for families with children in 2022.

Calculating your state Earned Income Tax Credit amount in Utah is easy: it will be 20% of whatever your federal EITC amount is when you file both your federal and state taxes. However, due to the way it was structured by the state legislature, Utah's EITC currently excludes many hardworking families who should benefit.

Our state EITC's biggest limitation is that it is "non-refundable." Utah is one of only five states with this exclusionary policy. Unlike the federal EITC, Utah's tax credit can only be applied to the income taxes you owe. You will never receive any money back from claiming the state EITC. Unless your state taxes add up to the amount of the state EITC you are allowed to claim, or more than that amount, your family misses out on the full benefit.

A refundable state EITC is a simple and cost-effective way to level the playing field for Utah families. These days, families who don't make a lot of money struggle to afford to live and raise a family in Utah. Especially for families with young children, who are just starting out in their careers, every little bit of extra financial support really helps.

State leaders say that our state EITC is meant to provide a maximum benefit for working families with children, with annual (adjusted) incomes between $11,000 and $26,000. Imagine a family with two young children, where one parent is still in college, and the other parent works only 32 hours a week. Because Utah's EITC is not refundable, none of the struggling families in this income range will see any benefit from the tax credit.

Though they don't make a lot of money, these people actually pay more taxes, as a percent of their income, than the wealthiest people in Utah. These hard-working families deserve a refundable state tax credit.

Our state EITC policy also requires that your earned income must be reported on a W-2 form, as proof of your work. This requirement means the state EITC can't be claimed by self-employed people, people who work on contract and people who participate in the "gig economy" (such as driving for Lyft or watching pets through Rover). Even though these workers may be eligible for the federal EITC, they can't benefit from the state credit because they don't receive a W-2 to recognize their hard work.

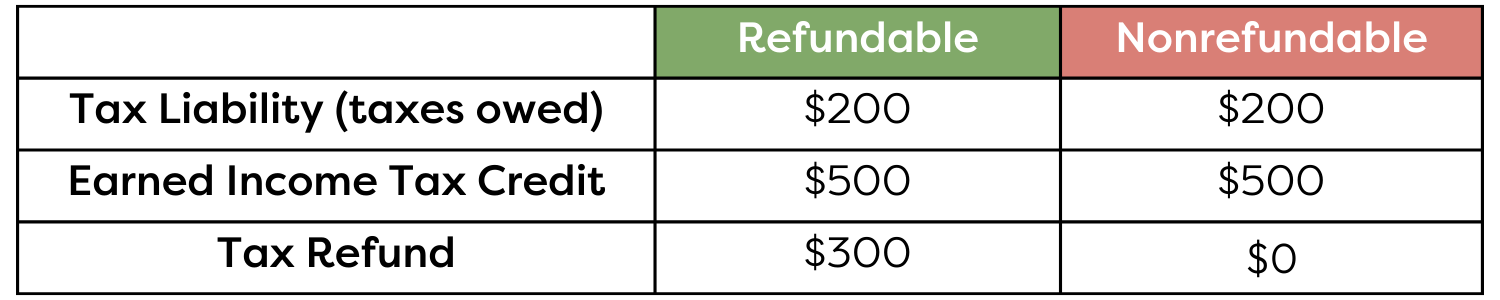

What is Refundability?

A refundable tax credit means that if the amount of the credit is more than the amount of taxes you own, you can get the extra amount back as a refund payment!

A non-refundable tax credit means that the amount of the credit can only ever offset the amount of taxes you owe. You can't benefit from any portion in excess of the income tax you owe, and you can't carry any unused portion of the credit over into another tax year.

Here's how this difference plays out in Utah for a married couple with two children, filing their taxes jointly. In this hypothetical family, one parent earns $39,000 working full-time (about $19/hr), and they only owe $200 in state income tax. If Utah’s EITC were refundable, they would realize the full benefit of the credit by receiving a refund of $300. Because our state EITC is non-refundable, that $300 just disappears. After it cancels out the $200 in taxes the family owes, Utah's EITC stops working.

In the coming year, legislators have the opportunity to empower working families in Utah with a much better Earned Income Tax Credit. By making our state Earned Income Tax Credit (EITC) refundable, state leaders could tangibly enhance the lives of these families, providing them with essential financial support needed for their daily well-being. If you're curious about the significance of equitable tax policies and the intricate web of tax distribution, learn more by following the link provided below.

Glossary

Tax Credit: a dollar-for-dollar amount that a taxpayer (s) claim on their tax return to reduce the income tax they owe. You can use this to reduce your tax bill and potentially increase your refund amount.

Tax Liability: the amount of taxes owed by a taxpayer to the government before taking into account allowable tax credits.

Nonrefundable Tax Credit: reduces the taxes you owe --- allows a taxpayer to only receive a reduction of their tax liability until it reaches zero.

Refundable Tax Credit: allows a taxpayer to receive a refund if the credit they receive is greater than their tax liability.

Sources

- https://www.cbpp.org/research/federal-tax/the-earned-income-tax-credit

- https://www.cbpp.org/blog/many-states-are-creating-or-expanding-tax-credits-to-help-families-afford-the-basics

- https://www.cbpp.org/research/state-budget-and-tax/states-can-enact-or-expand-child-tax-credits-and-earned-income-tax

- https://www.irs.gov/credits-deductions/individuals/earned-income-tax-credit-eitc

- https://www.irs.gov/newsroom/tax-credits-for-individuals-what-they-mean-and-how-they-can-help-refunds#

- https://itep.org/whopays/utah/

- https://taxfoundation.org/taxedu/glossary/tax-refund/

Tax Policy 101: What is Refundability?

Tax policy is complicated. Talking about taxes involves jargon, and concepts that can be confusing. For example, what is a 'refundable' tax credit? What exactly does that mean, and how does it help families? We answer these questions here with a quick breakdown of what refundability is and how it impacts families.

What is a "refundable" tax credit?

When a tax credit is refundable, it is available to all families. Even if a family doesn’t owe anything when they file their income taxes, a refundable tax credit makes it possible for them to get money back in the form of a tax refund. Families can then use that money to pay for necessities.

What is a "non-refundable" tax credit?

A non-refundable tax credit can only ever be used to pay for taxes. If a family doesn’t owe any taxes after deductions, they can’t access any of the tax credit. If the family only owes a little in income taxes, they can only use the non-refundable credit to pay down whatever they owe.

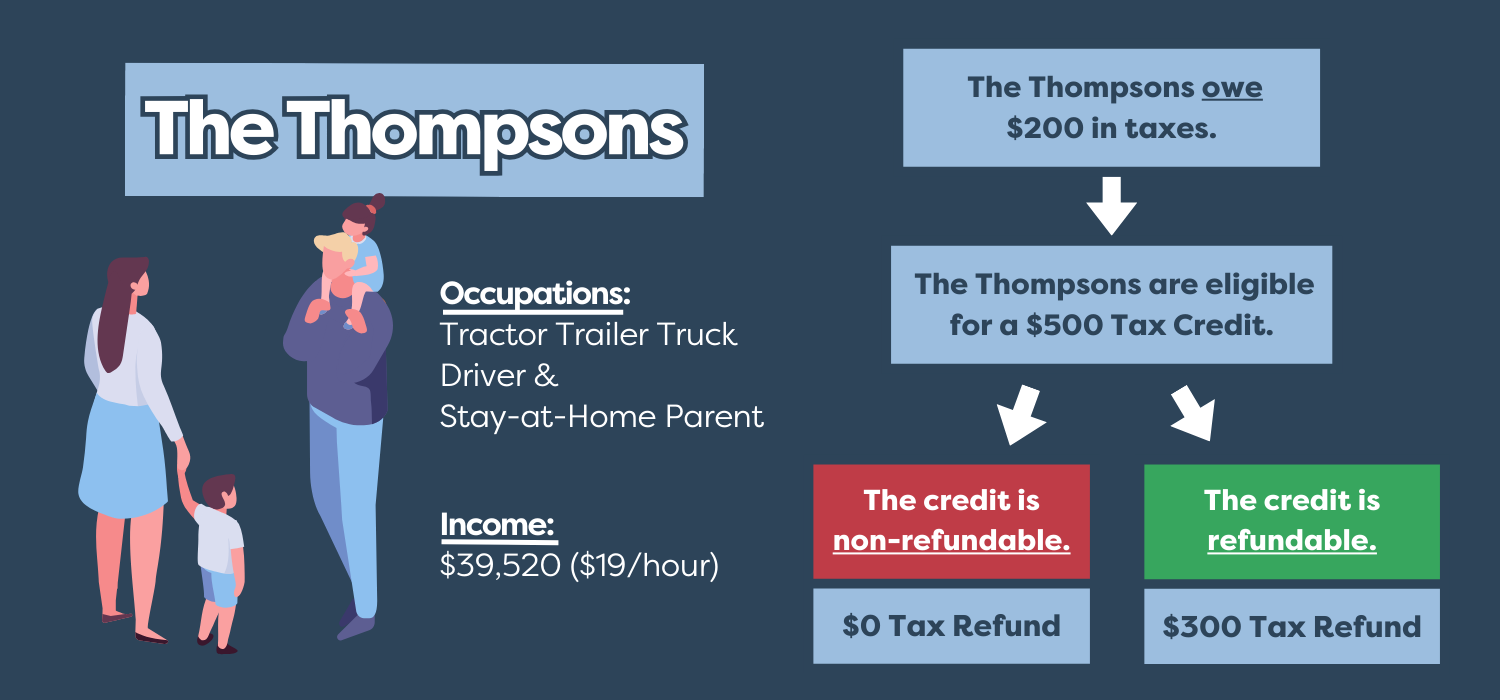

How does refundability impact a family like yours?

In the illustrated example below, the Thompsons have two young children and make a family household income of $39,520 for the year. Based on their income and after deductions, they owe $200 in taxes. Now imagine they qualify for a $500 tax credit. Refundability can greatly impact how much they owe in taxes and whether they'll keep more of their earnings through a refund.

If the $500 tax credit is non-refundable, it will be applied to offset what the Thompsons owe in taxes. Since they owe $200, the credit will help reduce the amount they owe to $0 – a positive outcome.

However, an even better outcome for young families arises when that $500 tax credit is refundable. If refundable, the $500 tax credit can go towards the amount they owe in taxes ($200) and the remaining amount of $300 would go back to the Thompsons as a refund. This $300 can help with expenses like car repairs, new winter coats for the kids, and baby formula. Though it may not seem like a lot, families facing financial challenges can make good use of this help.

To learn more about making Utah’s EITC refundable, go here.

To learn more about making Utah’s CTC refundable, go here.

To read about other refundable tax credits in Utah, go here.

Glossary

Tax Credit: a dollar-for-dollar amount that a taxpayer (s) claim on their tax return to reduce the income tax they owe. You can use this to reduce your tax bill and potentially increase your refund amount.

Nonrefundable Tax Credit: reduces the taxes you owe --- allows a taxpayer to only receive a reduction of their tax liability until it reaches zero.

Refundable Tax Credit: allows a taxpayer to receive a refund if the credit they receive is greater than their tax liability.

Tax Policy: policies that determine how we collect taxes.

Tax Cuts Hurt Kids

Why Voices Opposes Proposed Income Tax Cuts

Over the past four years, Utah's Legislative Leadership has consistently prioritized tax cuts above the needs of Utah's families. Despite a $400 million tax cut passed last year that benefited the most wealthy Utahns, and now fearmongering about a supposed $130 million budget shortfall, Legislative Leadership is yet again pushing for another $170 million in tax cuts.

As the 2024 Legislative Session unfolds, many legislators will claim a need to curb spending and tighten purse strings - that we can’t afford to fully fund social services or any new programs. The question arises: How can we afford $160 million in tax cuts when many crucial needs remain unmet? In a time when working families are struggling to afford groceries, granting more tax cuts to the wealthy is a step in the wrong direction.

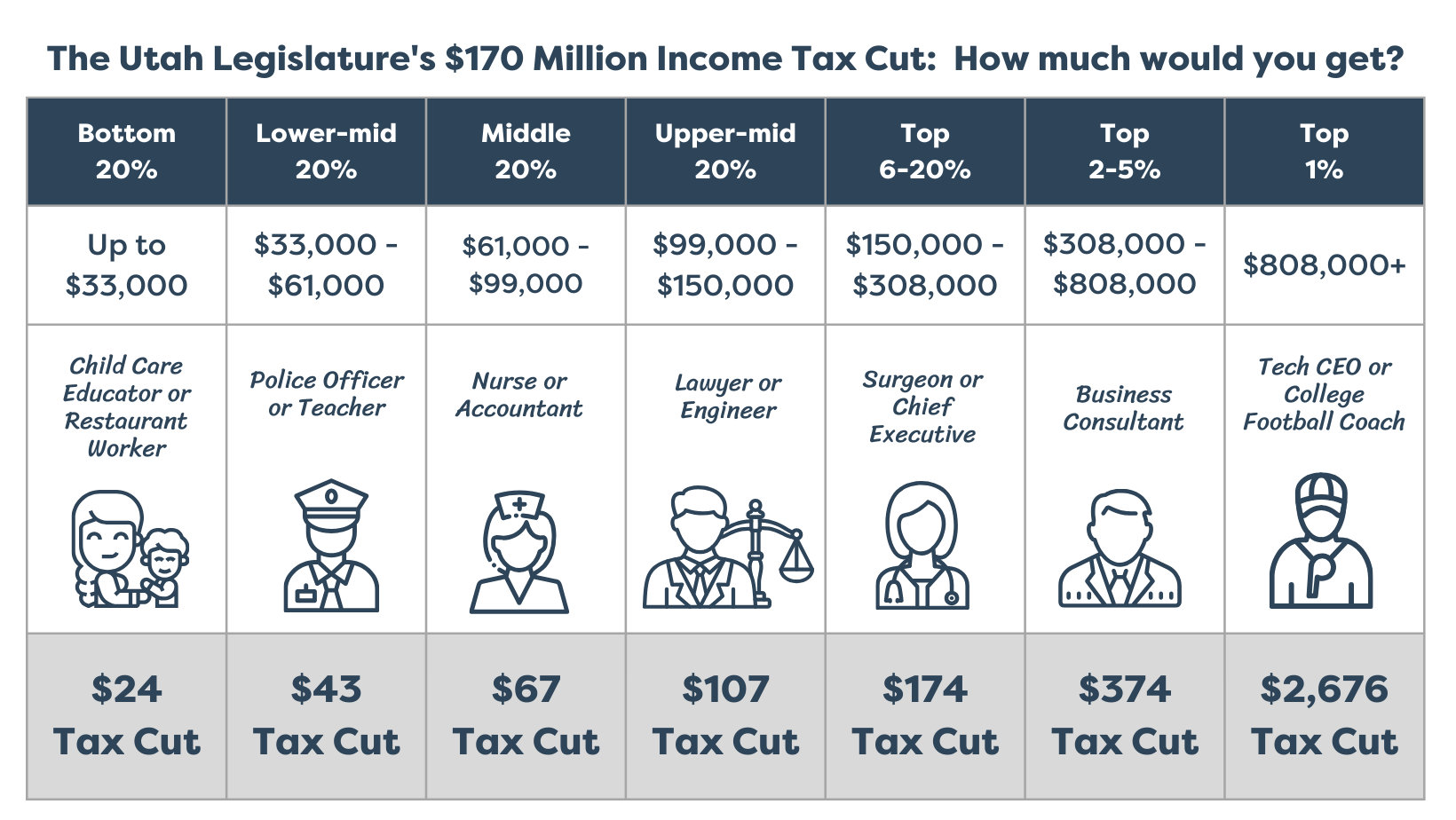

Who Benefits from the Proposed Tax Cuts?

The proposed tax cut will help the richest 1% more than anyone. Our analysis shows the proposal will save the bottom 80% of Utah earners between $24 and $107. While the top 1% of Utah earners will save a whopping $2,676. These tax cuts will not provide real help to working families.

Out of the proposed $170 million tax cut, $40 million will go to the top 1% of Utah's wealthiest individuals. In contrast, the bottom 80% will split about $61 million.

Note: This image was updated to reflect the changed fiscal note for SB69, increasing the estimate from $160 Million to $170 Million on 2/23/24.

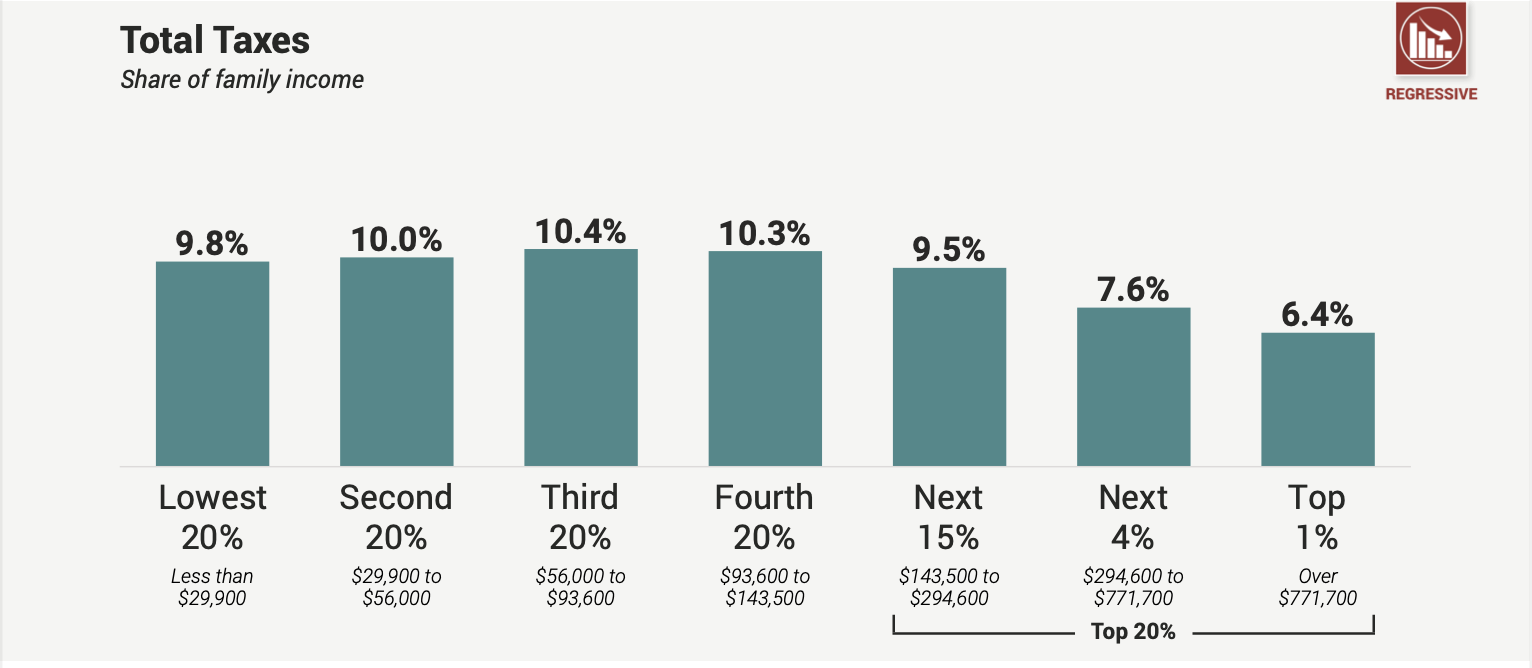

Utah's Unfair Tax Code

Contrary to the argument that the top 1% pays more in taxes, the reality is that low- and middle-income families bear a higher tax burden. Families making less than $29,900 per year pay 9.8% of their total income in state and local taxes, while the top 1% pays an effective tax rate of only 6.4%.

Why Voices Opposes the Proposed Income Tax Cuts

Voices for Utah Children opposes the proposed tax cuts due to the unmet needs of children and families in Utah. Our income tax should be used to increase funding for education, child care, nutrition, mental health programs, and other services with long-term societal benefits.

The appeal of tax cuts fades when we realize it means losing essential services. Children need us to be their voice, and we need to show up and advocate for their future. It's not just the right thing to do for them; it's a move that benefits all of Utah. Here's why investing in children pays off:

- Investment in the future: Children are the future, and investing in their well-being leads to positive long-term outcomes. Early childhood interventions improve educational attainment, job prospects, and overall health, benefiting society as a whole. This includes supporting our child care system, which is facing a loss of nearly $600 million in federal support this year.

- Promoting equality: Programs for children often target low-income families and disadvantaged communities, narrowing the gap in opportunities and promoting a fairer society. Access to quality education, healthcare, and essential services can break the cycle of poverty, creating an even playing field for every child.

- Stimulating the economy: A healthy, educated population contributes to a stronger economy. Investments in children's programs create a ripple effect, boosting productivity, encouraging innovation, and fostering economic growth in the long run.

We need to hit pause on tax cuts and instead acknowledge that investing in children is the better path to follow. It will lead to a stronger and more prosperous Utah, and those benefits will far outweigh any tax cut currently being considered.