Income taxes are the most familiar type of tax for most Utahns. They’re the most visible and personal, showing up on every paycheck, tax return, and refund. Unlike sales or property taxes, income taxes are directly tied to how much money a family earns.

What is Income Tax?

Income tax is money paid to the government based on how much a family earns in a year. In Utah, there are two main types:

- State Income Tax: Utah’s personal and corporate income tax has a flat tax rate of 4.55%, meaning everyone pays the same percentage of their earnings, no matter how much they make.

- Federal Income Tax: The federal government uses a progressive income tax system, where the more a family earns, the higher the percentage paid. Rates range from 10% to 37%, using marginal tax rates. This means income is taxed in chunks, with each portion falling into a different tax bracket.

Income tax is collected in several ways. Most individuals pay through withholding, where their employer automatically deducts taxes from each paycheck. Those who are self-employed or earn income without withholding—such as from freelance work or rental properties—may need to make estimated tax payments throughout the year. At the end of the year, taxpayers file an annual tax return to report their income and determine whether they have paid the correct amount. If they’ve overpaid, they receive a refund; if they’ve underpaid, they owe the difference

How Much Do Utahns Pay in Income Taxes?

Income tax is calculated based on total income, minus any deductions or credits:

- Deductions lower taxable income. Most people take the standard deduction, while others itemize expenses like mortgage interest or medical bills.

- Tax credits reduce the actual amount of tax owed, dollar for dollar.

In Utah, most households benefit from the Utah Taxpayer Tax Credit, which acts like a built-in deduction and helps reduce taxes for lower- and middle-income families.

Not all Utah residents are required to file a state tax return—filing depends on income, age, and filing status. On average, Utah families pay an effective state income tax rate of 3.04%—meaning that after credits and deductions, most families contribute about 3.04% of their total income in state income taxes. Utahns pay approximately 7.29% of their income in federal income taxes.

How is Income Tax Revenue Spent?

The income tax represents the largest single source of state tax revenue and ensures that a portion of each person's earnings contributes to the common good, funding essential services across the state. The income tax is an important part of any government’s revenue stream, but unlike other states, Utah’s income tax fund is constitutionally designated to support K-12 public education, higher education, and services for children and people with disabilities. The federal government uses income tax funds to pay for national programs like defense, Social Security, and Medicare.

Does Income Tax Impact Everyone Equally?

A fair tax system uses a mix of property tax, sales tax, and income tax to ensure stability, fairness, and responsiveness. Income taxes play a key role in that mix because they promote fairness by being based on the ability to pay.

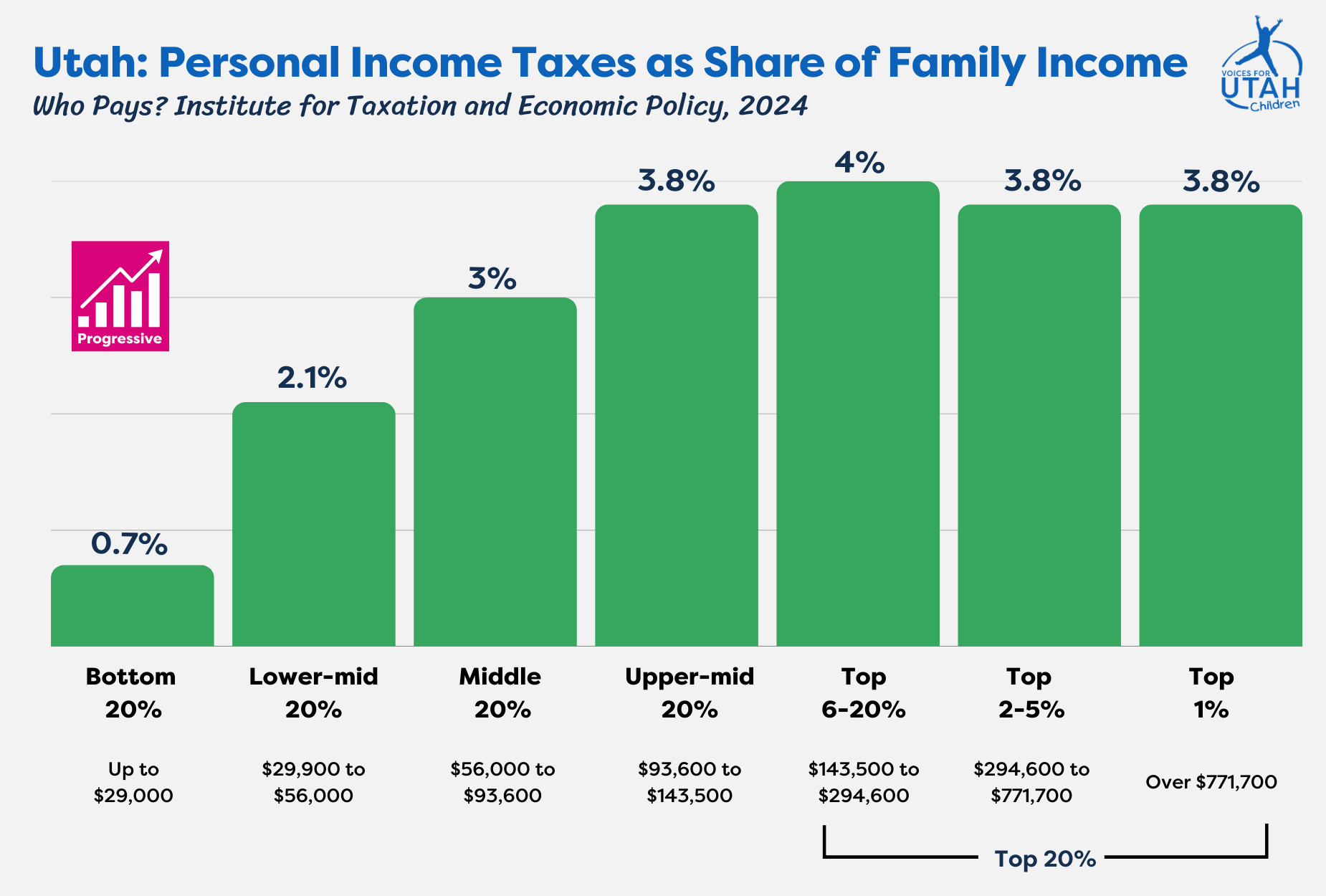

Income tax is typically the most progressive tax, meaning people with higher incomes pay a larger share of their income in taxes. That’s because it’s based on ability to pay—a core principle of fair tax policy. But Utah’s flat tax system—where everyone pays the same rate—complicates that. Only nine states have flat income taxes. While it appears equal, it's considered regressive in practice: lower-income families pay a greater share of their income than wealthier households.

The Utah Taxpayer Tax Credit helps offset this, especially for low- and moderate-income earners. According to research from the Institute on Taxation and Economic Policy, Utah’s income tax is still mostly progressive, with lower-income families paying a smaller share of their income than top earners.

Utah’s income tax is a cornerstone of equity in the state’s tax system. Because income tax revenue is constitutionally dedicated to education, it helps create one of the fairest school funding systems in the country—ensuring high-poverty districts receive the support they need. However, lawmakers’ recent efforts to eliminate the income tax and shift the burden to property taxes, put both tax and education equity at risk.

Income Tax & Racial Equity

Utah’s flat tax structure—even with the Taxpayer Credit—makes it harder to close racial income and wealth gaps. Generations of discrimination in housing, education, and employment have led to unequal earnings. White households are overrepresented in the top income brackets, while Black, Indigenous, and Latino households are overrepresented in the lowest ones. When income tax cuts mostly benefit high-income earners, they also disproportionately benefit White households, which can widen existing disparities. Without targeted reforms—like more progressive rates or refundable credits—Utah’s tax system risks reinforcing, rather than correcting, those inequities.

Are There Any Income Tax Relief Programs?

There are many state credits and federal credits available to help families lower their income tax burden, including:

- Earned Income Tax Credit: A federal and Utah state credit for low- to moderate-income working families, especially those with children.

- Child Tax Credit: A federal and Utah state credit to help families afford the cost of raising children by reducing taxes owed.

- Social Security Tax Relief: Utah has recently expanded tax exemptions for Social Security income, helping retirees who earn less than $90,000 per year.

Resources

Annual Tax Reports (Utah State Tax Commission)

A Visual Guide to Tax Modernization in Utah (Kem C. Gardner Policy Institute)

Federal Income Tax Rates, Internal Revenue ServiceFederal Income Tax Rates and Brackets (Internal Revenue Service)

Utah: Who Pays (Institute on Policy)

Utah Compendium of Budget Information (Utah State Legislature)

Who Must File (Utah State Tax Commission)

Who pays, and doesn’t pay, federal income taxes in the U.S.? (Pew Research)