When we cut income taxes, it's property taxes that help cover our schools.

Utah’s public schools serve over 670,000 kids in more than 1,000 public schools. For a long time, Utah was praised for its fair school funding system, making sure high-poverty districts got the support they needed. But with repeated income tax cuts, troubling changes are showing up in how we fund education. Right now, Utah spends less per student than any other state, and our overall effort to fund education is slipping [i]. While income tax money for education has stayed the same since before the Great Recession, local property tax revenue has shot up—by 29% between 2014 and 2024.

Why Relying Too Much on Property Taxes Is a Problem

Relying too much on property taxes is problematic for several reasons. Property taxes hit low- and middle-income families harder. In contrast, income taxes are based on what people can afford to pay, making them a more equitable way to fund schools. In states where education funding is tied too closely to property taxes, the wealth of a child’s community can determine the quality of their education.

Utah’s income tax is unique in that since 1946, all income tax revenue has been exclusively allocated for K-12 public education. Since then, the pot has expanded to fund higher education and social services that support children and individuals with disabilities. In recent years, Utah’s State Legislature has been trying to redirect this designated funding elsewhere. With their ultimate goal of income tax elimination, we have to wonder: How will we fund education?

A Quick Look at How Utah Funds Schools

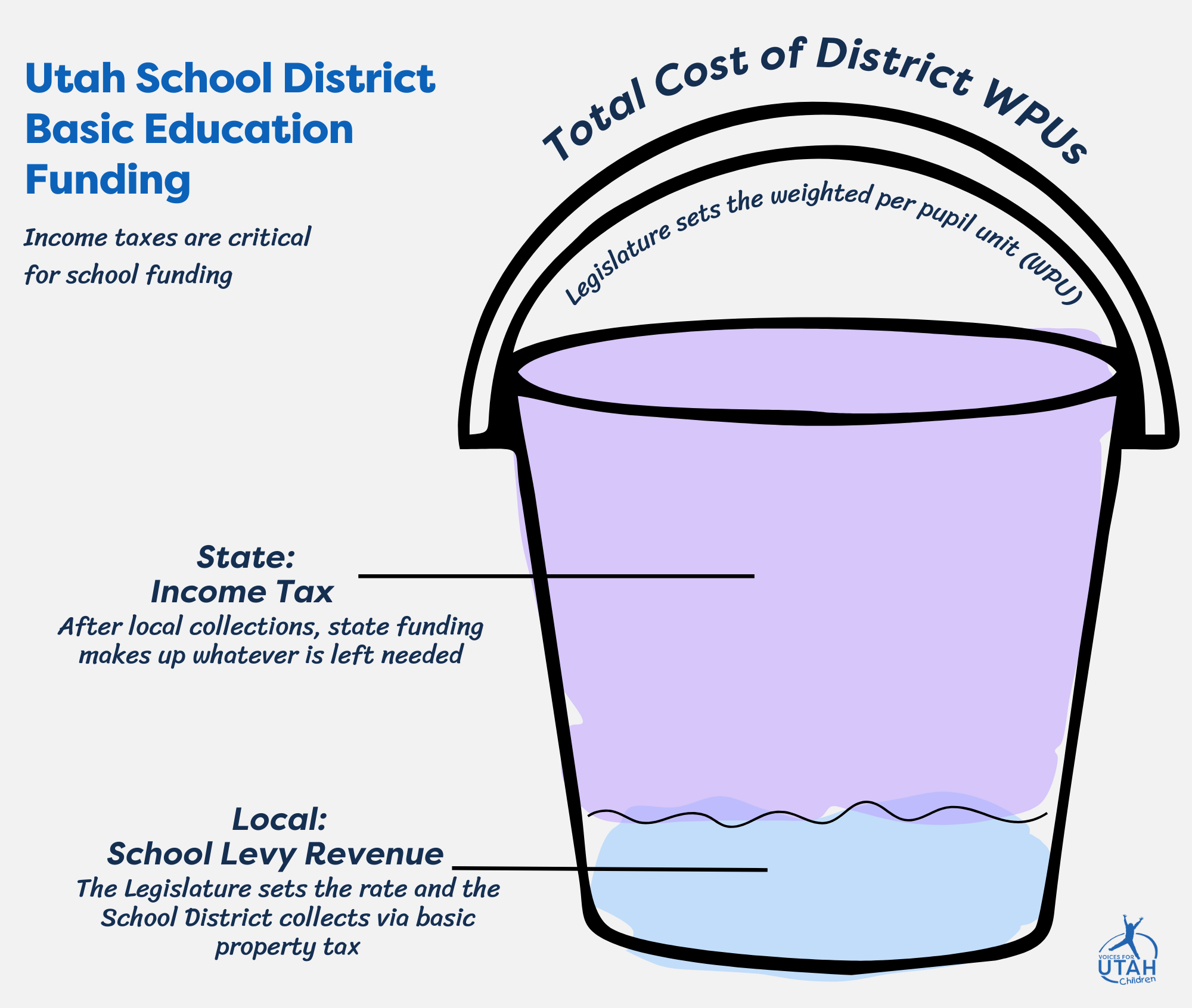

Utah uses something called the Minimum School Program (MSP) to make sure all kids get equal opportunities, no matter where they live. The main part of this system is the Basic School Program, which includes:

- Weighted Pupil Unit (WPU): The Legislature sets a per-student funding requirement.

- Uniform Property Tax Levy: The Legislature sets a uniform tax rate for all school districts. Money from this tax counts toward meeting the WPU. State income tax funds make up the rest. This is not subject to truth in taxation the way other property tax increases are.

This setup means local property taxes contribute to school funding, but income taxes are critical for covering shortages.

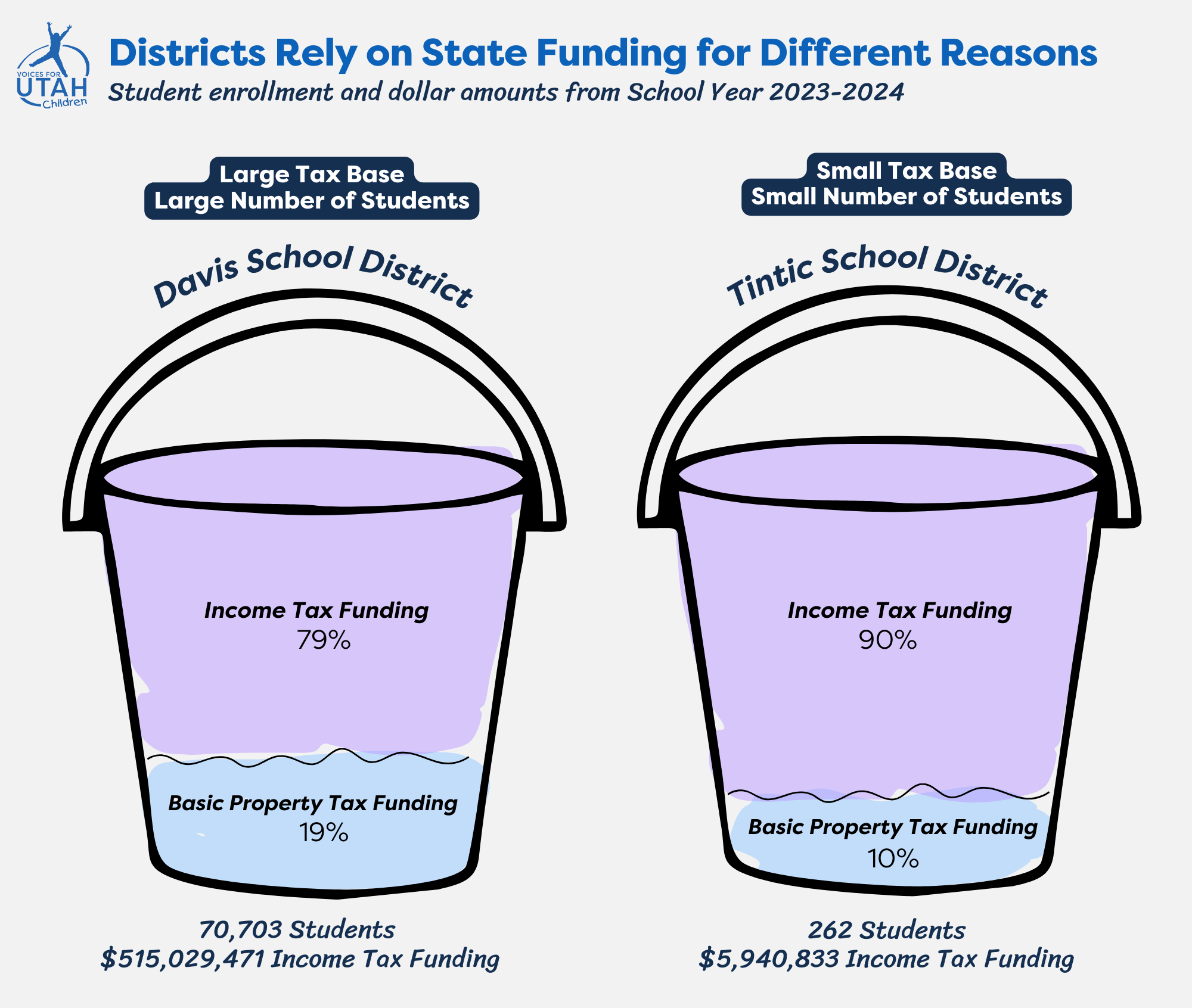

How Funding Varies Between School Districts

How much a school district depends on income taxes varies widely. The amount of property tax revenue a district gets depends on factors like property values, the size of the tax base, and how many students are enrolled. Depending on these factors, income tax funding can make up anywhere from 8% to 90% of a district’s budget.

Each district faces unique challenges. Therefore, each district is reliant on state income tax funding for different reasons:

- Rural Districts: Smaller tax bases mean less local funding, so these districts rely on a higher share of state income tax funds.

- Urban Districts: They might generate more local revenue, but large student populations mean they depend on larger dollar amounts from state funds.

- Outlier Example – Park City: With high property values and fewer students, Park City is the only district that fully funds its basic program with property taxes alone.

For a visual breakdown of which districts rely most on income tax funding, by dollar amount and share, see this interactive map.

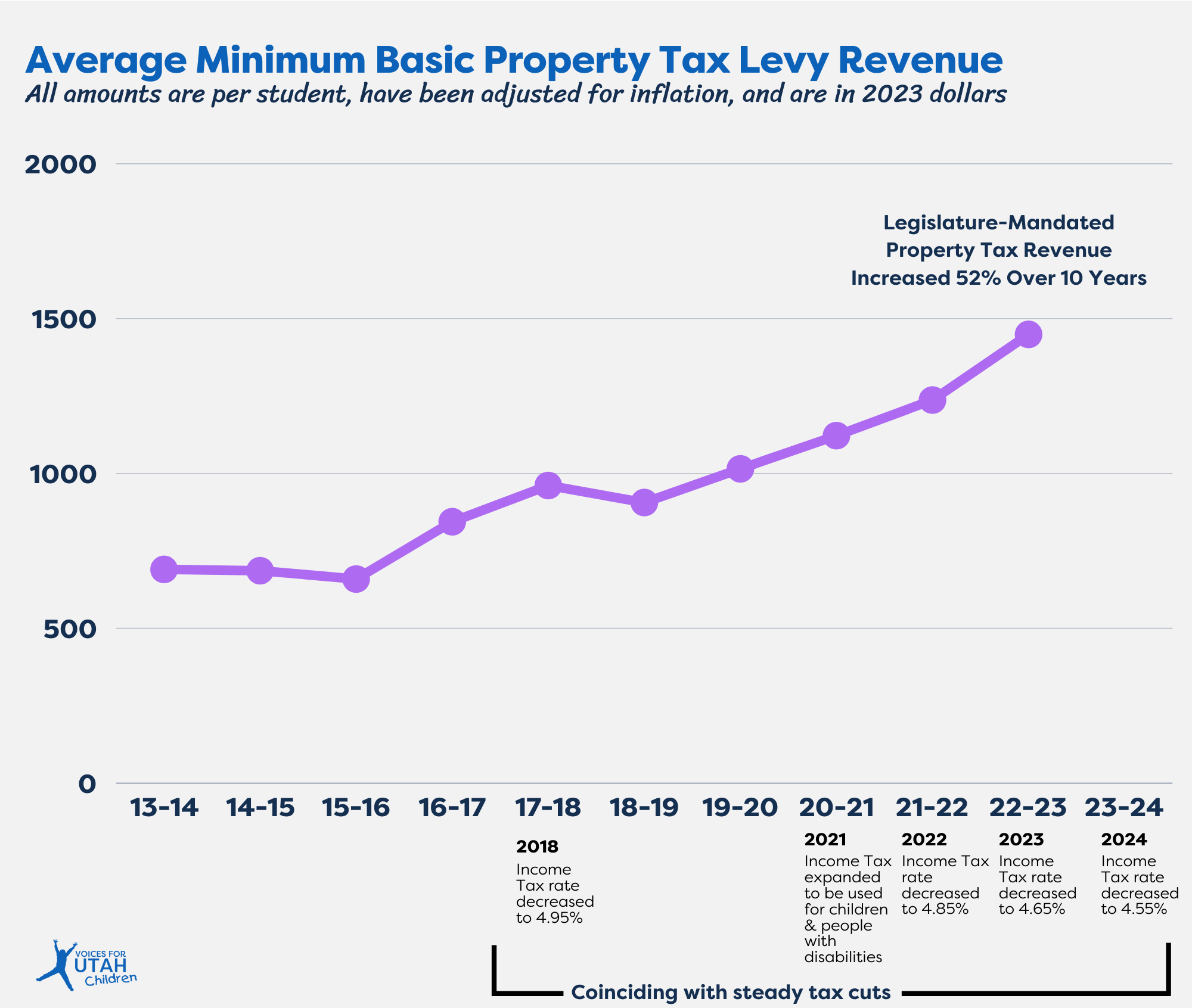

Property Taxes Are Shouldering More of the Load

In 2024, income tax funds covered only 69% of state and local school funding, down from 77% in 2014 [ii]. Over the past decade, 29 of the 41 school districts saw a decline in the share of funding from income tax. Some districts experienced even steeper drops: North Summit (-40%), South Summit (-34%), Wasatch (-33%), Salt Lake (-20%), Grand (-19%), and Rich (-18%).

At the same time, the property tax [iii] required for the basic program per student increased by 52%, from $690 to $1,449 over the same period [iv]. This shift makes districts depend more on property taxes—a funding method that is not only unstable but also less fair.

The Utah Legislature has increased the amount of funding school districts must levy for the basic program, which school districts and communities cannot control. As school districts increase their minimum Basic property tax levy, income taxes increasingly cover a smaller share of school district funding [v].

What this Means for Communities

Rural Districts at Risk

Rural areas, which in Utah have higher childhood poverty rates, struggle to compete for funding against other essential services like public safety and transportation. Increased reliance on property taxes can lead to underfunded schools and strained community services.

Impact on Low- and Middle-Income Families

Each year, the Legislature cuts income tax rates–mainly benefiting the top 5% of earners [vi]–reducing the funds available for education. Income tax cuts mostly benefit the wealthiest 5%, while higher property taxes hurt everyone else. Overall, when all taxes are considered, Utah’s system is already regressive—with households earning less than $771,700 facing higher effective tax rates than the wealthiest [vii]. If the Legislature continues shifting the burden onto property taxes, with the ultimate goal of eliminating income tax altogether, the tax code will be less fair for low- and middle-income families. Some lawmakers want Utah to follow Texas, which has no income tax but very high property taxes and one of the most unfair tax systems in the country [iix].

Short-Sighted Policies

Underfunded schools in high-poverty areas often struggle with fewer resources, less experienced teachers, and weaker curricula, leading to worse outcomes for students. With Utah’s booming economy and the nation’s largest share of children, not investing in education could hurt our state’s future. Companies may recruit talent from out of state, and young adults in Utah are already lagging behind for education attainment [ix].

Stop Cutting Income Taxes

Property taxes have gone up a lot in recent years. While lawmakers talk about providing relief, they rarely mention how continuous income tax cuts force us to lean more on property taxes. Utah’s state income tax revenue is designated for education. Without reckless tax cuts, we could fund education without relying so much on property taxes.

To give every child a fair shot at success, lawmakers need to stop cutting income taxes and keep education funding strong.

Recent Legislative Update

In the 2025 session, lawmakers passed SB37, changing how local property tax revenue for schools is handled. Instead of staying in an education-designated fund, these dollars will now go into the state’s general fund, where they can be spent on anything—not just education. The state will then replace that money in school budgets using income tax funds, which are currently earmarked for education and certain social services. Lawmakers claim this promotes school funding equalization, but the bill itself does not increase funding equity. Rural school districts, parents, teachers, school employees, superintendents, and the Board of Education opposed the measure, as did Voices for Utah This shift weakens local control over school funding while giving the state more power to redirect money elsewhere. For years, lawmakers have sought ways to access education-designated income tax revenue for other purposes. SB37 is a workaround to free up funds for non-education spending, a move some have called money washing. Lawmakers even rejected an amendment that would have ensured property tax funding remained dedicated to education.

Sources

[i] Voices for Utah Children, Tracking Utah’s K-12 Education Funding, 2024, https://utahchildren.org/newsroom/speaking-of-kids-blog/tracking-utahs-k-12-education-funding

[ii] Student enrollment data can be found at https://schools.utah.gov/datastatistics/reports. The minimum school program fiscal year reports for the charter summaries, district summaries, and final update from fiscal year 2014 to 2024 found at: https://www.schools.utah.gov/financialoperations/msp. Analysis and presentation of the data is the work of Voices for Utah Children, as are any opinions expressed. The Utah State Board of Education ensured the accuracy of our calculations.

[iii] All amounts have been adjusted for inflation and are in 2023 dollars. Student enrollment data can be found at https://schools.utah.gov/datastatistics/reports. School district tax rates and property tax collection data were provided by the Utah State Board of Education. Analysis and presentation of the data is the work of Voices for Utah Children, as are any opinions expressed. The Utah State Board of Education ensured the accuracy of our calculations.

[iv] Note: The other cause of property tax increases for education is increases to Voted and Board Local Levy that are determined locally. School districts can instate this local levy, under truth in taxation, if they have the local support and resources. Our calculations focus on the basic program, which is determined by the Utah Legislature, not local control.

[v] Note: Charter schools relied almost entirely on income tax funding (99%) throughout this time.

[vi] Voices for Utah Children, Another Year, Another Tax Cut 2025, https://utahchildren.org/newsroom/speaking-of-kids-blog/another-year-another-tax-cut-who-benefits

[vii] Institute on Taxation and Economic Policy, Utah: Who Pays? 2024, https://itep.org/utah-who-pays-7th-edition/

[iix] Institute on Taxation and Economic Policy, Texas: Who Pays? 2024, https://itep.org/texas-who-pays-7th-edition/

[ix] U.S. Census Bureau, 2023 ACS 5-year estimates, "Sex by Age by Educational Attainment for the Population 18 years and over,” Table B15001